- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

September 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. markets navigate mixed signals following the Federal Reserve's recent interest rate cut, investors are keenly observing opportunities that might arise amidst these shifting economic conditions. Penny stocks, often associated with smaller or newer companies, continue to be a relevant investment area due to their potential for growth at lower price points. While the term may seem outdated, these stocks can offer significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.19 | $471.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.64 | $278.06M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.23 | $215.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.34 | $227.68M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.88 | $22.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.75 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.961 | $7.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.86 | $86.1M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 377 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Alpha Teknova (TKNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha Teknova, Inc. produces essential reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics globally, with a market cap of $241.89 million.

Operations: The company generates revenue from its Specialty Chemicals segment, totaling $38.92 million.

Market Cap: $241.89M

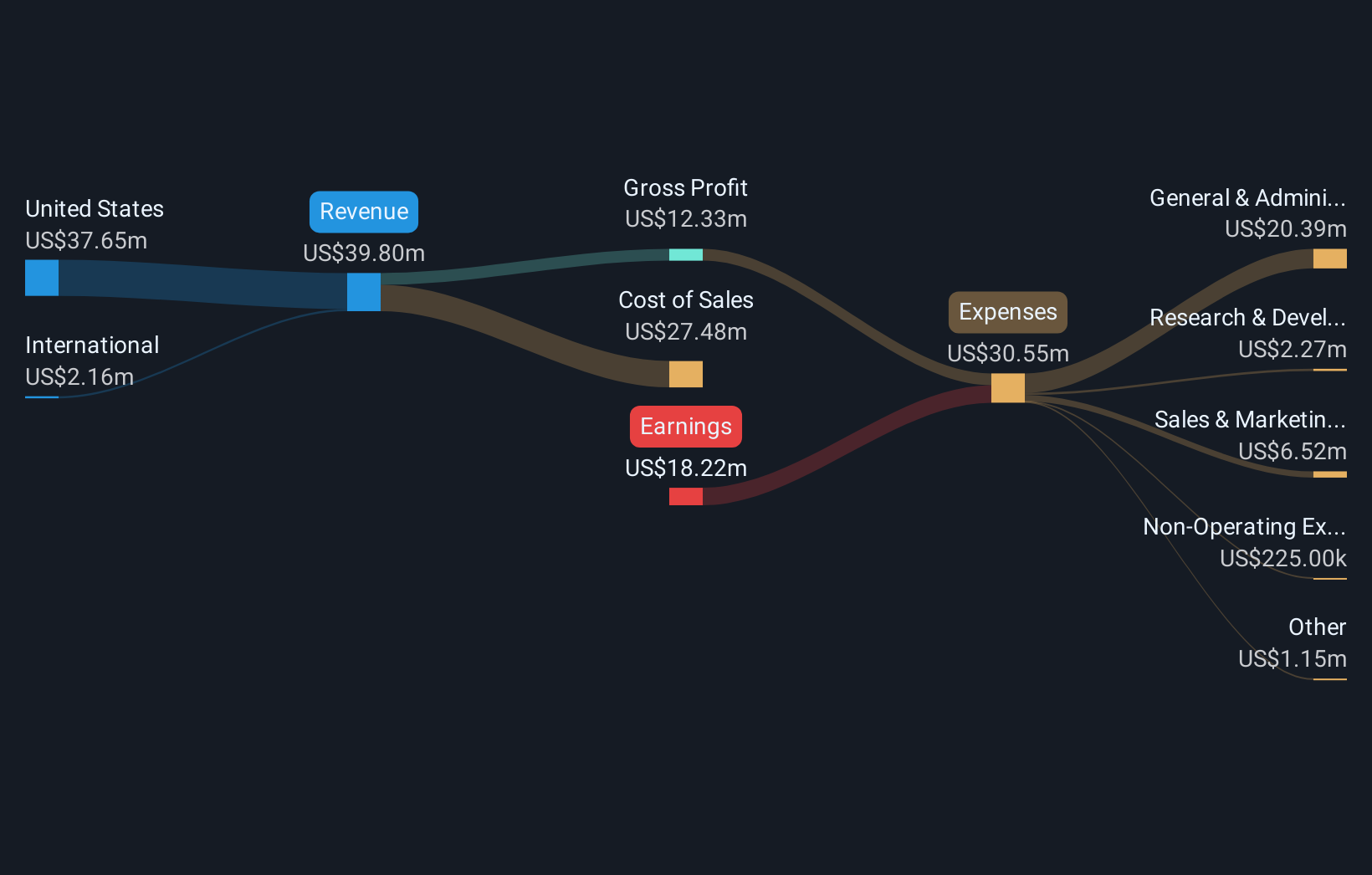

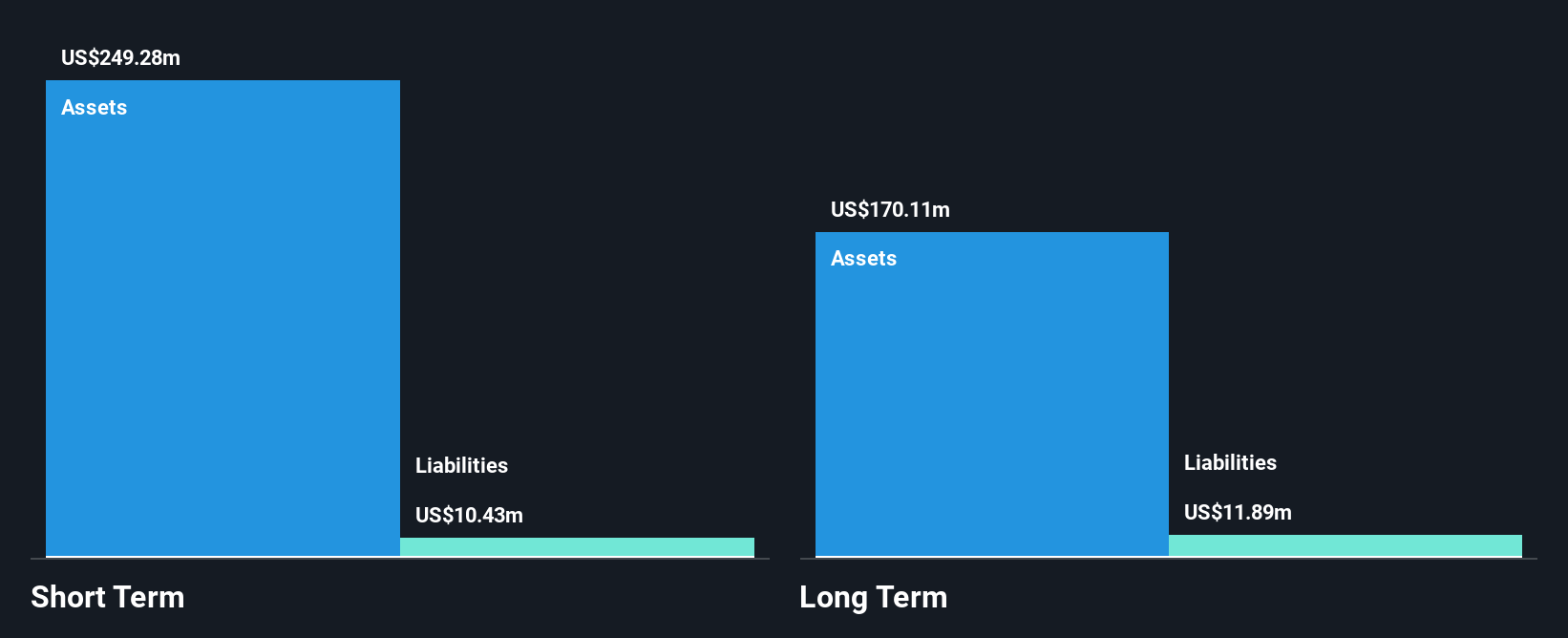

Alpha Teknova, Inc., with a market cap of US$241.89 million, is navigating the challenges typical of penny stocks. Despite being unprofitable and not projected to reach profitability in the next three years, it has shown revenue growth, reporting US$20.08 million for the first half of 2025 versus US$18.9 million a year ago. The company benefits from strong short-term financial health, with assets exceeding both short- and long-term liabilities and more cash than debt. Recent inclusion in multiple Russell indices may enhance visibility among investors while its experienced management team supports strategic direction amidst ongoing losses.

- Click to explore a detailed breakdown of our findings in Alpha Teknova's financial health report.

- Gain insights into Alpha Teknova's outlook and expected performance with our report on the company's earnings estimates.

Solid Power (SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of $678 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, totaling $22.67 million.

Market Cap: $678M

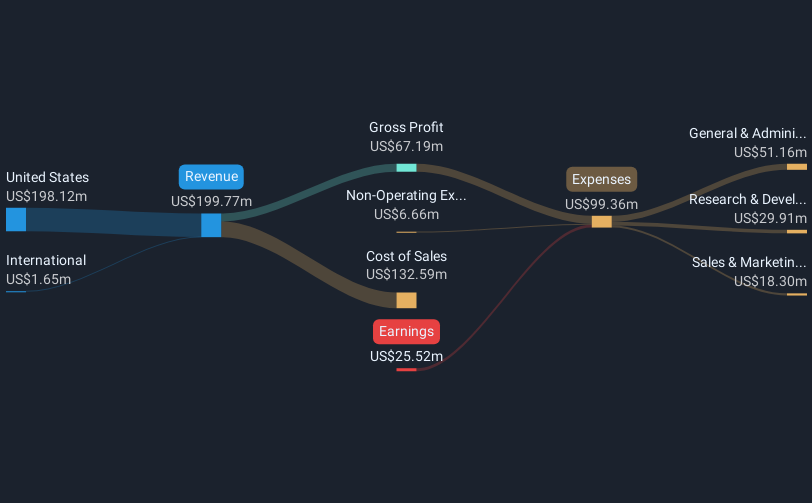

Solid Power, Inc., with a market cap of US$678 million, exemplifies the volatility and potential of penny stocks. Despite being unprofitable and not expected to reach profitability in the next three years, it has demonstrated revenue growth, reporting US$13.56 million for the first half of 2025 compared to US$11.03 million a year ago. The company is debt-free with sufficient cash runway for over two years if current cash flow trends persist. Recent inclusion in several Russell indices may increase investor attention; however, its inexperienced management team could present challenges as it navigates ongoing financial losses and high share price volatility.

- Click here to discover the nuances of Solid Power with our detailed analytical financial health report.

- Explore Solid Power's analyst forecasts in our growth report.

SmartRent (SMRT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SmartRent, Inc. is an enterprise real estate technology company that offers management software and applications to rental property stakeholders in the U.S. and internationally, with a market cap of $291.51 million.

Operations: SmartRent generates revenue from its Electronic Security Devices segment, totaling $155.53 million.

Market Cap: $291.51M

SmartRent, Inc., with a market cap of US$291.51 million, illustrates the complexity of penny stocks through its unprofitable status and revenue decline, reporting US$79.65 million for the first half of 2025 compared to US$99.01 million a year ago. Despite these challenges, SmartRent remains debt-free and has sufficient cash runway for over a year based on current free cash flow trends. The company's recent share buyback program highlights management's confidence but is tempered by an inexperienced board and management team amidst ongoing financial losses and stable weekly volatility at 10%.

- Navigate through the intricacies of SmartRent with our comprehensive balance sheet health report here.

- Understand SmartRent's earnings outlook by examining our growth report.

Where To Now?

- Embark on your investment journey to our 377 US Penny Stocks selection here.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)