- United States

- /

- Auto Components

- /

- NYSE:ALV

Could Autoliv’s (ALV) Zero-Gravity Safety Tech Signal a New Edge in Mobility Innovation?

Reviewed by Sasha Jovanovic

- Adient and Autoliv recently announced the mass production readiness of jointly developed advanced safety solutions designed to protect occupants in deeply reclined, zero-gravity vehicle seating positions.

- This technology specifically addresses a growing industry challenge as ergonomic seating trends outpace conventional safety system capabilities, positioning both companies at the forefront of occupant protection innovation.

- We'll examine how Autoliv's debut of safety innovations for zero-gravity seating may reshape its investment narrative in emerging mobility segments.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Autoliv Investment Narrative Recap

To be a shareholder in Autoliv, you need confidence in the company's ability to deliver sustained growth by supplying advanced safety technologies, especially as demand for automotive occupant protection increases worldwide. The recent zero-gravity seating partnership with Adient highlights Autoliv’s push into emerging mobility segments, but the near-term business remains most sensitive to ongoing uncertainty in global vehicle production, which continues to overshadow shorter-term catalysts, this news does not materially alter that risk.

Among recent corporate updates, the April launch of the Omni Safety™ system for reclined seating stands out as especially relevant to the Adient partnership announcement, underscoring Autoliv’s consistent investment in innovation for evolving automotive safety needs. Both product launches feed into the company’s core catalyst: capturing greater safety content per vehicle as regulatory expectations climb, which may provide some insulation from industry cyclicality.

Yet, while these product advances may help offset cyclical weakness, investors should also be alert to the risk that persistent global production slowdowns could challenge Autoliv’s ability to fully realize...

Read the full narrative on Autoliv (it's free!)

Autoliv's outlook anticipates $11.8 billion in revenue and $896.4 million in earnings by 2028. This is based on a 4.2% annual revenue growth rate and a $181.4 million increase in earnings from the current $715.0 million level.

Uncover how Autoliv's forecasts yield a $135.21 fair value, a 16% upside to its current price.

Exploring Other Perspectives

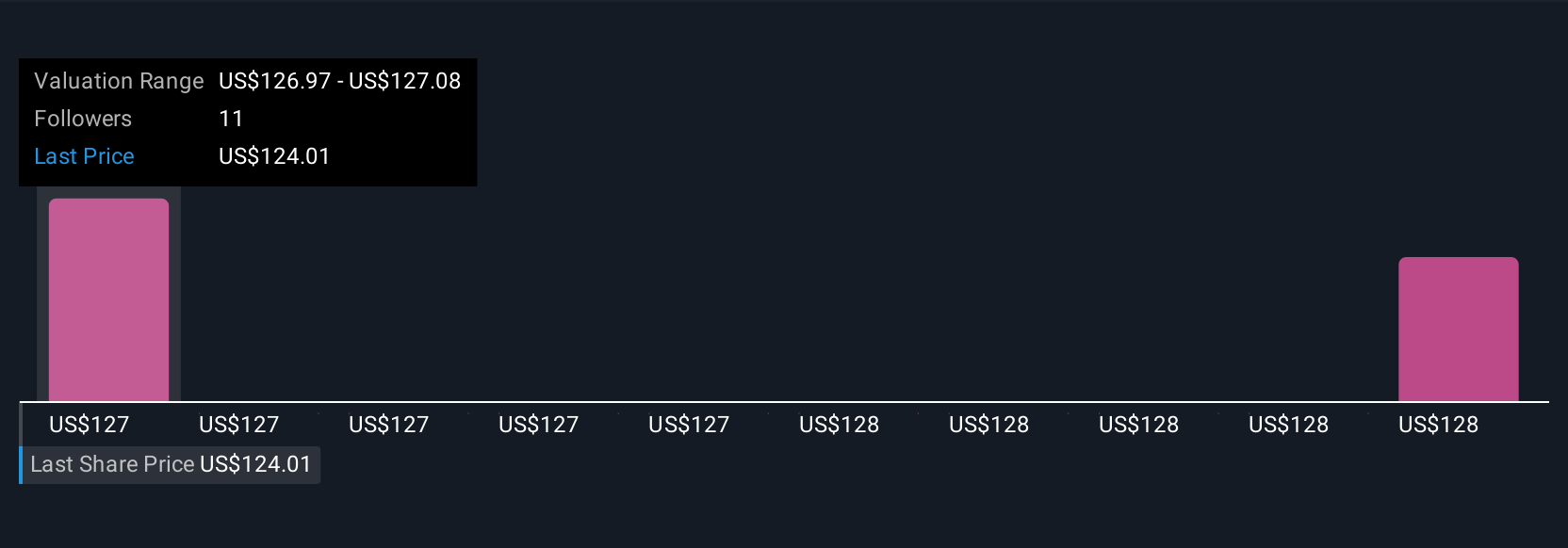

Simply Wall St Community members have set fair value estimates for Autoliv ranging from US$126.97 to US$136.65 across three viewpoints. Ongoing uncertainty in global auto production growth remains a major consideration for the company’s prospects, so exploring a range of community perspectives offers valuable context for assessing potential risks and reward.

Explore 3 other fair value estimates on Autoliv - why the stock might be worth as much as 17% more than the current price!

Build Your Own Autoliv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autoliv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Autoliv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autoliv's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALV

Autoliv

Through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives