- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Does Tesla’s Valuation Reflect Reality After Ditching the Optimus Robot Goal?

Reviewed by Bailey Pemberton

We all know Tesla is a stock that can spark heated debates around the dinner table. Maybe you’re one of the early believers, seeing huge multi-year returns pile up in your portfolio. Or maybe you’re just watching from the sidelines, wondering if the recent rollercoaster moves mean it’s finally time to buy in. Over the past month, Tesla’s share price has soared 23.4%, tacking on a solid 14.2% year-to-date and a massive 77.1% over the last year. Even over a five-year span, the stock is up nearly 191%.

That kind of performance can make it feel like you’ve already missed the boat. Yet, new headlines keep the story evolving. The recent buzz around a more affordable Model Y hints at a push to widen Tesla’s customer base. Meanwhile, talk of shelving the ambitious Optimus robot project reminds us the company does not shy away from big dreams, even if timelines slip. Elon Musk’s other ventures, such as his AI startup xAI acquiring tens of billions in Nvidia chips, add another layer of intrigue. However, they also introduce risk, given the interconnectedness with Tesla.

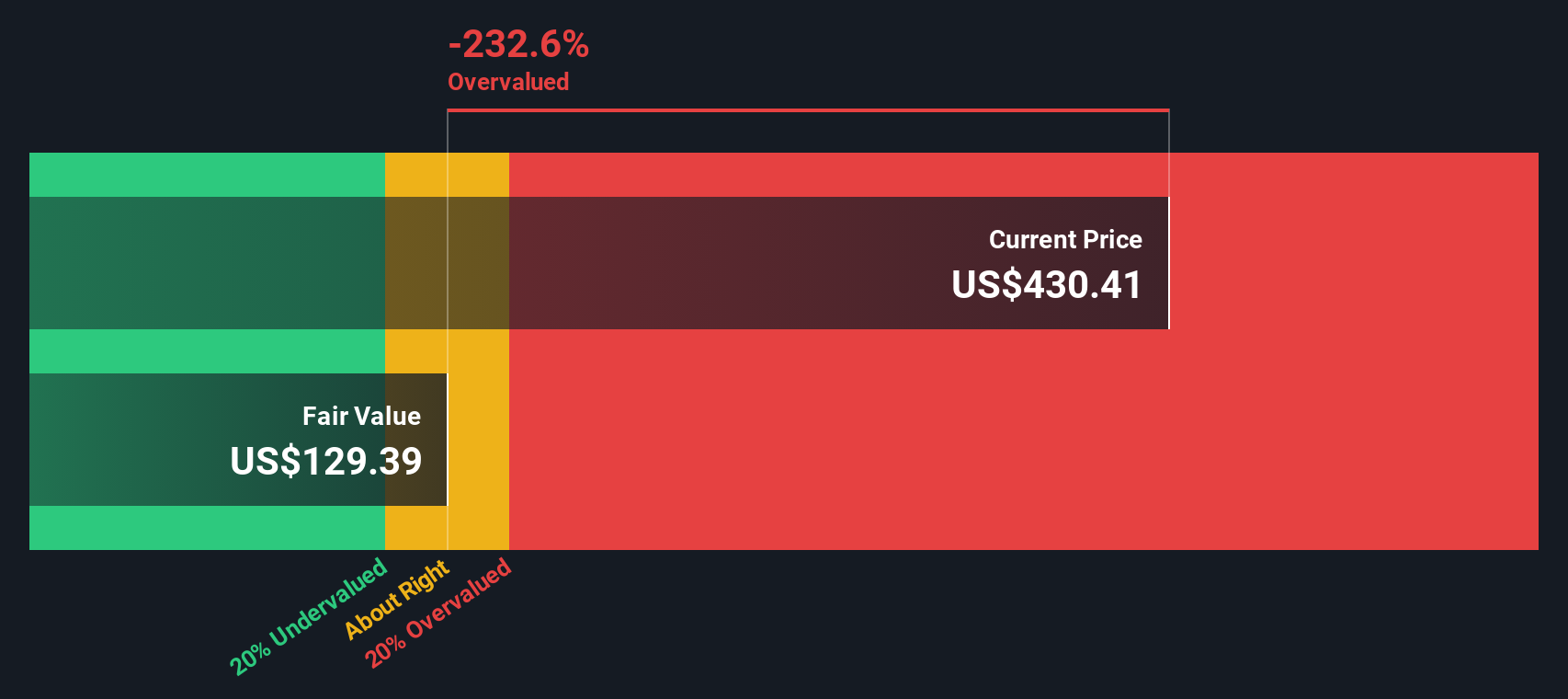

But after all those price moves and news flashes, here’s the real question: Is Tesla undervalued, overvalued, or just right? When running the company through six core valuation checks, Tesla receives a valuation score of 0, indicating it is not undervalued in any of them. So what do these checks actually mean for investors, and how should you weigh them? Let’s break down what traditional valuation methods say, and stay tuned because there is an even smarter way to make sense of Tesla’s value that we’ll get to by the end.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. This gives investors a sense of what Tesla could be worth based on its future ability to generate cash, rather than just current earnings or sales.

For Tesla, the latest reported Free Cash Flow stands at $6.63 Billion. Analysts forecast Tesla's Free Cash Flow to accelerate rapidly, reaching an estimated $25.36 Billion by the end of 2029. While analysts provide projections up to five years out, Simply Wall St extrapolates further by mapping cash flow growth well into the next decade. These projections are all expressed in US dollars, matching the company's reporting currency.

According to this DCF analysis, Tesla's estimated fair value per share is $159.94. Given the current trading price, this implies the stock is approximately 170.8% overvalued based on this model. This means its market price is far above what the company's future cash flows would suggest.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 170.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tesla Price vs Sales (P/S)

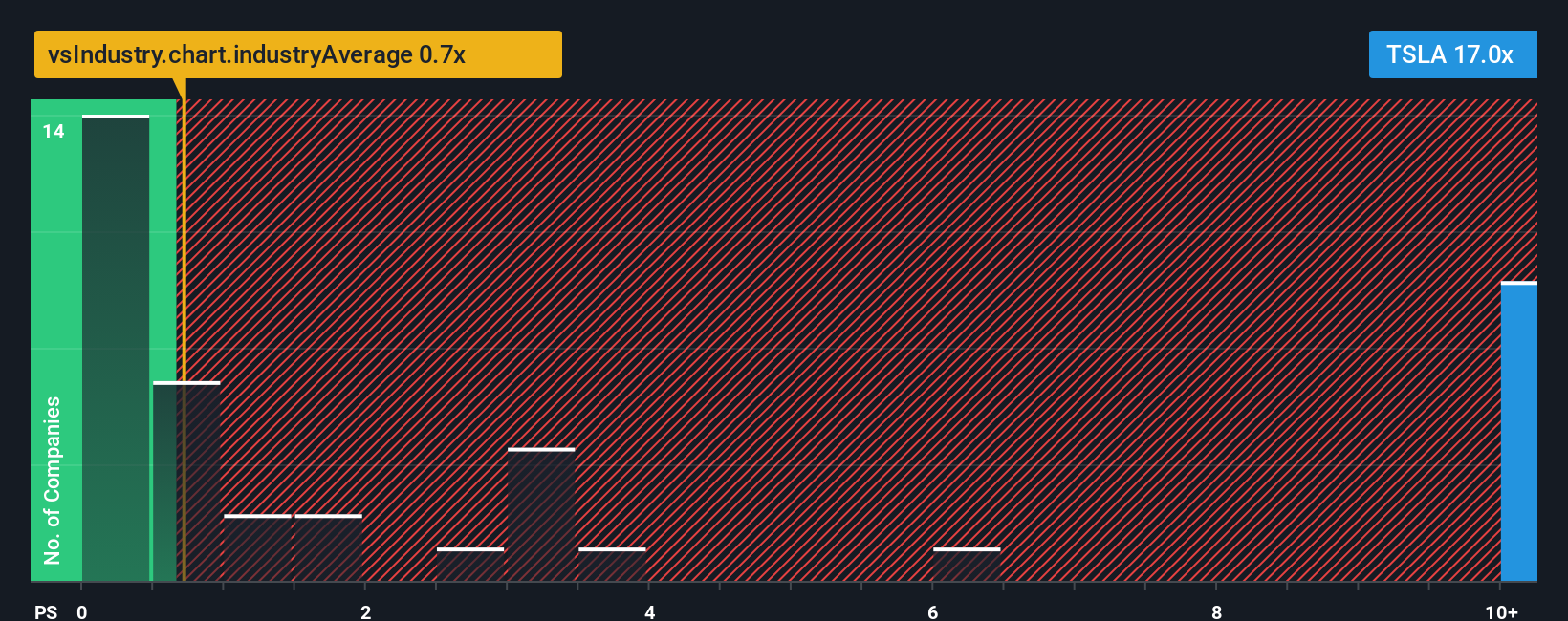

The Price-to-Sales (P/S) ratio is often the preferred valuation tool for companies like Tesla that are profitable but also focused on rapidly growing revenue. The P/S ratio helps investors compare the stock price to the company’s total sales, offering a clear picture of how much investors are paying for each dollar of Tesla’s revenue. This can be especially telling for growth companies, where future earnings potential may still be ramping up, but top-line growth remains strong and is a key driver of value.

Growth expectations and risk both play big roles in deciding what a “normal” or “fair” P/S ratio should be. High-growth companies tend to justify higher multiples, since investors are betting today’s sales will expand quickly. However, the higher the perceived risks, such as competition or execution challenges, the less justified an ultra-high multiple becomes.

Currently, Tesla trades at a P/S ratio of 15.53x. This is well above both the auto industry’s average of 1.38x and its closest peers at about 1.28x. Such a steep premium can look concerning at first glance, but raw comparisons do not always capture the full story behind Tesla’s scale, brand strength, or growth prospects. That is where Simply Wall St’s proprietary Fair Ratio comes into play. The Fair Ratio, calculated at 3.91x for Tesla, adjusts for factors like profit margins, growth forecasts, company size, and even market risks to generate a tailored benchmark for valuation. Unlike a straight peer or industry average, the Fair Ratio offers a smarter, apples-to-apples reference point for investors.

When we compare Tesla’s actual P/S of 15.53x to its Fair Ratio of 3.91x, the stock looks significantly overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a number; it is your story, linking what you know and believe about a company like Tesla to a financial forecast and fair value.

Narratives let you express your perspective about Tesla's future by setting assumptions for its revenue growth, profit margins, and valuation multiples, then seeing how these beliefs shape your fair value estimate. This approach bridges the gap between numbers and real-world business developments, turning facts and headlines into a clear view of whether Tesla is a buy, hold, or sell for you personally.

Best of all, Narratives are easy to use and available to everyone on Simply Wall St's Community page, already trusted by millions of investors. As news breaks or earnings are released, your Narrative updates automatically to reflect the latest information, with no spreadsheet work required.

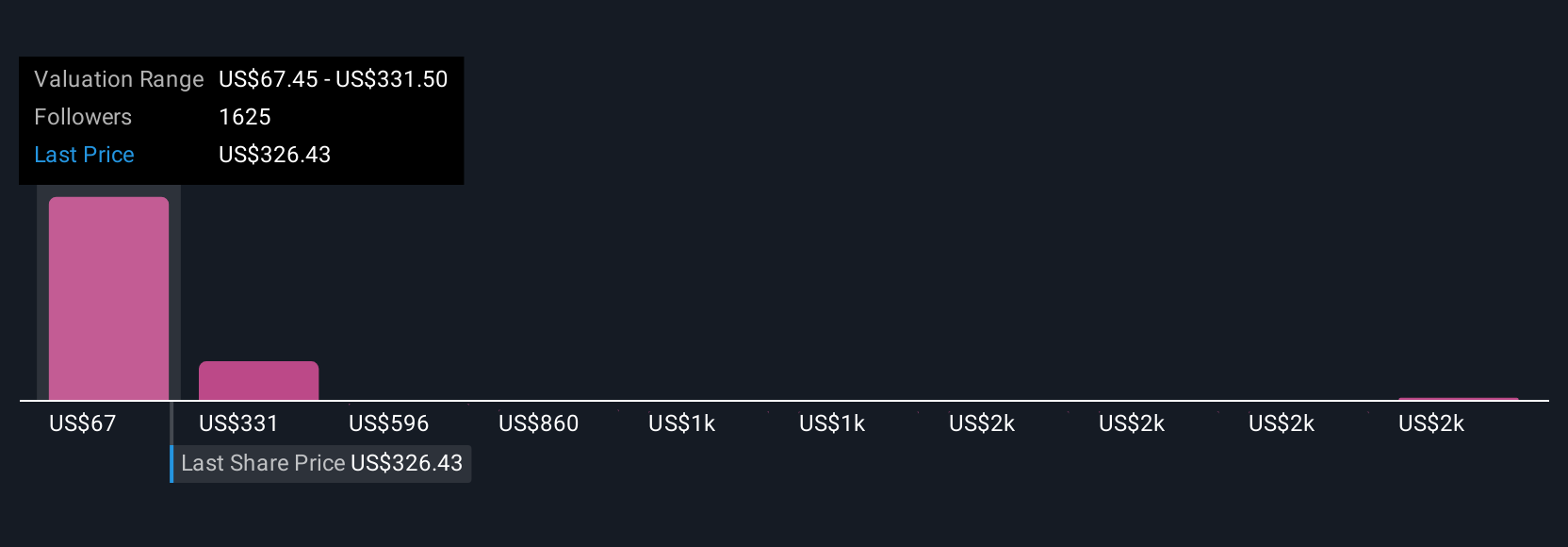

For example, some investors believe Tesla's fair value is under $70, driven by skepticism about autonomous driving. Others are convinced Tesla is a future tech giant worth more than $2,700 per share due to breakthroughs in robotics and AI. Narratives help you compare these sharply different perspectives side by side.

For Tesla, we’ll make it really easy for you with previews of two leading Tesla Narratives:

🐂 Tesla Bull CaseFair value: $2,707.91

Current price vs. fair value: 84.0% below narrative fair value

Projected revenue growth (per year): 77%

- Forecasts Tesla transforming into a multi-industry tech powerhouse and projects 2030 revenues of $1.94 trillion with net profit margins of 27.5%.

- Fair value estimates today range from $2,120 (bear) to $4,240 (bull) per share, driven by high P/E multiples based on execution in AI, FSD, and energy businesses.

- Concludes Tesla is drastically undervalued if it achieves ambitious growth, while also acknowledging risks from competition and regulation.

Fair value: $322.21

Current price vs. fair value: 34.5% above narrative fair value

Projected revenue growth (per year): 18%

- Sees Tesla’s valuation as overextended and argues that real-world execution of ambitious technology such as the Dojo AI supercomputer, Full Self-Driving, and energy storage growth faces significant hurdles.

- Highlights doubts about the commercial viability and timeline of new products like the Cybercab robotaxi, and expresses concerns around market optimism versus actual readiness.

- Notes that the current market price factors in ideal outcomes, while this narrative projects moderate but credible growth, resulting in an overvalued stock according to this method.

Do you think there's more to the story for Tesla? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success