- United States

- /

- Auto

- /

- NasdaqGS:TSLA

How Investors Are Reacting To Tesla (TSLA) Leadership Change in AI and Robotics Amid Ongoing Robotaxi Trials

- Tesla's head of the Optimus humanoid robot program, Milan Kovac, has stepped down, with Ashok Elluswamy taking over amid ongoing robotaxi trials and executive-public political disagreements.

- The leadership change in Tesla's AI and robotics division has intensified investor scrutiny of the company's ambitious innovation roadmap at a time of heightened political and regulatory risk.

- We'll examine how the departure of the Optimus robotics head may shift Tesla’s investment narrative amid new management and innovation questions.

Tesla Investment Narrative Recap

Tesla shareholders need to believe in the company's capacity to execute on its ambitious AI and robotics vision, while weathering volatility from executive turnover and external headlines. The recent departure of the Optimus robotics head, followed by Ashok Elluswamy stepping in, has drawn more investor attention but does not appear to materially affect the most important short-term catalyst: the progression of Tesla's robotaxi trials. The biggest immediate risk remains political and regulatory uncertainty tied to high-profile leadership disputes.

Tesla’s recent rollout of robotaxi testing in Austin stands out as especially relevant, given the leadership changes in its robotics division. As these autonomous vehicle initiatives continue to be watched closely, both new management stability and successful expansion of robotaxi trials will likely be priority areas for investors focused on near-term catalysts.

In contrast, some investors may be overlooking the heightened regulatory and political challenges, details of which could significantly reshape the risk profile...

Read the full narrative on Tesla (it's free!)

Exploring Other Perspectives

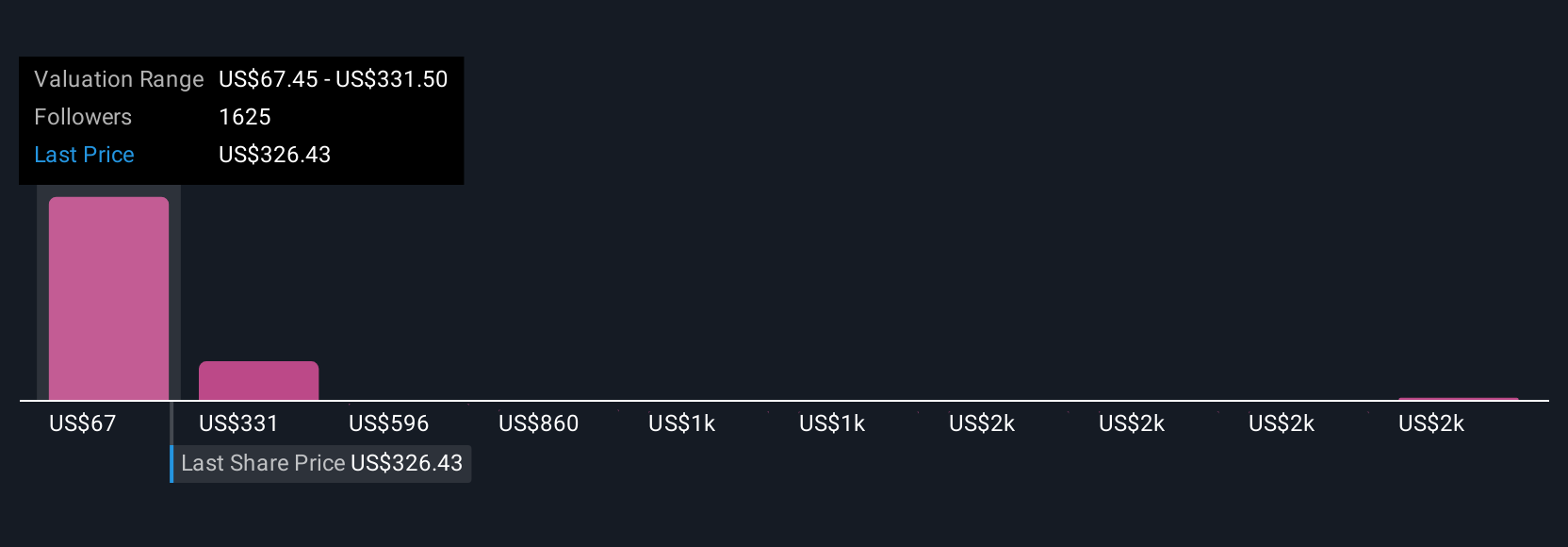

Private fair value estimates from 186 members of the Simply Wall St Community range widely from US$67 to US$2,707 per share. With executive turnover heightening questions around Tesla's innovation trajectory, these varied forecasts show how much investor opinions can differ, consider reviewing multiple viewpoints for a fuller picture.

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives