- United States

- /

- Auto

- /

- NYSE:GM

General Motors (GM) Valuation Check After Analyst Upgrades and Rising Confidence in Multi‑Year Earnings Potential

Reviewed by Simply Wall St

General Motors (GM) just rode a fresh wave of analyst optimism, with upbeat projections on future profitability and software driven margins helping push the stock to new highs and sharpening investor focus on earnings durability.

See our latest analysis for General Motors.

The optimism is showing up in the numbers too, with the share price at $80.51 and a powerful 30 day share price return of 18.55 percent feeding into a 62.72 percent one year total shareholder return and a standout 131.39 percent total shareholder return over three years. This suggests momentum is building as investors re rate GM’s earnings power.

If GM’s run has you rethinking your auto exposure, it could be a good moment to scan the broader space and see which other auto manufacturers are starting to catch a bid.

Yet with GM now trading slightly above the average analyst target but still at a discount to some intrinsic value estimates, investors face a familiar dilemma: Is there meaningful upside left, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 5.8% Overvalued

With General Motors closing at $80.51 against a most popular fair value of about $76, the narrative implies the market is paying a premium for its improving fundamentals.

Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

Want to see how shrinking the share count, rising margins, and a surprisingly restrained earnings multiple combine into this valuation call? The full narrative unpacks the math behind that premium view.

Result: Fair Value of $76.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and stubbornly high EV warranty costs could quickly pressure margins and undermine the bullish case embedded in current expectations.

Find out about the key risks to this General Motors narrative.

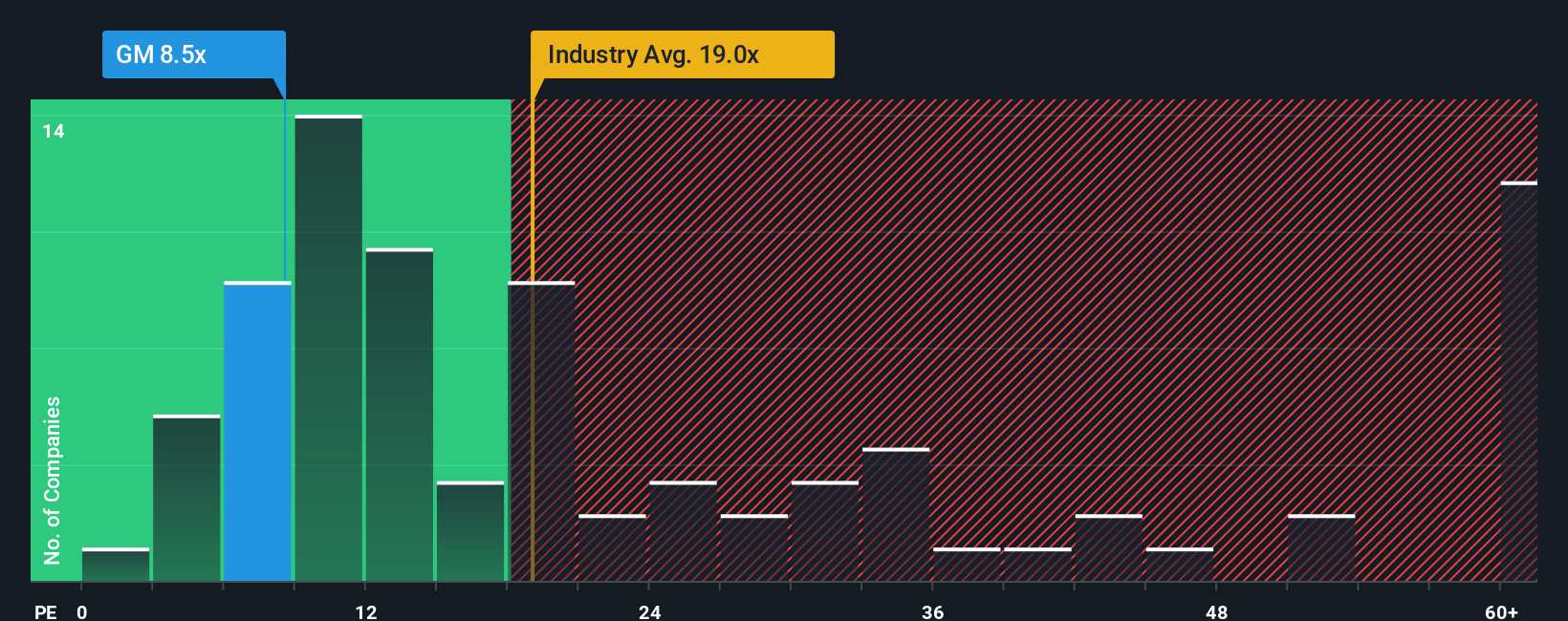

Another Take: Earnings Ratios Tell a Different Story

While the consensus narrative leans toward GM being modestly overvalued, its 15.8x price to earnings ratio looks cheap next to the 20.9x fair ratio, the 18.4x global auto average, and 25.2x for peers. That gap hints at upside, but it is worth asking whether this reflects a genuine opportunity or a potential value trap.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Motors Narrative

If you see the setup differently, or would rather dig into the numbers yourself, you can build a personalized narrative in under three minutes. Do it your way.

A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to line up your next smart move before the market leaves you behind.

- Capture potential mispricing by targeting companies trading below their cash flow value with these 911 undervalued stocks based on cash flows that might not stay cheap for long.

- Capitalize on innovation in automation, data, and machine learning by zeroing in on these 26 AI penny stocks shaping tomorrow’s growth stories.

- Lock in reliable income streams by focusing on these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s cash returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)