- United States

- /

- Auto

- /

- NYSE:F

Ford (F): Net Margin Reaches 2.5%, Challenging Skeptics on Earnings Momentum vs. Valuation Concerns

Reviewed by Simply Wall St

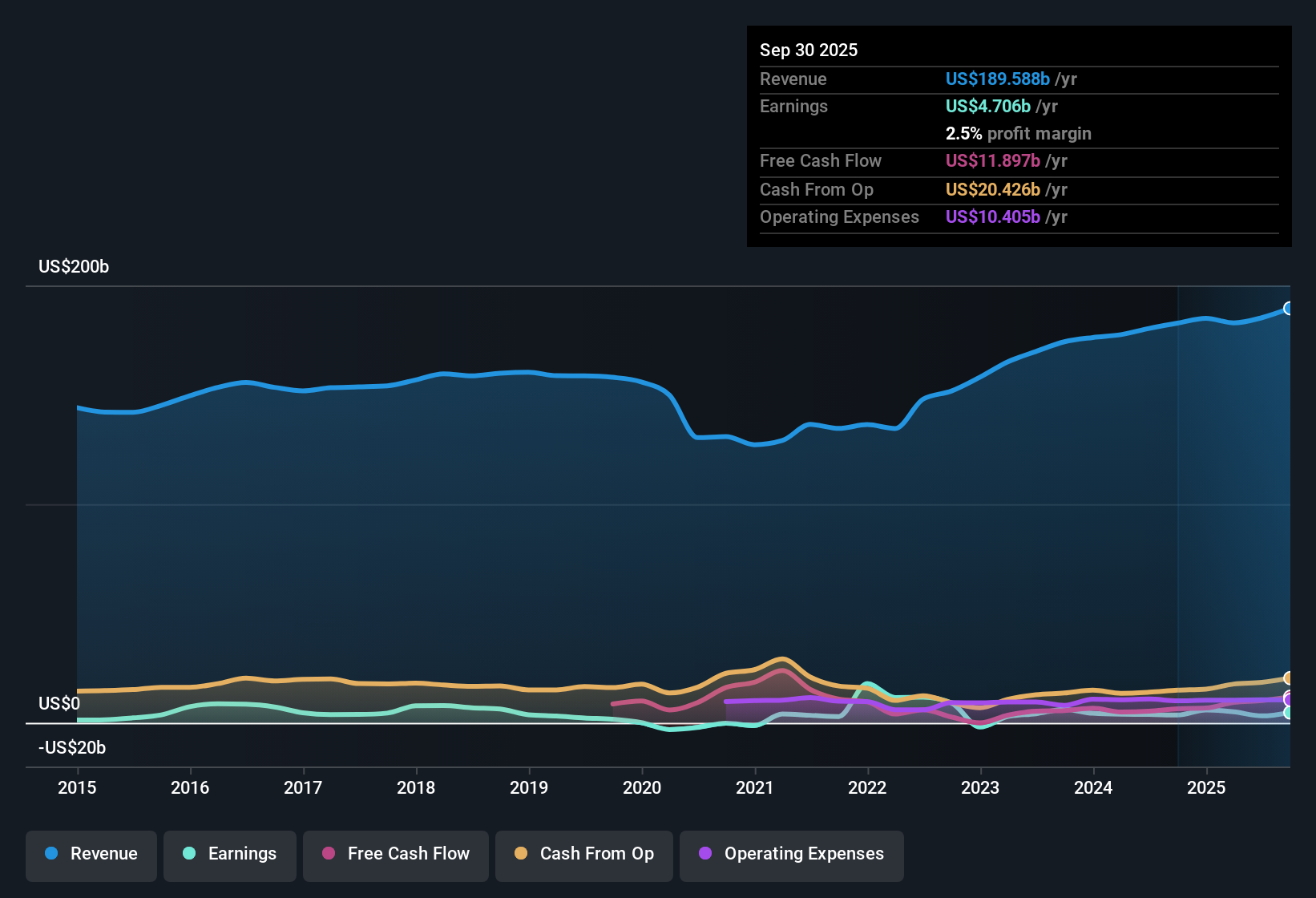

Ford Motor (F) reported a net profit margin of 2.5%, up from last year’s 1.9%, and delivered 33.4% earnings growth over the past year, far outpacing its five-year average earnings growth rate of -0.5% per year. The company’s EPS is expected to keep climbing at 16.3% per year, slightly above the forecasted 15.5% growth rate for the wider US market. Meanwhile, revenue is forecast to edge lower at -0.6% per year in the coming three years. Despite stock price optimism and high-quality earnings, market attention remains focused on how Ford balances profit gains, valuation signals, and pressure on revenue outlook.

See our full analysis for Ford Motor.Now it’s time to see how these numbers line up against the prevailing narratives, whether they strengthen the bulls, the bears, or prompt a rethink in the debate.

See what the community is saying about Ford Motor

Margins Climb Toward 3.6% Target

- Net profit margin is set to more than double from today’s 1.7% to a projected 3.6% in three years, even as revenue growth trails at -0.2% per year over the same period.

- In the analysts' consensus view, higher-margin recurring revenues from software and aftermarket services are fueling these gains.

- Paid software subscriptions in Ford Pro rose 24% year-over-year, and aftermarket now drives almost 20% of the division’s EBIT. Both support structurally higher margins.

- Ongoing cost controls and manufacturing efficiencies are expected to drive sustainable cost savings that reinforce earnings durability.

Forecast Diverges From Industry Valuation

- Ford’s current price-to-earnings ratio stands at 11.7x, well below the global auto industry average of 18.8x and the peer average of 18.6x, despite a share price of $13.84 that exceeds its DCF fair value of $8.64.

- The analysts' consensus narrative highlights tension between Ford’s discounted valuation metrics and the market pricing in future growth.

- To match earnings expectations for 2028, Ford would need to trade at a still-conservative 9.3x forward PE. This implies only modest rerating even if profit targets are met.

- The current share price sits 6.4% above the analyst consensus price target, suggesting investors are baking in higher conviction on earnings acceleration or new catalysts.

Consensus sees Ford balancing a low valuation against its future potential and operational momentum.

📊 Read the full Ford Motor Consensus Narrative.

Legacy and Transition Risks Remain Prominent

- Substantial risks persist from Ford’s heavy reliance on trucks and large SUVs, with future profitability exposed if EV transition lags or regulatory requirements accelerate.

- Bears argue that recurring warranty and recall costs continue to drag on margins, and that slow progress in electrification could leave Ford vulnerable if market or compliance conditions shift unexpectedly.

- An estimated $2 billion annual tariff headwind and ongoing global trade policy uncertainty further weigh on profitability and could offset recent margin improvements.

- High investment needs for autonomy and software are necessary to compete, but could cap near-term free cash flow as Ford scales next-generation platforms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ford Motor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique interpretation of the numbers? Craft your own view and share your perspective within just a few minutes. Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Persisting revenue headwinds and concerns over valuation leave Ford exposed if margin improvements stall or if market expectations shift unexpectedly.

If you want opportunities with stronger fundamentals and a better margin of safety, check out these 870 undervalued stocks based on cash flows to find companies trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion