- United States

- /

- Auto Components

- /

- NYSE:APTV

How Investors May Respond To Aptiv (APTV) Exploring $5 Billion Sale and Upcoming Software Spin-Off

Reviewed by Sasha Jovanovic

- Following a plan first announced in January, Aptiv PLC has recently reached out to potential buyers for its electrical distribution systems business, reportedly seeking a valuation of about US$5 billion amid ongoing discussions with strategic buyers and private equity firms.

- This move comes as investor focus intensifies on Aptiv’s planned software spin-off, anticipated to drive growth and margin expansion, while several analysts have revised their earnings estimates upwards, reflecting increased confidence in the company’s outlook.

- We'll examine how Aptiv's pursuit of a software spin-off may shape the company's growth prospects and future investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

Aptiv Investment Narrative Recap

Owning shares in Aptiv means believing in the global shift toward connected and electrified vehicles, and the company's ambition to lead in advanced software and vehicle electronics. The newly disclosed sale process for its electrical distribution systems business supports Aptiv’s focus on higher-growth tech areas but does not exert a material effect on the most immediate catalyst: the upcoming software spin-off, or on the primary risk, which remains margin pressure from macroeconomic and auto sector volatility.

Recently, Aptiv announced a potential US$5 billion valuation as it actively gauges buyer interest for the electrical distribution arm; this follows analyst upgrades and sets the stage for sharper focus on software and electronics-related earnings momentum. Trimming legacy businesses while preparing for the software spin-off may unlock value and financial flexibility, signaling Aptiv’s intent to accelerate its transition to high-margin growth avenues even as market risks linger.

Yet, should headwinds in global vehicle production or sudden shifts in OEM schedules intensify, investors must also weigh the risk that ...

Read the full narrative on Aptiv (it's free!)

Aptiv's narrative projects $23.3 billion revenue and $1.9 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $0.9 billion increase in earnings from $1.0 billion today.

Uncover how Aptiv's forecasts yield a $88.00 fair value, in line with its current price.

Exploring Other Perspectives

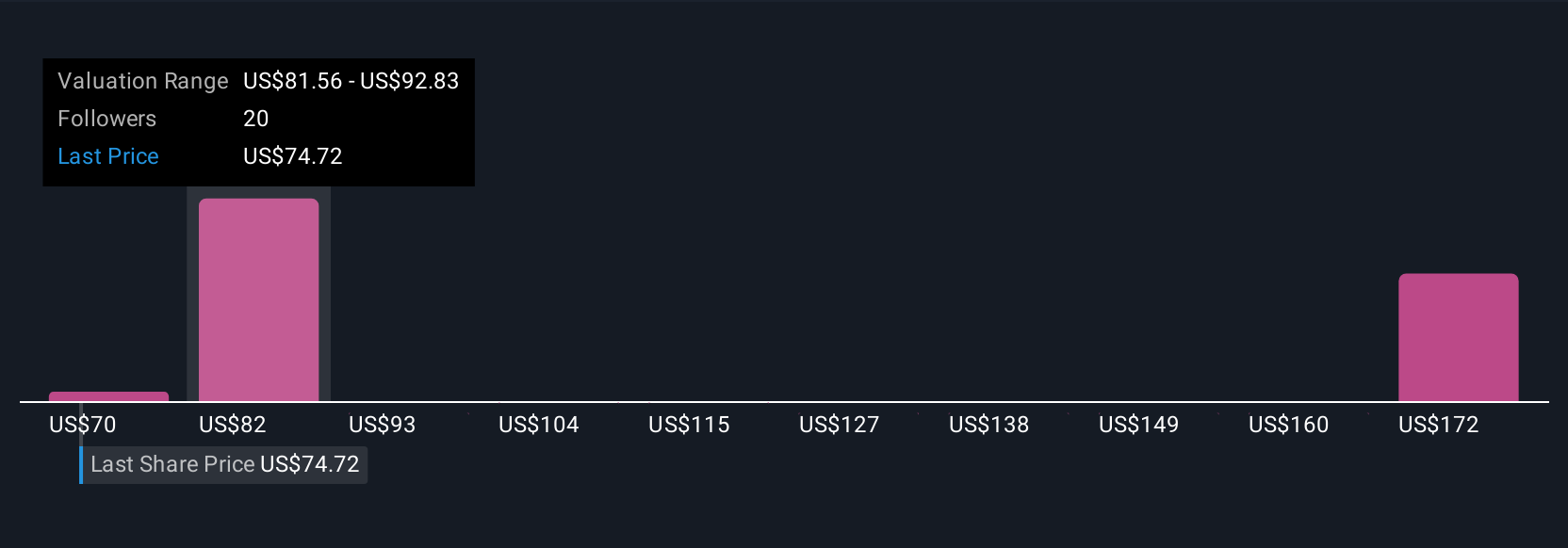

Seven members of the Simply Wall St Community estimate fair values for Aptiv ranging from US$70.29 up to US$207.31. While many expect growth from advanced electronics and software, you may want to compare these different views because sector volatility and shifting production schedules remain key variables.

Explore 7 other fair value estimates on Aptiv - why the stock might be worth 18% less than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives