- United States

- /

- Auto Components

- /

- NYSE:APTV

Aptiv (APTV) Valuation in Focus After Company Split Announcement and Upbeat Analyst Outlook

Reviewed by Kshitija Bhandaru

Aptiv (APTV) has made headlines with plans to split into two separate businesses in early 2026. Investors hope this move will reveal more value in its core operations and future growth prospects.

See our latest analysis for Aptiv.

The news of Aptiv’s planned split has certainly added to the buzz around its recent performance, with investor optimism also buoyed by positive earnings surprises and an improving revenue outlook. The stock’s strong 90-day share price return of nearly 18% and 37% year-to-date show momentum is building, even as its five-year total shareholder return remains in negative territory.

If Aptiv’s recent moves have you looking for other opportunities in the auto space, now is a great time to explore See the full list for free.

With all eyes on Aptiv’s split and its recent momentum, investors are left wondering if Aptiv’s current valuation reflects hidden upside, or if the market has already priced in its post-split growth story.

Most Popular Narrative: 9.9% Undervalued

At $82.73, Aptiv trades below the most-followed narrative’s fair value estimate of $91.81. This suggests notable upside if the underlying expectations hold true. With investor attention heightened by the recent split announcement, this valuation rests on a series of bullish assumptions that set the stage for significant re-rating potential.

Strong demand for Aptiv's advanced electrical and electronic architectures, including high-voltage and high-speed data connectivity products, is being driven by the global shift toward electric vehicles and increasingly complex vehicle electrical systems. This trend is supporting robust new business bookings and growth in content per vehicle, which acts as a positive catalyst for revenue growth and, as volume scales, for operating leverage and margins.

Curious what growth rates the narrative thinks will unlock this premium? Hint, it’s not just about more cars sold. The real secret is Aptiv’s evolving mix of next-generation technology and how profits are projected to scale far more quickly than many realize. Click through to find out which ambitious projections are fueling this valuation call.

Result: Fair Value of $91.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global market uncertainty and volatile commodity prices remain key risks that could quickly shift Aptiv's current growth outlook.

Find out about the key risks to this Aptiv narrative.

Another View: What Does Our DCF Model Say?

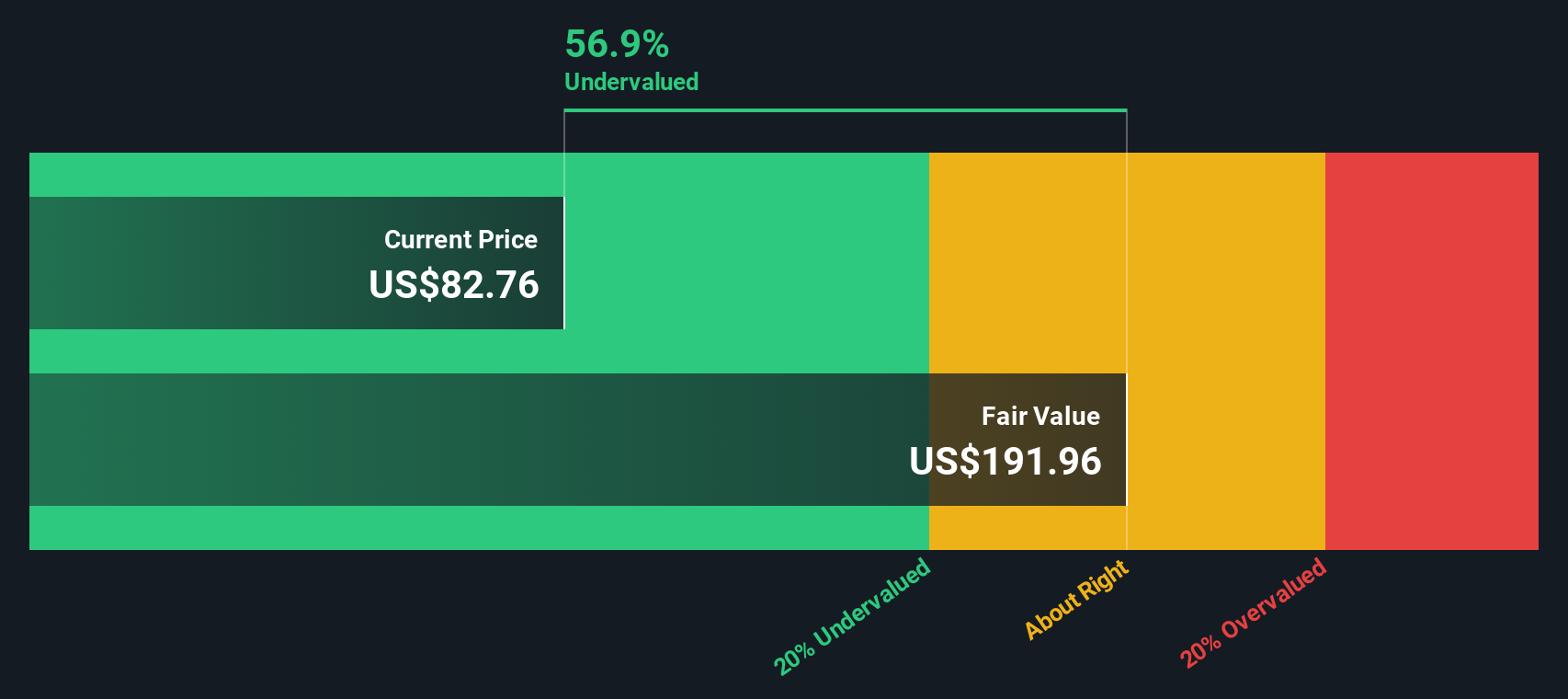

While the most-followed narrative suggests Aptiv could be undervalued based on future growth expectations, our SWS DCF model paints an even starker picture. The model estimates fair value at $192.79, far above the current price, which signals significant potential undervaluation. Could the market be missing something big here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aptiv Narrative

If you see things differently or prefer digging deeper on your own, you can create your own Aptiv outlook from scratch in just a few minutes. Do it your way

A great starting point for your Aptiv research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of trends and never missing an opportunity. Give yourself the edge by checking out these handpicked stock ideas supported by real market data.

- Boost your portfolio’s resilience and passive income by evaluating leading companies paying high yields with these 18 dividend stocks with yields > 3%.

- Benefit from the AI-driven surge by checking out these 25 AI penny stocks. These companies are poised to reshape entire industries with advanced automation and innovation.

- Tap into tomorrow’s tech breakthroughs and ride the growth wave with these 26 quantum computing stocks, focused on computing’s next frontier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives