- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Is It Time to Reassess Tesla After 13% Year-to-Date Gain?

Reviewed by Bailey Pemberton

- Ever wondered if Tesla’s headline-grabbing stock price really lines up with its long-term value, especially with so many opinions swirling around?

- After a solid 3.0% rise over the past week, Tesla’s year-to-date gains now stand at 13.4%, while the stock has delivered a 135.8% return over the last three years.

- In the past month, headlines have highlighted Tesla’s continued expansion in global EV markets, ongoing progress in self-driving technology, and production developments at key gigafactories. All of these factors contribute to changing investor expectations and recent share price moves.

- By one widely used valuation approach, Tesla scores a 0 out of 6 for being undervalued right now. Before drawing any conclusions, it can be helpful to unpack how these valuation methods work and explore whether there is a more effective way to assess the company’s true worth at the end of this article.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate the intrinsic value of a company by extrapolating its future cash flows and discounting them back to today’s dollars. This approach provides a forward-looking perspective by projecting how much cash Tesla will generate for its shareholders over the coming years.

Currently, Tesla’s Free Cash Flow sits at approximately $6.40 Billion, which serves as a starting point for both analyst and model projections. Analyst estimates provide detailed forecasts up to 2029, and beyond that, extended projections are calculated using models from Simply Wall St.

According to these forecasts, Tesla’s Free Cash Flow could reach $54 Billion by 2035, though much of this growth is based on extrapolated estimates. Most analyst coverage is limited to the next few years, which results in a reliance on longer-term projections. All figures are reported in US dollars, keeping the analysis consistent with Tesla’s financial reporting.

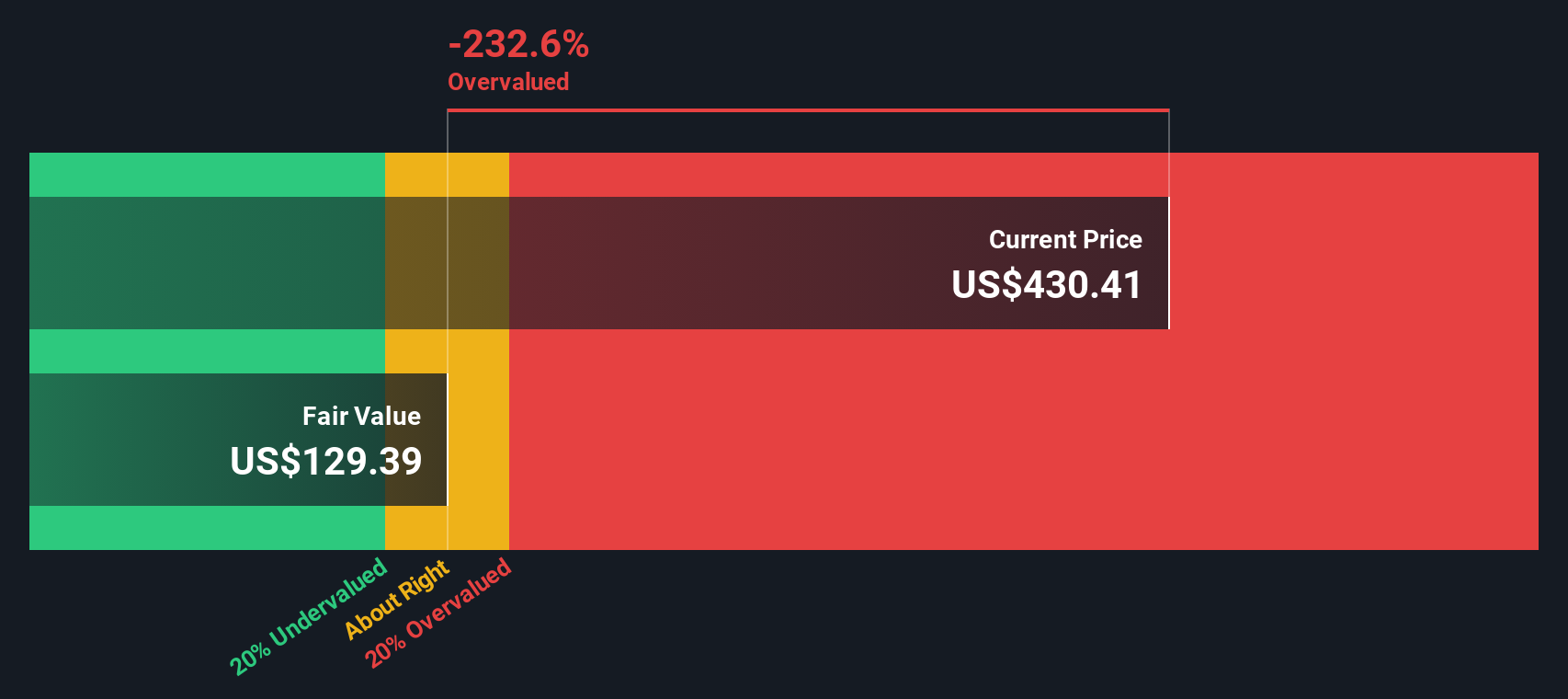

Based on this two-stage cash flow analysis, Tesla’s intrinsic value is estimated at $138.78 per share. Compared to the current market price, this suggests the stock is roughly 210% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 210.0%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tesla Price vs Sales (P/S)

For companies like Tesla that are rapidly scaling and reinvesting profits for future growth, the Price-to-Sales (P/S) ratio is a particularly useful valuation metric. While earnings can fluctuate with investments in new technology or capacity, sales provide a clearer snapshot of the company’s current reach and operational momentum. Investors tend to rely on the P/S ratio to gauge whether growth expectations are fairly reflected in the share price, as well as to account for risks such as competition and margin pressures that could affect future profitability.

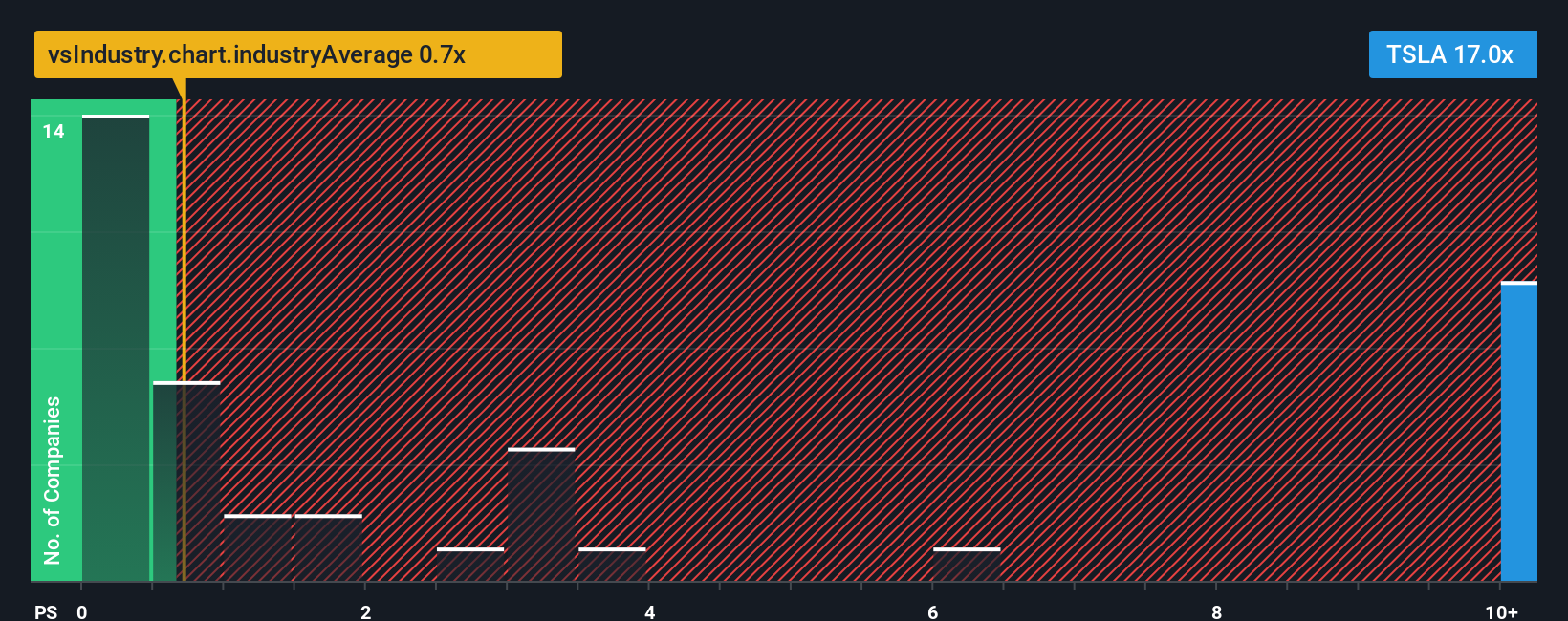

At the moment, Tesla’s P/S ratio sits at 15.0x. This is substantially higher than the auto industry average of 0.9x and also above the company’s peer group average of 1.38x. Such a premium suggests that investors are pricing in robust revenue growth and a sustained competitive advantage. However, high multiples can reflect increased risk if those expectations are not met.

Simply Wall St's proprietary "Fair Ratio" takes this analysis further by adjusting for Tesla’s unique risk profile, earnings growth, profit margin, industry classification, and market capitalization. Unlike simple peer or industry averages, the Fair Ratio gives a more nuanced estimate of what would constitute a reasonable P/S multiple for a company with Tesla’s characteristics. Tesla’s Fair Ratio is calculated at 2.88x, meaning the stock trades at more than five times what this holistic benchmark would suggest.

As Tesla’s actual P/S ratio of 15.0x diverges significantly from the Fair Ratio benchmark of 2.88x, the stock appears to be meaningfully overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven way to express your personal perspective on a company by connecting what you believe about Tesla's business, technology, risks, and growth to financial forecasts such as future revenues, margins, and a Fair Value per share.

Unlike traditional models that rely solely on numbers, a Narrative uses your assumptions and reasoning to build a forecast and then calculates what Tesla's shares should be worth. This approach is accessible to everyone via Simply Wall St's Community page, where millions of investors share, compare, and update their Narratives as news, earnings, or events unfold.

Narratives give you a clear and dynamic framework for investment decisions. If your Narrative Fair Value is higher than today's Price, it might be a buying opportunity. If it is lower, you may want to exercise caution or consider selling. As fresh information comes in, these forecasts update automatically, helping you react quickly with confidence.

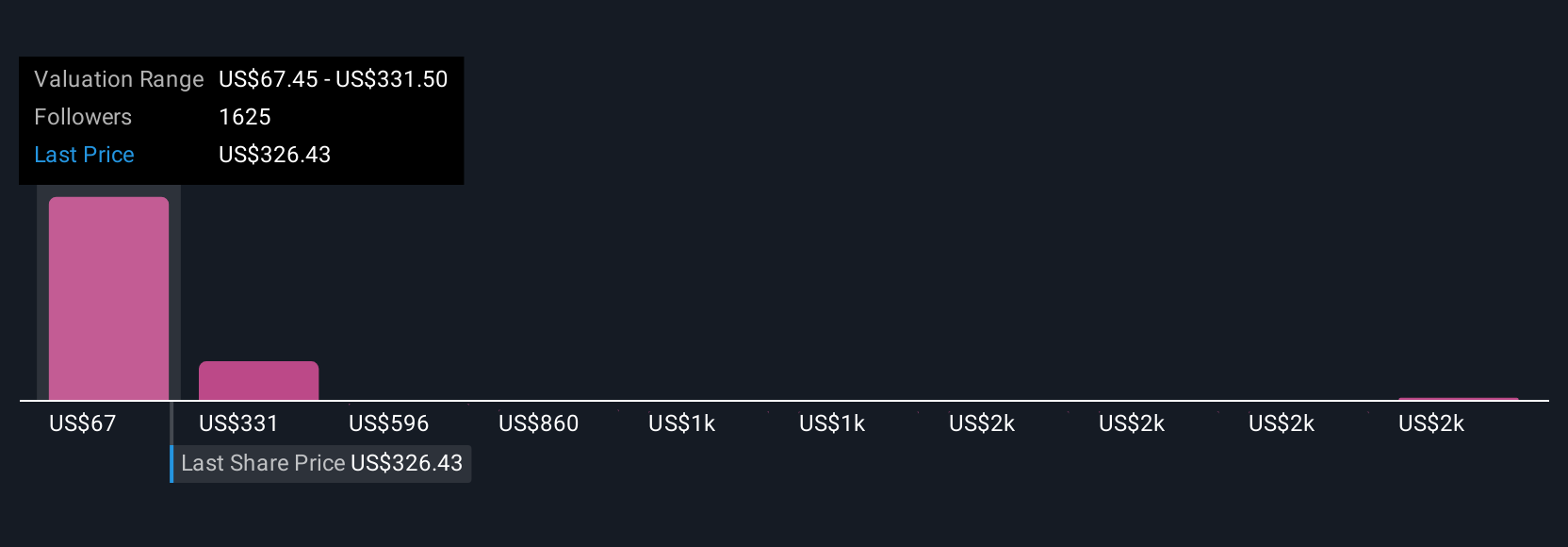

For example, on Simply Wall St, Tesla Narratives range from viewing it as "just a car company" with a Fair Value below $70 per share to seeing it as a future AI and robotics powerhouse worth over $2,700 per share. This reflects the diversity of real investor outlooks, all grounded in clear stories and their financial implications.

For Tesla, however, we'll make it really easy for you with previews of two leading Tesla Narratives:

Fair Value: $2,707.91

Current discount to Fair Value: -84.1%

Projected revenue growth: 77%

- Sees Tesla evolving beyond cars and projects major growth in AI, robotics, energy, and software, with 2030 revenue reaching $1.94 trillion and net profit of $534 billion.

- After discounting future earnings, estimates Tesla’s current fair share price between $2,120 (Bear), $2,968 (Base), and $4,240 (Bull), which is far above today's market price.

- Considers the enormous upside if Tesla executes its vision and acknowledges risks such as ambitious targets, competition, and regulatory hurdles.

Fair Value: $332.71

Current premium over Fair Value: 29.4%

Projected revenue growth: 30%

- Highlights Tesla’s strong catalysts such as the Cybertruck, Full Self-Driving, and robotics, but notes significant execution challenges and an increasingly competitive EV market.

- Estimates a more modest future with 2029 revenue potentially reaching $150 billion and profit margins in the 20 to 22 percent range, with increasing risks from regulation, supply chains, and pricing pressures.

- Projects valuation multiples to contract over time and suggests Tesla is already pricing in most upside, carrying substantial risk if expectations fall short.

Do you think there's more to the story for Tesla? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026