- United States

- /

- Auto

- /

- NasdaqGS:TSLA

How Rising Costs and AI Spending at Tesla (TSLA) Are Shaping Its Next Chapter

Reviewed by Sasha Jovanovic

- Tesla recently reported record third-quarter revenue of US$28.10 billion, driven by consumers buying ahead of the EV tax credit expiration, but saw net income drop to US$1.37 billion as rising costs cut profitability.

- Even amid strong operational advancements in AI and robotics, investors are weighing concerns about future demand, margin pressure, and execution on ambitious technology projects.

- We'll explore how Tesla's sharp decline in profitability and ambitious AI investments influence its future-focused investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tesla Investment Narrative Recap

To be a Tesla shareholder today, investors need conviction in the company's ability to transform transportation and energy through leadership in AI, automation, and scalable manufacturing, especially as its future depends heavily on the rapid expansion of high-margin software and robotaxi revenues. Tesla’s record Q3 revenue is a clear positive, but the quarter also highlights persistent margin pressures from rising costs and expiring US tax credits, making near-term demand trends and execution on technology rollouts crucial, short-term, the biggest catalyst remains the rollout speed and uptake of Full Self-Driving and robotaxi offerings, while the main risk is a prolonged margin squeeze if costs stay elevated and demand cools. The current news, including recalls and growing Supercharger partnerships, is not expected to materially shift these near-term priorities or risks.

Among the recent news, the announcement that Subaru Solterra owners now have access to Tesla Superchargers stands out for its relevance. This move supports Tesla’s charging network expansion and strengthens the recurring revenue opportunity from energy and infrastructure services, providing some support to long-term catalysts but not altering the immediate margin and demand risk.

Yet, against this backdrop, investors should not lose sight of the risk if global tariffs and rising manufacturing costs persist longer than...

Read the full narrative on Tesla (it's free!)

Tesla's outlook projects $148.1 billion in revenue and $15.4 billion in earnings by 2028. This scenario is based on a forecast annual revenue growth rate of 16.9% and an increase in earnings of $9.5 billion from the current $5.9 billion.

Uncover how Tesla's forecasts yield a $366.77 fair value, a 19% downside to its current price.

Exploring Other Perspectives

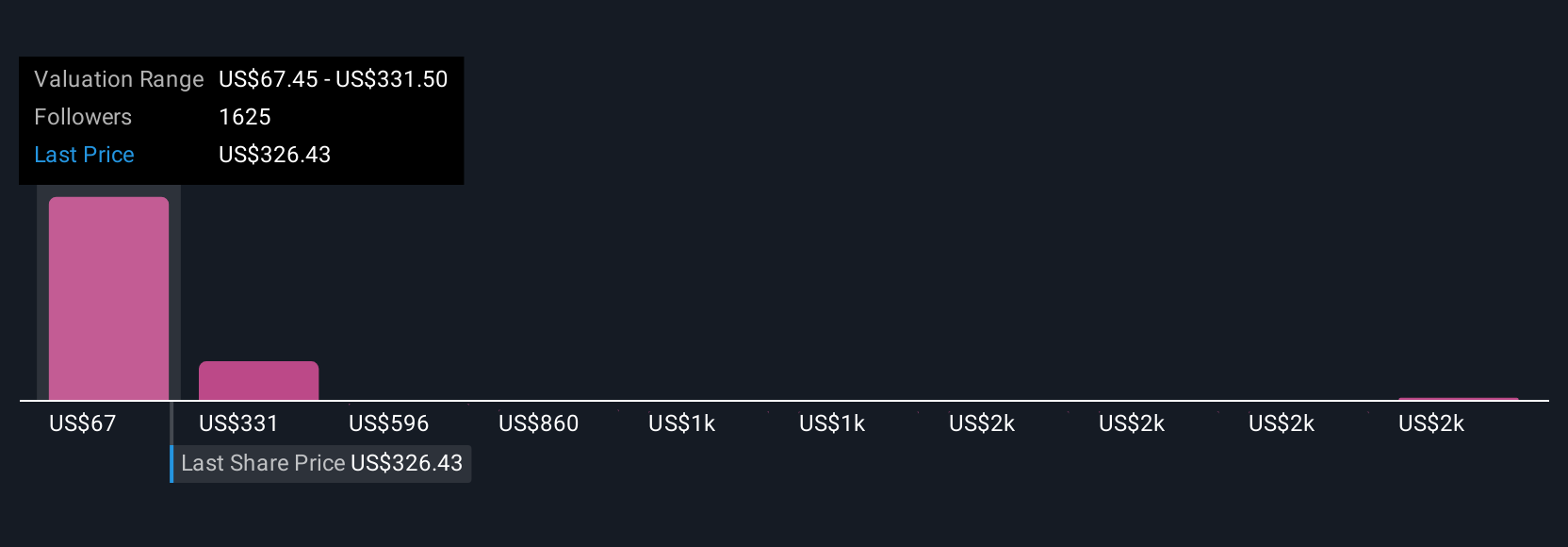

Private investors in the Simply Wall St Community assigned fair values ranging from US$67.45 to US$2,707.91 based on 226 analyses. The outlook still hinges on whether margin pressure will continue hurting Tesla’s bottom line.

Explore 226 other fair value estimates on Tesla - why the stock might be worth over 5x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives