- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN): A Fresh Look at Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

See our latest analysis for Rivian Automotive.

Rivian’s share price has been on a bit of a rollercoaster lately. After a tough month with a 1-month share price return of -13.41%, the stock still sits above water for the year to date and delivered a strong 1-year total shareholder return of nearly 29%. While momentum has cooled recently, these returns show investors are still optimistic about Rivian’s longer-term prospects within the fast-evolving EV sector.

If Rivian’s shifting momentum has you thinking about what else the auto industry has to offer, take the next step and discover See the full list for free.

With Rivian’s valuation and growth outlook in the spotlight, the key question becomes whether the current share price offers value, or if future growth is already fully reflected in the market. Is there a buying opportunity, or is everything priced in?

Most Popular Narrative: 6.8% Undervalued

Rivian Automotive's fair value, as calculated in the most widely followed narrative, sits at $14.48 compared to a last close price of $13.50. With the fair value modestly above recent trading, attention is now on the financial drivers and forecasts backing this view.

The launch of the R2 platform represents a step-change improvement in Rivian's cost structure. Management has secured supplier contracts and component sourcing that reduce bill of materials by nearly 50% versus R1, significantly lowering per-unit costs. This operational overhaul is expected to improve gross margins and the path to profitability as scale is achieved.

Want to know what powers this ambitious valuation? The full narrative teases game-changing margins, bold growth bets, and a financial roadmap most companies only dream about. What key numbers fuel Rivian’s brighter outlook? See how rapid expansion, rising revenue, and margin moves could turn this forecast into a reality if expectations hold up.

Result: Fair Value of $14.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting government incentives and ongoing high cash burn could quickly put Rivian’s upbeat outlook to the test if conditions become less favorable.

Find out about the key risks to this Rivian Automotive narrative.

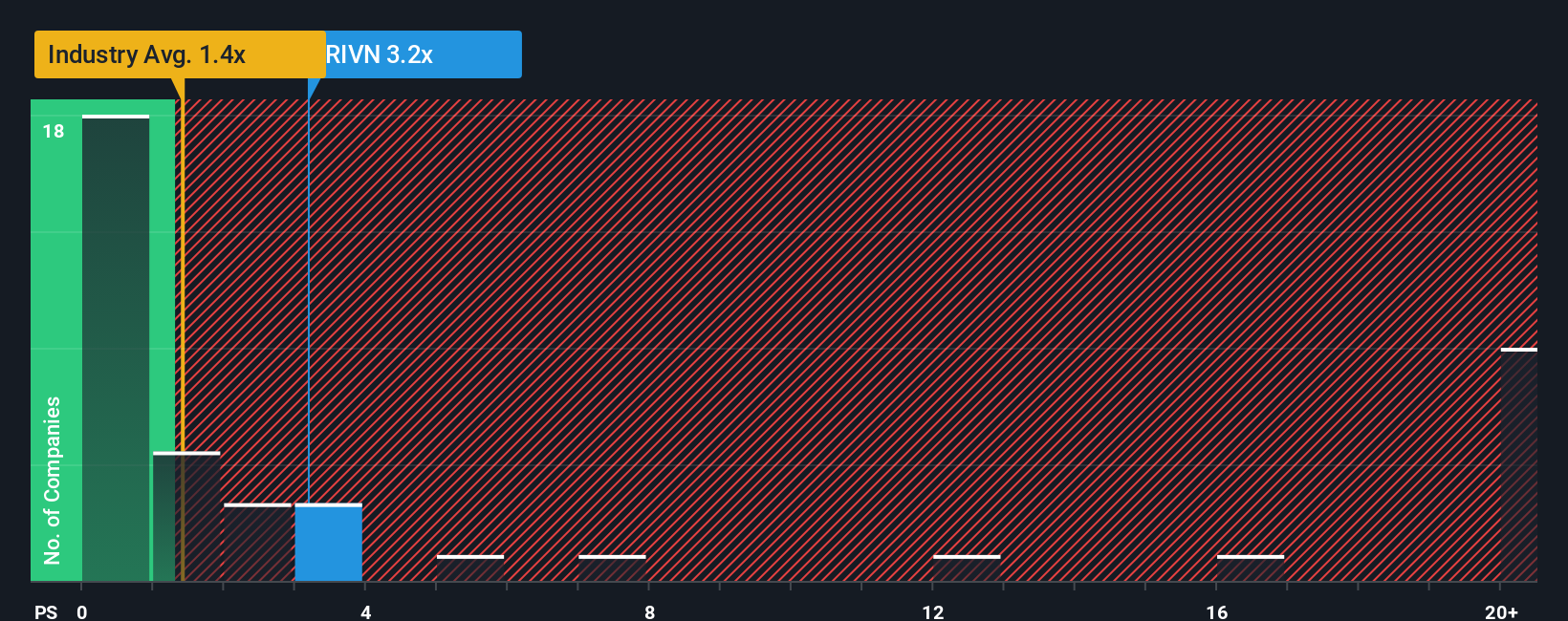

Another View: Multiples Tell a Cautionary Tale

While the analyst narrative paints Rivian as undervalued, another lens signals caution. Its price-to-sales ratio is 3.2x, much higher than both the US auto industry average of 1.3x and the peer average of 1.5x. The fair ratio, which the market could shift toward, stands at 1.4x. This wide gap suggests investors may be paying a premium today. This raises questions about downside risk if expectations reset. Will Rivian’s story justify its current valuation premium, or could sentiment swing the other way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rivian Automotive Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own view in just a few minutes, your way. Do it your way.

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your shot at new opportunities. The Simply Wall Street Screener surfaces standout stocks you might not have considered. Give your portfolio an edge by checking out these fresh ideas now.

- Unlock growth potential and tap into the future by checking out these 26 AI penny stocks poised to benefit from advancements in machine learning and artificial intelligence.

- Boost your income with regular payouts when you explore these 21 dividend stocks with yields > 3% featuring companies known for delivering strong yields above 3%.

- Spot hidden gems flying under the radar with these 869 undervalued stocks based on cash flows, highlighting stocks that the market may be mispricing right now based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives