- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Is Rivian Fairly Priced After Recent 15% Drop and New Production Updates?

Reviewed by Bailey Pemberton

Let’s talk about Rivian Automotive, a stock that’s been stirring up plenty of debate among investors trying to figure out their next move. Whether you’re holding, watching, or thinking of jumping in, there’s no denying Rivian captures plenty of headlines and even more attention on social media feeds. The past year has seen its share of drama. The stock is up 27.2% over the last twelve months, but those gains mask some real volatility, with a drop of 15.2% just in the past thirty days and a dip of 3.7% in the last week alone. If you zoom out to a three-year view, the picture gets even stormier, with shares down a staggering 62.5%.

What’s behind these swings? A big part of the story is tied to the ever-changing landscape for electric vehicle innovators like Rivian. Recent mentions in the financial press have focused on the company’s push to expand production, secure new partnerships, and navigate ongoing supply chain challenges. Investors are recalibrating their expectations, sometimes reacting quickly to headlines, whether that’s new deals, production milestones, or hints at competition in the EV space. This heightens the sense of both risk and opportunity.

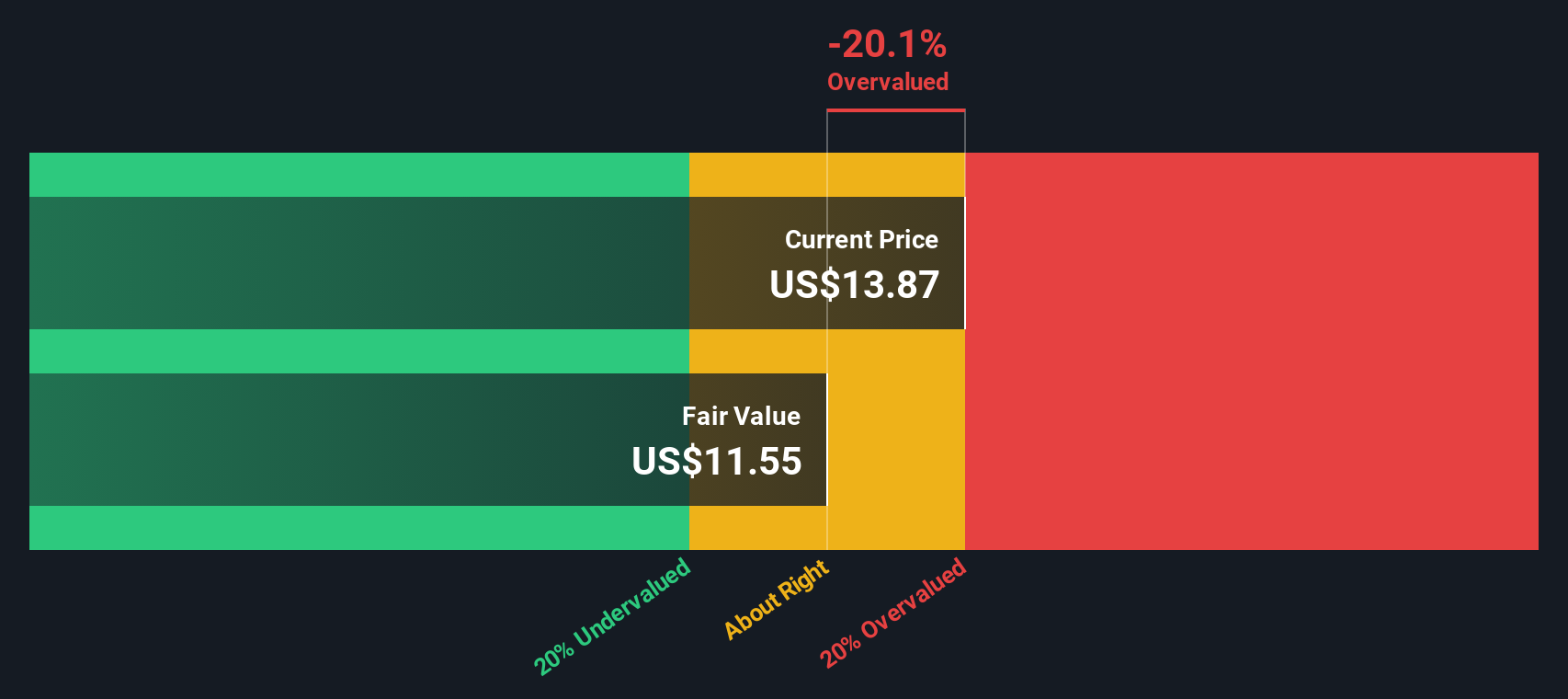

But beyond headlines and price charts, the bigger question is: what is Rivian really worth today? By the numbers, its valuation score comes in at 0 out of 6, which suggests Wall Street doesn’t see it as undervalued across standard metrics right now. Still, traditional valuation methods only tell part of the story. Next, we’ll break down how Rivian stacks up by different valuation yardsticks and explore a perspective that might offer an even clearer view of whether it deserves a spot in your portfolio.

Rivian Automotive scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rivian Automotive Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present value. In Rivian Automotive's case, the DCF uses a 2 Stage Free Cash Flow to Equity model, which takes into account current financials and forecasts of growth before settling at a more stable, long-term rate.

