- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Is Investor Pushback on Musk’s Pay Shaping the Tesla (TSLA) Growth Story?

Reviewed by Sasha Jovanovic

- In the past week, the New York State Common Retirement Fund disclosed it had urged Tesla shareholders to vote against all directors up for re-election and against Elon Musk’s trillion dollar pay proposal at the November 6, 2025 annual meeting, while also backing a shareholder proposal to lower the derivative-suit ownership threshold.

- This investor activism comes alongside ongoing debate around Tesla’s leadership, as well as its transition from a pure automotive company to a business with increasing focus on AI, autonomous services, and software-driven revenue streams.

- We’ll examine how the heightened scrutiny over Musk’s compensation plan might alter Tesla’s evolving investment narrative and growth profile.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tesla Investment Narrative Recap

For investors in Tesla, the core belief is in the company's transition from a high-growth automaker to a leader in artificial intelligence, autonomous vehicles, and software-enabled revenue. The recent activist push against board members and Elon Musk’s compensation package brings governance and leadership into the spotlight, but it appears unlikely to materially alter the near-term catalyst of scaling robotaxi and FSD services; however, it has heightened focus on risks around execution and regulatory friction.

This scrutiny of Tesla’s leadership comes as the company manages a recall of nearly 13,000 vehicles due to a battery defect, underscoring both the operational complexities and the importance of product reliability as Tesla expands into new markets and technologies. While governance debates may capture headlines, real execution risks, like safety issues or regulatory delays, remain more likely to impact Tesla's growth trajectory and margin expansion in the short term.

By contrast, it’s the potential for regulatory setbacks in key markets that investors should be watching most closely…

Read the full narrative on Tesla (it's free!)

Tesla's outlook anticipates $148.1 billion in revenue and $15.4 billion in earnings by 2028. Achieving this would require 16.9% annual revenue growth and a $9.5 billion increase in earnings from the current $5.9 billion.

Uncover how Tesla's forecasts yield a $391.32 fair value, a 16% downside to its current price.

Exploring Other Perspectives

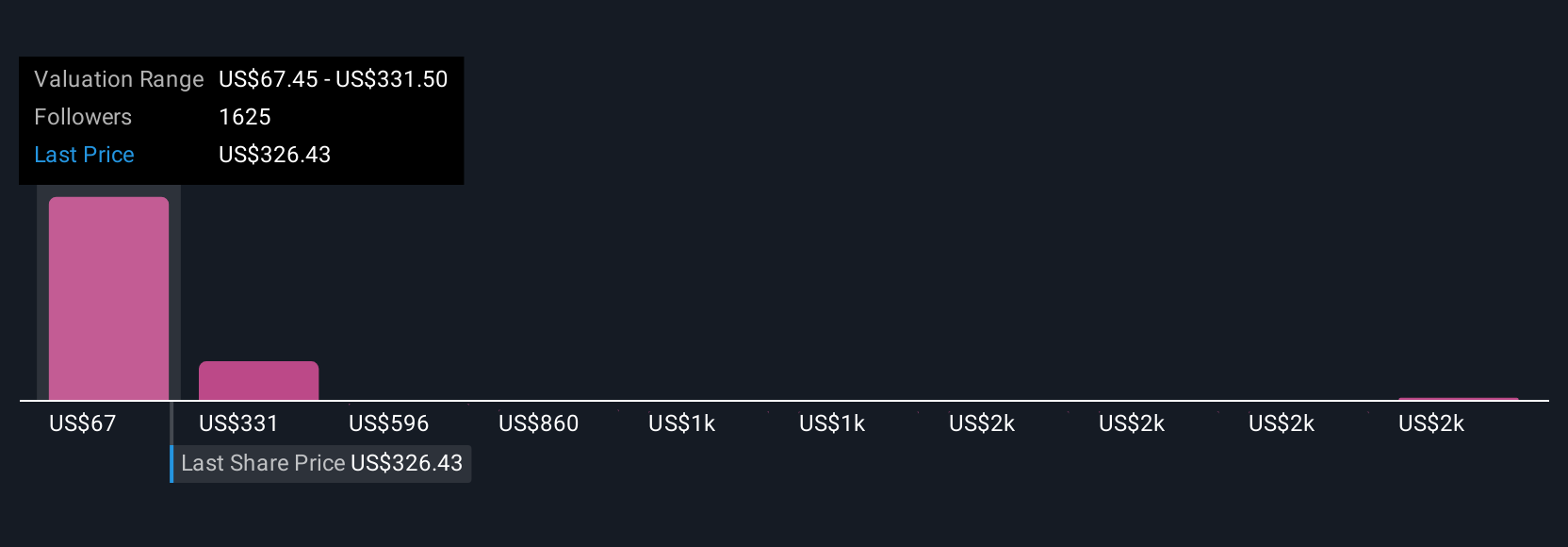

Community members on Simply Wall St offer 228 fair value estimates for Tesla, ranging from US$67 to over US$2,700 per share. As you weigh these diverse viewpoints, keep in mind that regulatory or legal obstacles could delay Tesla’s plans for global autonomous rollouts, affecting overall performance.

Explore 228 other fair value estimates on Tesla - why the stock might be worth less than half the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives