- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA) Margin Drop to 5.3% Challenges Bullish Growth Narratives Despite Robust Long-Term Forecasts

Reviewed by Simply Wall St

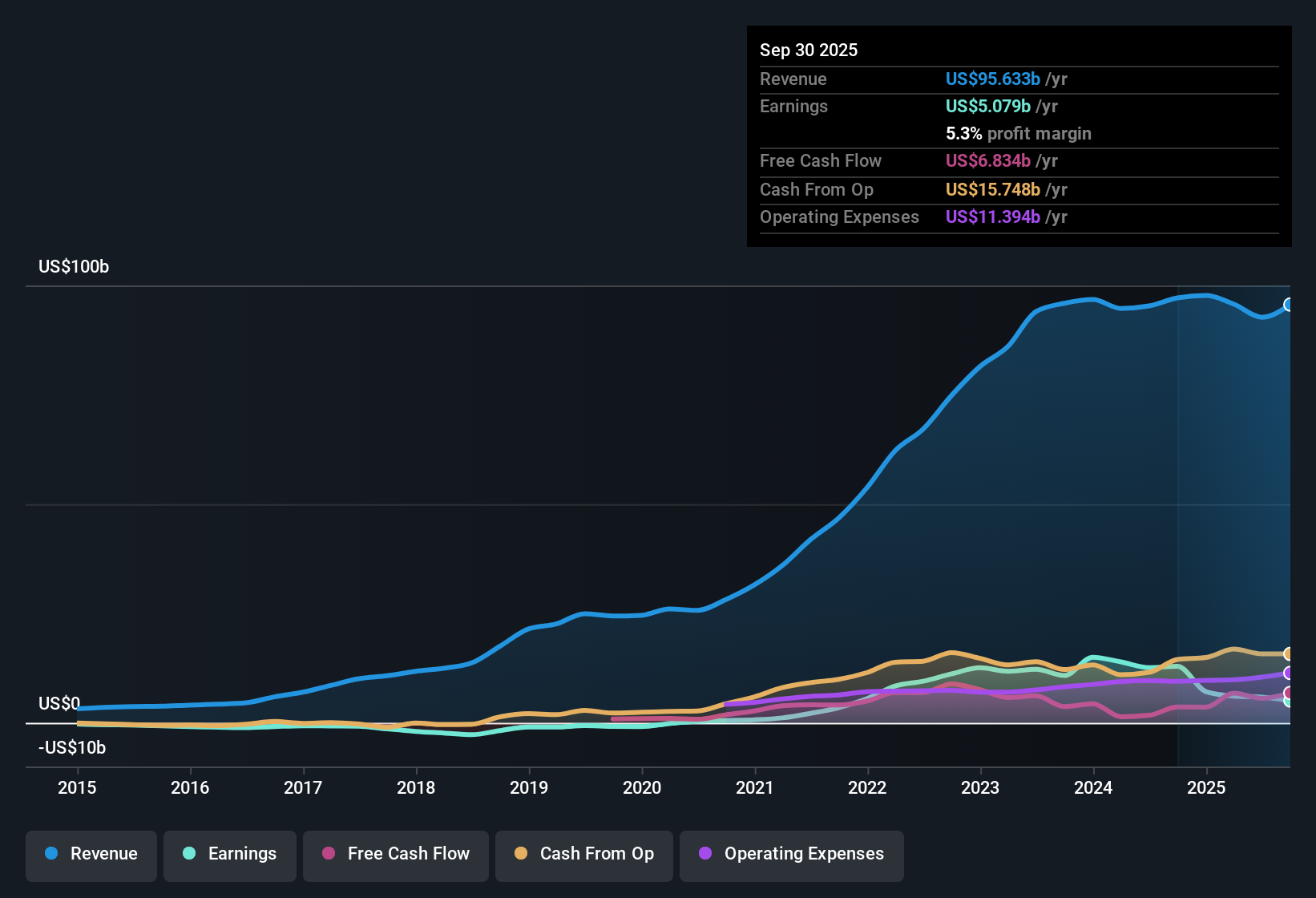

Tesla (TSLA) reported a net profit margin of 5.3%, down from last year’s 13.3%, as the company saw negative earnings growth over the most recent year despite averaging 19.2% annual earnings growth over the past five years. Still, the outlook remains upbeat, with revenue forecast to rise 16.9% per year and earnings expected to surge by 36% annually, both easily outpacing broader US market averages.

See our full analysis for Tesla.Up next, we’ll see how these results hold up against the major market narratives, and which storylines might be put to the test.

See what the community is saying about Tesla

Recurring Software Margins on the Horizon

- Tesla's transition to high-margin software, driven by Full Self-Driving (FSD) subscriptions and autonomous services, significantly expands potential for recurring earnings, with revenue forecast to grow 16.9% annually versus a US market average of 15.5%.

- Analysts' consensus view highlights that expansion into autonomous services and energy storage is shifting Tesla toward a business model with stronger, more stable margins.

- Scaling FSD and robotaxi initiatives could meaningfully increase recurring revenue, while analysts expect profit margins to improve from 6.3% today to 10.4% in three years.

- Yet, some analysts caution that regulatory delays or slow adoption abroad, especially in the EU and China, may slow this high-margin transition and delay meaningful impact to earnings.

Surprising future revenue growth meets skepticism. See how Tesla's evolving business model stacks up in the full consensus narrative. 📊 Read the full Tesla Consensus Narrative.

Premium Valuation vs. Peers

- Shares trade at a price-to-sales multiple of 15.6x, towering above both the US auto industry average of 1.3x and the peer average of 1.2x, while also sitting well above the DCF fair value estimate of $138.58.

- Analysts' consensus view underlines that at a current price of $448.98, investors are being asked to believe in outsized future earnings ($15.4 billion forecast by 2028) and a future PE of 89.5x, more than quadruple the US industry’s 18.1x.

- The analyst consensus price target is $380.05, about 15% below the current share price, suggesting a potential re-rating if anticipated growth does not materialize as quickly as hoped.

- At these valuation levels, even strong execution may not guarantee near-term upside. Sentiment will depend on Tesla's ability to deliver on aggressive software and autonomous growth forecasts.

Margin Pressures Offset by Long-Term Growth

- Net profit margin fell sharply to 5.3% from 13.3% last year, even as Tesla’s five-year annual earnings growth of 19.2% signals robust long-term expansion potential.

- Analysts' consensus view points out the tension between margin compression, driven by higher costs, trade policies, and ramp-up expenses, and the high expectations for margin recovery through scaling energy storage and AI-driven cost reductions.

- Bears note intensifying margin pressures due to regulatory changes and loss of US incentives, but consensus holds that gigafactory expansion and software-driven business lines will help restore and eventually boost profitability.

- Tracking how quickly these growth drivers offset the current margin slide will be central to the investment case in upcoming periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tesla on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a fresh angle? Bring your insights to life and share your take in just a few minutes. Do it your way.

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Tesla’s ambitious growth plans, its rich valuation and recent margin pressures raise concerns that strong execution may still not ensure near-term returns.

If you want to avoid stretched price tags and margin volatility, check out these 875 undervalued stocks based on cash flows to uncover stocks trading at more attractive valuations right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion