- United States

- /

- Auto

- /

- NYSE:F

Ford (F) Valuation Check After $19.5 Billion EV Reset and Strategy Pivot Toward Hybrids and Affordable EVs

Reviewed by Simply Wall St

Ford Motor (F) just hit the reset button on its electrification strategy, shelving several big ticket EV projects, including the current F 150 Lightning, and pivoting hard toward hybrids, extended range models, and smaller, cheaper EVs.

See our latest analysis for Ford Motor.

Investors have largely looked through the short term noise, with the share price up strongly this year. It has delivered a year to date share price return of 37.93% and a one year total shareholder return of 47.54%, even as Ford absorbs hefty EV write downs and reshapes its alliances in batteries and European EVs.

If Ford’s pivot has you rethinking the whole auto space, it could be worth exploring other auto manufacturers that might offer a different balance of growth, income and electrification risk.

With the stock now trading above some analyst targets and a hefty $19.5 billion EV reset looming, is Ford still a classic value play in transition, or has the market already priced in its next chapter of growth?

Most Popular Narrative: 6.4% Overvalued

With Ford’s last close at $13.31 versus a narrative fair value of $12.52, the widely followed view sees only modest downside from here, hinging heavily on how quickly earnings can scale.

The analysts have a consensus price target of $10.8 for Ford Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $8.0.

Want to see what kind of margin expansion and earnings surge could underpin that valuation gap, and why revenue is still expected to drift? The full narrative spells out the growth runway, the compression in future multiples, and the precise assumptions that turn today’s price into a tight call on fair value.

Result: Fair Value of $12.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent EV division losses, as well as tariff or trade setbacks, could still undermine Ford’s margin recovery and challenge the current valuation narrative.

Find out about the key risks to this Ford Motor narrative.

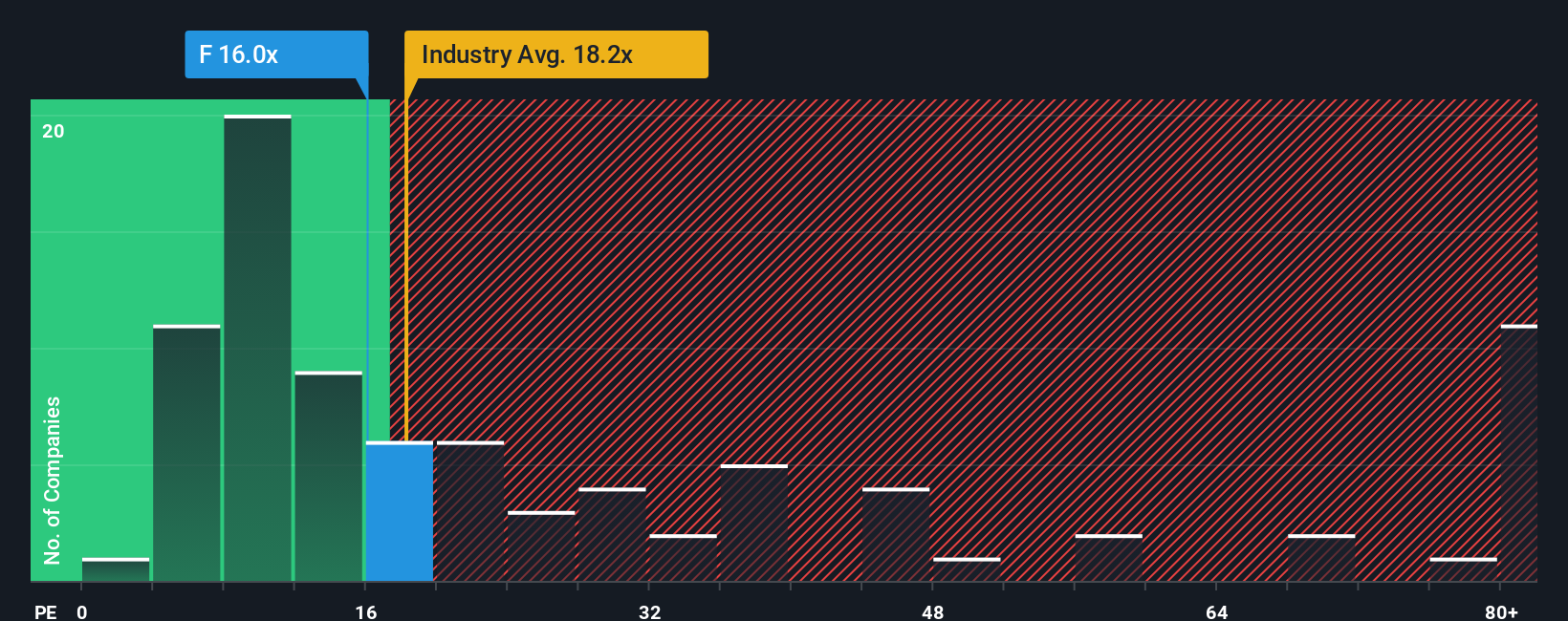

Another Lens on Value

On earnings, Ford looks cheap. It trades on about 11.3 times profits versus 18.7 times for the global auto sector, and a fair ratio of 26.9 times implied by our regression work. That wide gap hints at either a value opportunity or a warning the market sees something investors are missing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ford Motor Narrative

If you want to dig into the numbers yourself rather than lean on this view, you can build a fresh narrative in under three minutes, Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ford might be your starting point, but you will miss some of today’s most compelling themes if you do not scan the wider market with focused screeners.

- Capture income opportunities while rates stay uncertain by reviewing these 13 dividend stocks with yields > 3% that can steadily support your portfolio.

- Ride structural growth in automation and data by zeroing in on these 26 AI penny stocks shaping the next wave of intelligent software and hardware.

- Position ahead of the crowd by targeting these 80 cryptocurrency and blockchain stocks that are commercializing real world blockchain and digital asset solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion