- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Faraday Future’s Supercharger Access Could Be a Game Changer for Tesla (TSLA)

Reviewed by Sasha Jovanovic

- Earlier this month, Faraday Future Intelligent Electric Inc. announced that starting with their 2026 models, FF and FX series electric vehicles equipped with the North American Charging System (NACS) will have direct access to over 28,000 Tesla Supercharger stations across North America and select international markets.

- This move highlights the growing adoption of Tesla’s NACS charging standard and expands charging access for EV drivers, further supporting cross-brand interoperability in the electric vehicle ecosystem.

- We will examine how the broader adoption of Tesla's charging technology influences its competitive positioning and long-term investment case.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tesla Investment Narrative Recap

For many Tesla investors, the core belief rests on Tesla’s ability to lead the EV market and redefine mobility through software, AI, and infrastructure dominance. The recent announcement of Faraday Future adopting Tesla’s NACS charging system underscores Tesla’s growing ecosystem, but it does not materially impact the most pressing short-term catalyst, regulatory approval for robotaxi and FSD expansion, or the major near-term risk around regulatory and policy threats to margins and demand.

A relevant recent development is the company’s expansion of its Supercharger network partnerships with other automakers, such as Subaru and now Faraday Future. This trend reinforces Tesla’s platform reach, keeping charging infrastructure as an indirect catalyst, though it takes a backseat to more urgent issues like regulatory headwinds and changes in EV incentives.

Yet, in contrast to this growing adoption, one risk that could reshape Tesla’s financial trajectory looms in the form of...

Read the full narrative on Tesla (it's free!)

Tesla's outlook anticipates $148.1 billion in revenue and $15.4 billion in earnings by 2028. This scenario assumes 16.9% annual revenue growth and an earnings increase of $9.5 billion from the current $5.9 billion.

Uncover how Tesla's forecasts yield a $392.93 fair value, in line with its current price.

Exploring Other Perspectives

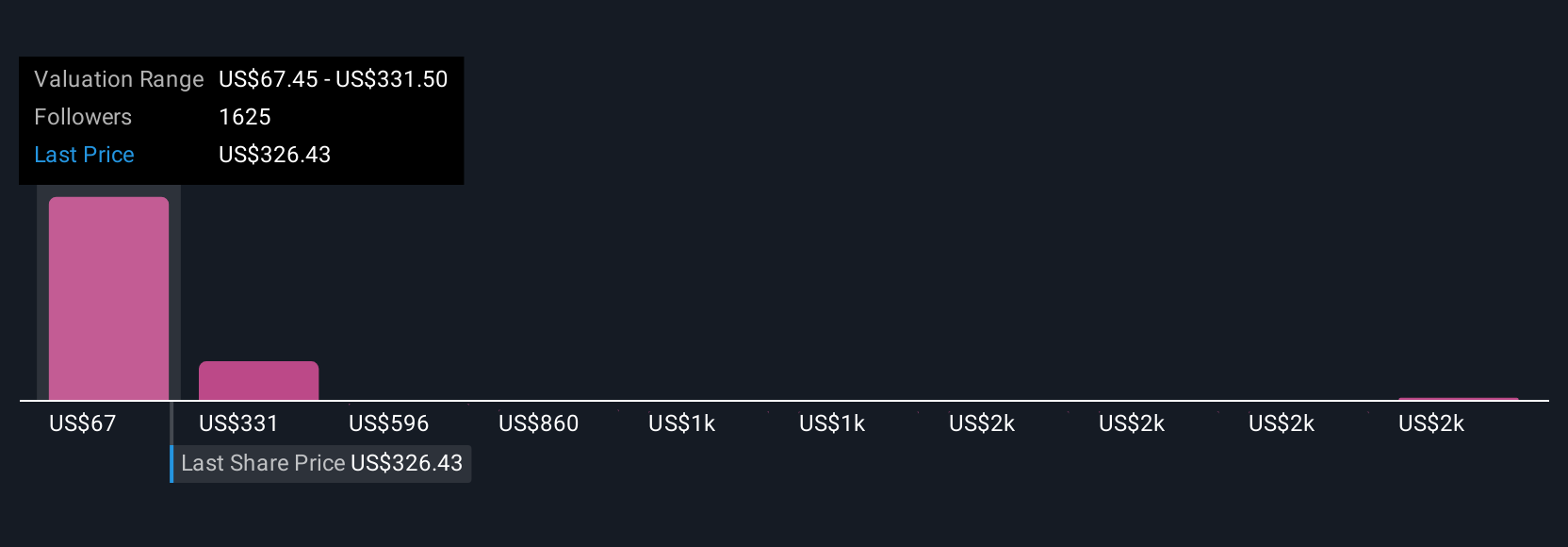

Community members on Simply Wall St provided 222 fair value estimates for Tesla, ranging widely from US$67 to US$2,707 per share. While investor views span the entire spectrum, many remain focused on the expanding robotaxi and FSD rollout as a key future driver, which could carry major implications for Tesla’s growth story.

Explore 222 other fair value estimates on Tesla - why the stock might be worth over 6x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives