- United States

- /

- Auto

- /

- NYSE:F

Assessing Ford Motor's Valuation Following Bold EV Investments and Platform Launch

Reviewed by Simply Wall St

Ford Motor (F) is making headlines this month after announcing a major $5 billion commitment to launch an affordable electric truck and introducing its new Universal EV Platform and Production System. These bold moves mark a clear effort by Ford to supercharge its electric ambitions and carve out a competitive position as the auto industry pivots toward electric vehicles. For investors weighing their next move, the scale and intent behind Ford’s EV investment are attention-catching, especially given the high costs, execution risks, and critical need to support its traditional profit-making operations.

Despite some bearish sentiment about the company’s electric division losses, it is hard to ignore the momentum building in Ford’s share price. The stock has climbed over 22% year-to-date and is up 13% in the past three months, outpacing the broader market and underscoring a shift in investor outlook. These gains arrive as Ford shores up its capital base with a new $3 billion loan and navigates a high-profile recall of several truck models. These developments serve as reminders of the company’s complex balancing act between legacy products and future growth bets.

With the stock’s recent advance and Ford doubling down on EV bets, is there still value left for those looking to buy in, or has the market already priced in the potential upside?

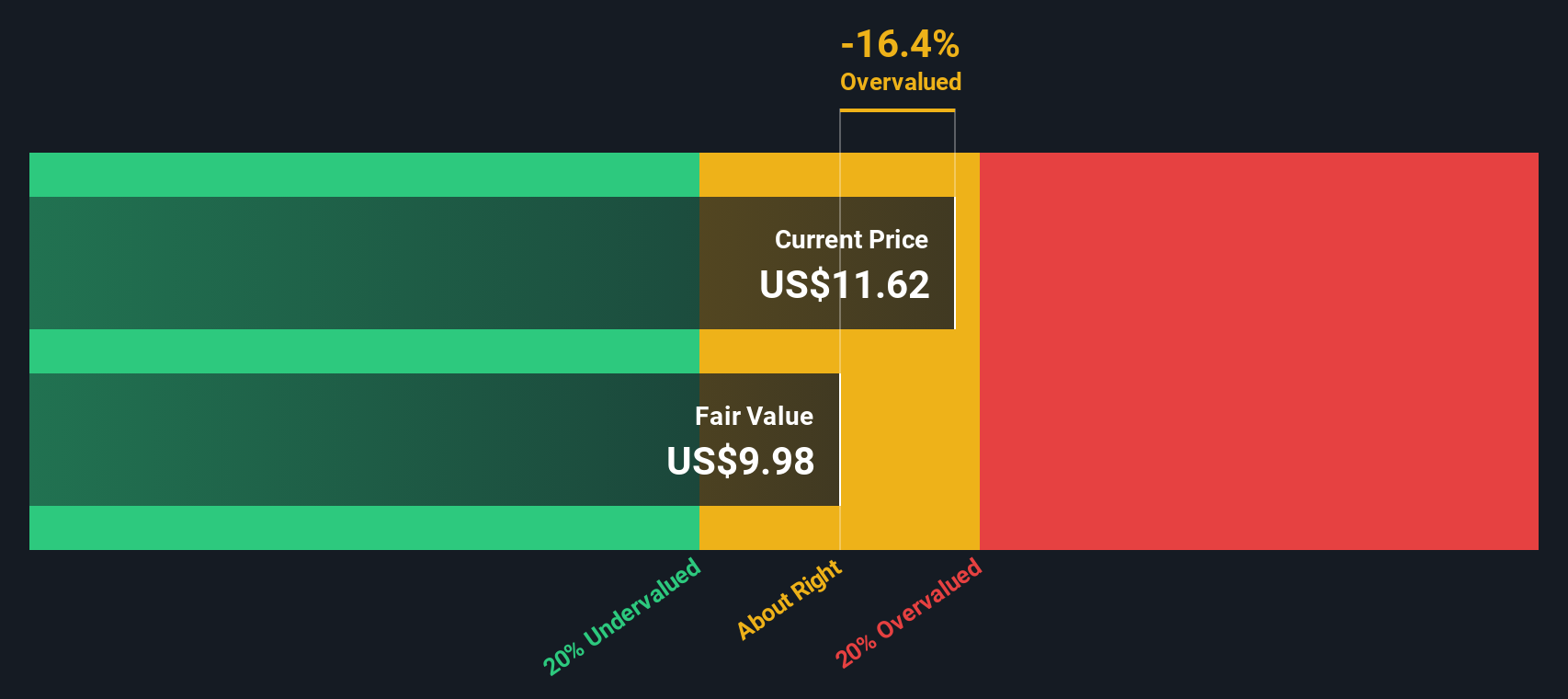

Most Popular Narrative: 21% Overvalued

According to the narrative by Bailey, Ford is currently trading above its fair value, reflecting lingering concerns about labor costs, competition, and credit market pressures.

"Ford’s sales have actually been declining globally over the past few years, independent of the recent macroeconomic troubles, and this is a trend I see continuing. The EU’s ban on the sale of ICE vehicles is still a number of years away, but I suspect that the impacts will be seen quite soon for Ford. In 2024, Britain will require that 22% of a manufacturer's vehicles sold to British customers be EVs, or the manufacturer risks facing harsh penalties. Ford would be among the hardest hit due to poor EV sales in the region."

This narrative makes bold predictions about Ford’s revenue, margins, sales volumes, and segment performance. It hints at a future that could look very different from today. Want to uncover the top assumptions driving Bailey’s fair value? There is a pivotal calculation at the heart of this thesis. Curious which factor single-handedly shifts the valuation? Dive deeper to decode the surprising logic behind this stock price target.

Result: Fair Value of $9.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a breakthrough in Ford’s EV adoption or an unexpected drop in interest rates could quickly shift the outlook and prove current expectations wrong.

Find out about the key risks to this Ford Motor narrative.Another View: SWS DCF Model Tells a Different Story

While the first valuation suggests Ford is overvalued based on how the market prices similar companies, our DCF model provides a more nuanced perspective. This approach examines Ford’s future cash flows and long-term fundamentals. Does this result challenge the initial overvaluation call, or does it reinforce it? The final answer may surprise you.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ford Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ford Motor Narrative

If you see things differently or want to examine the numbers firsthand, the tools are here for you to build your own narrative in just a few minutes. Start now: Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your outlook to just one company when there are so many promising opportunities waiting to be found. If you want to take the next step, now is your chance to uncover standout investments that could give your portfolio an edge. Use the Simply Wall Street Screener to confidently pursue these handpicked themes:

- Level up your long-term growth strategy by seeking out strong performers among undervalued businesses. Use the undervalued stocks based on cash flows screen for stocks trading below their cash flow potential.

- Catch the momentum of tomorrow’s tech by tracking companies at the frontier of artificial intelligence enhancements. Start with AI penny stocks to see who is leading the charge.

- Boost your income by targeting shares with attractive yields. Let dividend stocks with yields > 3% highlight dividend-paying companies offering more than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives