- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN): Analyst Downgrades and EV Policy Shifts Put Valuation in Focus

Reviewed by Simply Wall St

Several analyst reports have put Rivian Automotive (RIVN) in the spotlight this week, as concerns mount over slowing electric vehicle demand and the looming expiration of U.S. government tax credits.

See our latest analysis for Rivian Automotive.

Rivian’s share price has pulled back significantly this month, reflecting fresh concerns around demand and policy shifts, but its 1-year total shareholder return of nearly 25% shows that plenty of investors still see long-term potential, despite a rocky ride since its IPO. The mood lately has shifted more cautious as investors wait to see if new product launches and cost controls can reignite momentum.

If the EV sector’s twists and turns have you wondering what else is out there, now’s a perfect moment to explore more companies in the space with our See the full list for free.

With the shares trading at a discount to some analysts’ targets, but fresh downgrades and high uncertainty on the horizon, the big question is whether Rivian is undervalued today or if the market has already factored in what comes next.

Most Popular Narrative: 9.7% Undervalued

With Rivian Automotive's most popular narrative fair value set at $14.48 and the last close price at $13.08, the narrative suggests meaningful upside if the growth story plays out as anticipated. This introduces a chance to examine the key drivers behind this estimate.

The launch of the R2 platform represents a step-change improvement in Rivian's cost structure. Management has secured supplier contracts and component sourcing that reduce the bill of materials by nearly 50% compared to R1, significantly lowering per-unit costs. This operational overhaul is expected to improve gross margins and support a path to profitability as scale is achieved.

Want to know the playbook behind Rivian’s high fair value? This narrative is not just expecting growth; it relies on a bold, disruptive margin shift and ambitious delivery milestones. Curious about how these projections compare to sector norms? Explore further to uncover the assumptions and targets driving this valuation.

Result: Fair Value of $14.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high cash burn and cuts to EV tax incentives could delay profitability and present challenges for Rivian’s ability to deliver on these bold expectations.

Find out about the key risks to this Rivian Automotive narrative.

Another View: Comparing Market Ratios

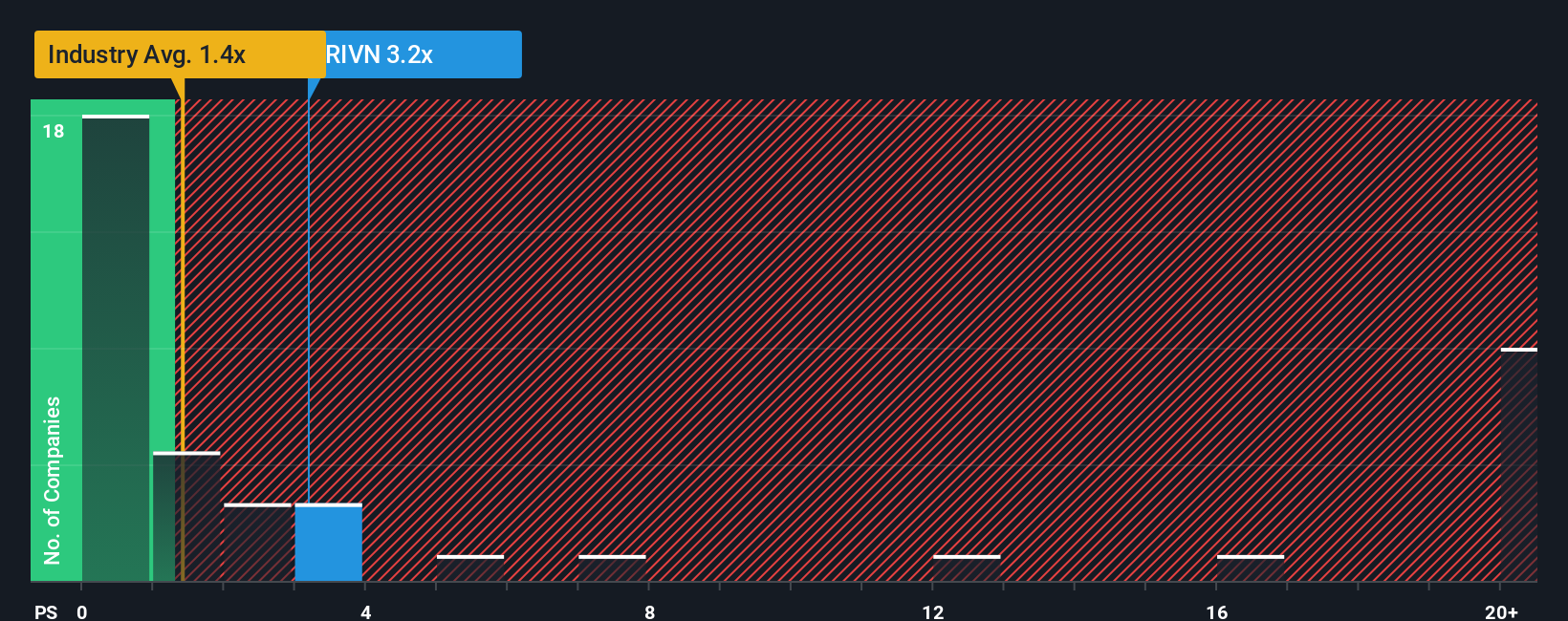

While the narrative points to under-valuation based on fair value projections, the current price-to-sales ratio for Rivian stands at 3.1x. This is notably higher than both the US Auto industry average of 1.3x and the peer average of 1.5x, as well as the estimated fair ratio of 1.4x. This gap means investors are paying a significant premium for growth and future expectations, which adds greater downside risk if the growth story falters. Is the market pricing in too much optimism or is there still hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rivian Automotive Narrative

If these views do not align with your own or you prefer to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing by checking out curated opportunities tailored to unique market trends and potential winners across tomorrow’s most promising industries.

- Seize the chance to target potential market movers by tapping into these 3587 penny stocks with strong financials with strong financials before wider attention follows.

- Harness the growing demand for smarter healthcare solutions by evaluating these 33 healthcare AI stocks advancing medical diagnostics, drug discovery, and patient care.

- Kickstart your search for stocks trading at attractive valuations by reviewing these 875 undervalued stocks based on cash flows based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion