- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Making Sense of Rivian After Recent Production Milestones and the 22% Year-to-Date Rally

Reviewed by Bailey Pemberton

- Wondering if Rivian Automotive stock is actually a smart buy right now? Let’s break down what the numbers and latest news really say about its value.

- Shares have made a noticeable climb, up 9.9% in the past week and an impressive 22.1% so far this year, but longer-term investors will remember it is still down 49.5% over three years.

- The company has recently drawn attention from the market after announcing new production milestones and partnerships in the electric vehicle space, helping fuel recent momentum. Analysts and industry observers are watching closely to see if this marks the start of a real turnaround.

- Right now, Rivian’s valuation score comes in at 0 out of 6, meaning it does not pass any of the checks for being undervalued. Let’s dig into what this means using a few popular valuation approaches, and stick around if you want to see a smarter way to assess whether Rivian is worth your attention.

Rivian Automotive scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rivian Automotive Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a stock by forecasting the company's future cash flows and discounting them back to today's value. This approach is popular because it focuses on the underlying financial performance rather than just market trends or multiples.

For Rivian Automotive, the model projects free cash flows based on a two-stage approach. In the latest year, the company's free cash flow stands at approximately -$442 million, highlighting its continued investment phase. Analyst estimates only reach five years ahead, projecting the company to finally turn positive by 2029, with free cash flow of about $431 million. Looking further into the next decade, cash flow projections are extrapolated and expected to continue growing.

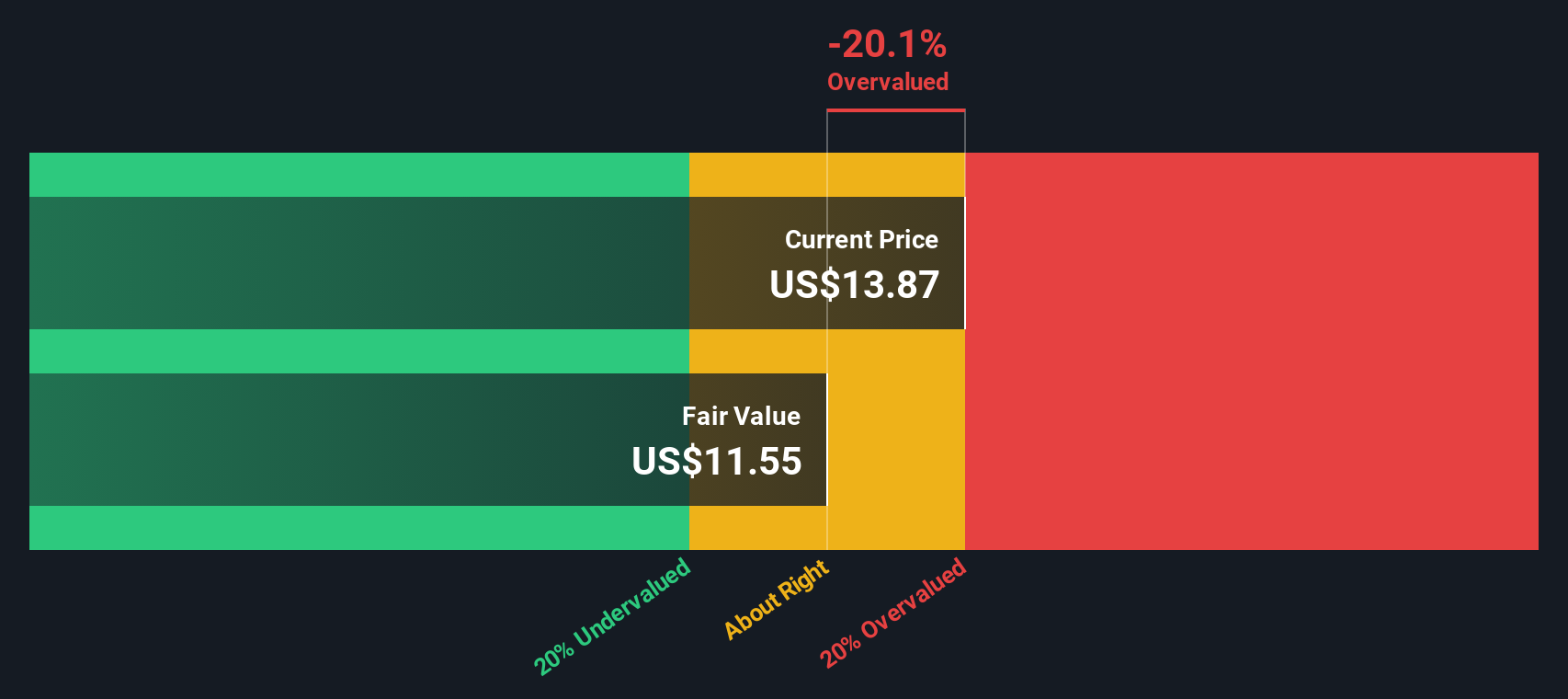

Despite these growth projections, the calculated fair value for Rivian shares is just $2.54 using this DCF approach. Compared to the current share price, the analysis shows the stock is 536.3% overvalued. This significant disconnect suggests the market remains highly optimistic about Rivian's long-term trajectory and is taking a view that goes far beyond what the cash flow projections currently support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rivian Automotive may be overvalued by 536.3%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rivian Automotive Price vs Sales

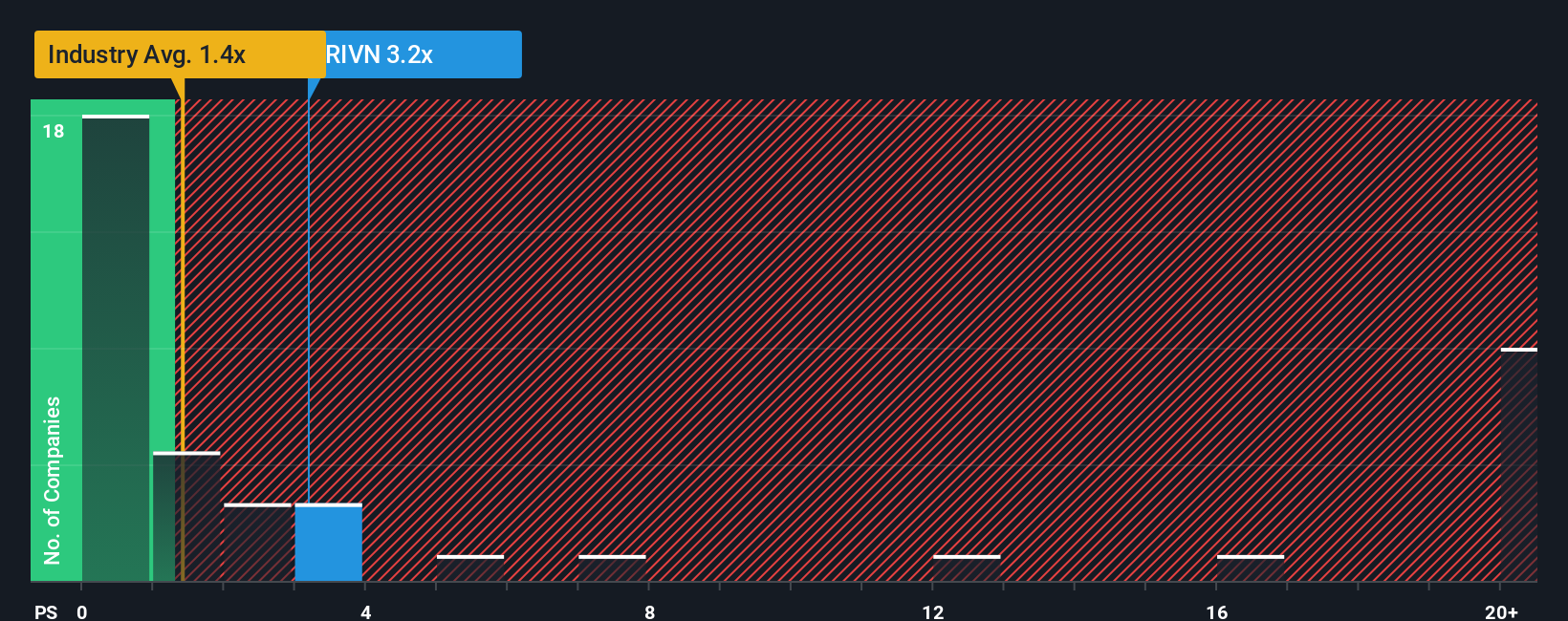

The price-to-sales (PS) ratio is a popular way to value companies, especially those that are not yet consistently profitable, as it looks at how much investors are paying for each dollar of revenue. While the price-to-earnings ratio often gets the spotlight, PS is more reliable for businesses like Rivian that are still ramping up production and working toward future profits. Investors should remember that higher growth expectations typically justify a higher PS ratio. Increased risk or weaker growth would call for a lower number.

Rivian is currently trading at a PS ratio of 3.40x. To put that in context, the average for the wider auto industry is just 0.91x, and Rivian’s peer group clocks in at 1.22x. Simply Wall St’s proprietary Fair Ratio for Rivian is calculated at 1.95x. This Fair Ratio is an advanced benchmark that goes beyond just comparing to industry averages or peers. It adjusts for crucial factors like Rivian’s expected revenue growth, profit margin potential, specific risks, and its market capitalization.

By prioritizing the Fair Ratio, investors get a tailored sense of what a "normal" multiple is for Rivian, taking into account its unique profile rather than just generic market averages. In this case, with an actual PS ratio of 3.40x compared to a Fair Ratio of 1.95x, Rivian stock appears to be trading at a premium to its adjusted fair value.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

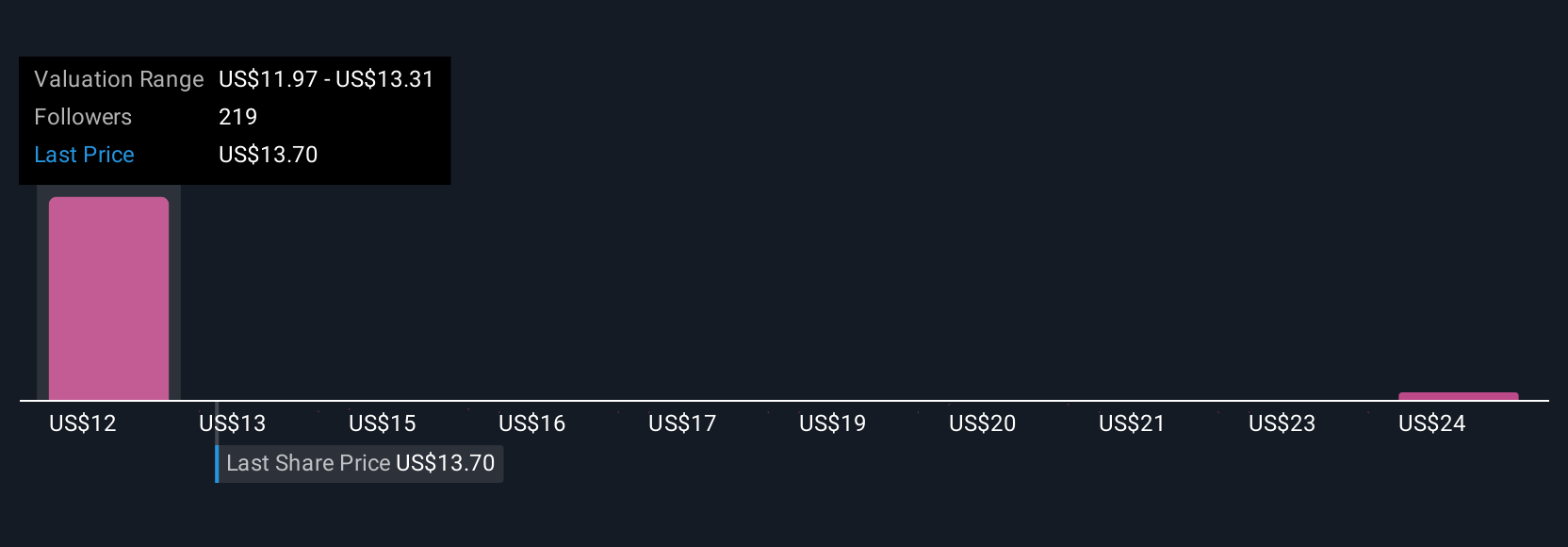

Upgrade Your Decision Making: Choose your Rivian Automotive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive tool that lets you define your own story for a company by connecting your expectations, such as future revenue, earnings, and margins, to a fair value estimate. Narratives bridge the gap between what you believe is likely to happen and what that means for the company's valuation, making the numbers meaningful and personal. Available on Simply Wall St’s Community page, Narratives are widely used by millions of investors to make sense of changing conditions and clarify if a stock is under- or overvalued compared to its current price.

Because Narratives update automatically whenever news or earnings are released, your perspective stays relevant even in fast-moving markets. For example, with Rivian Automotive, one investor may build a Narrative expecting robust demand and faster profitability and set a fair value of $21.00. Another, more cautious outlook could arrive at a fair value closer to $7.55. This dynamic approach turns your research into actionable insight, helping you decide with confidence when to buy, hold, or sell based on your unique perspective.

Do you think there's more to the story for Rivian Automotive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success