Currently, Rivian's last twelve months Free Cash Flow (FCF) stands at negative $1.21 billion, reflecting invested capital outflows as the company ramps up production and operations. Analyst forecasts are currently only available through 2029, with estimates expecting FCF to turn positive by then at roughly $961 million. Longer-term projections extend that positive trend, ultimately reaching approximately $3.75 billion by 2035 according to extrapolations. All cash flows are denominated in dollars ($).

Given these projections, the DCF estimates Rivian’s intrinsic value at $12.63 per share. That is just 2.3% higher than its current share price, indicating that Rivian is trading about where the DCF model suggests it should be, with neither a meaningful premium nor a discount relative to its cash flow-based fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Rivian Automotive's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

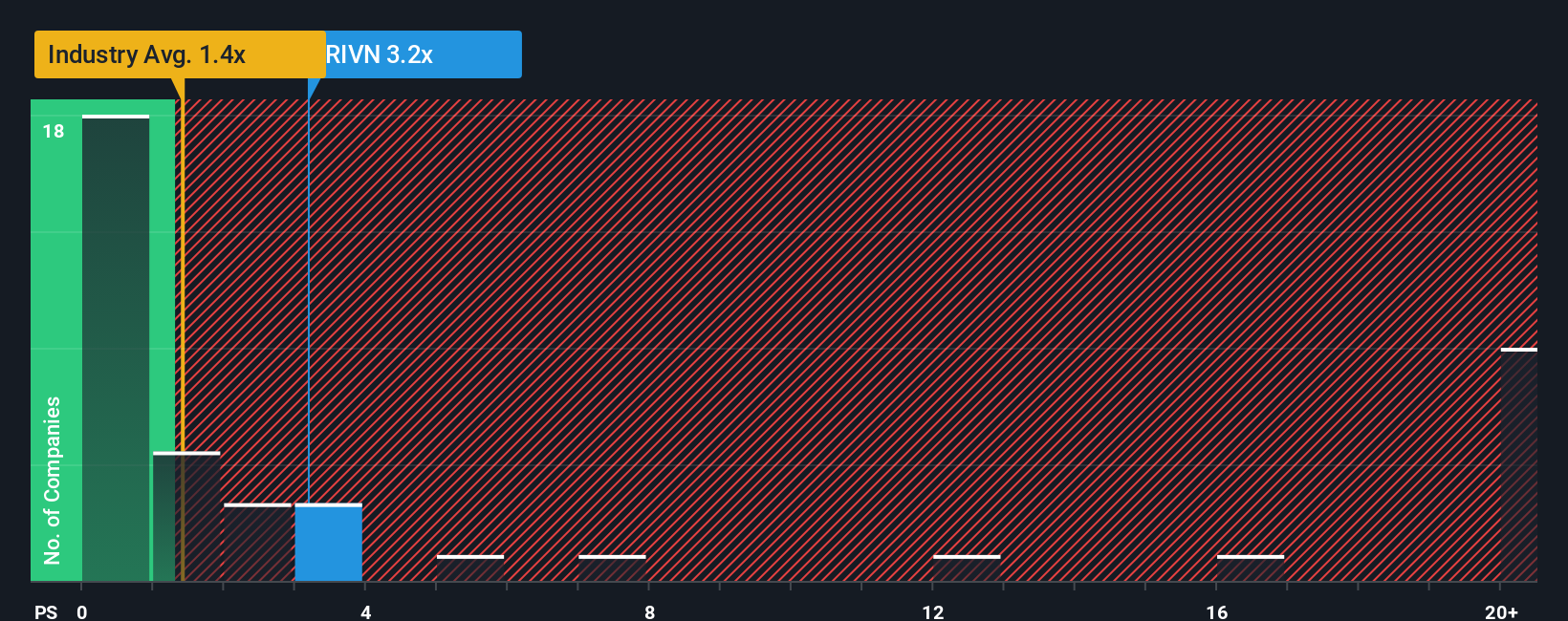

Approach 2: Rivian Automotive Price vs Sales

For companies that are still ramping up toward profitability, the Price-to-Sales (P/S) ratio is often the most relevant way to value the business. Since Rivian Automotive is not yet profitable, relying on P/S helps compare how much investors are paying for each dollar of revenue, making it a useful yardstick for fast-growing companies in emerging industries like electric vehicles.

Normally, a "fair" P/S ratio is influenced by factors such as expected growth, company size, and business risk. Higher growth and lower risk can justify a premium, while slower growth or uncertain outlook should be discounted. But context is crucial because comparing Rivian’s P/S to typical industry or peer levels can be misleading for companies in transition or with unique profiles.

Right now, Rivian trades at a P/S ratio of 3.04x. This is well above the auto industry average of 1.27x and its peer group’s average of 1.49x. However, Simply Wall St’s Fair Ratio model, which tailors the multiple to include Rivian’s unique growth profile, risk factors, profitability, and position within the industry, suggests a fair P/S of 1.38x. This is an advantage over generic benchmarks as it more holistically measures what investors should reasonably pay in light of Rivian's current conditions. With the actual ratio only modestly above the Fair Ratio, there is little evidence of meaningful overvaluation or undervaluation right now.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rivian Automotive Narrative

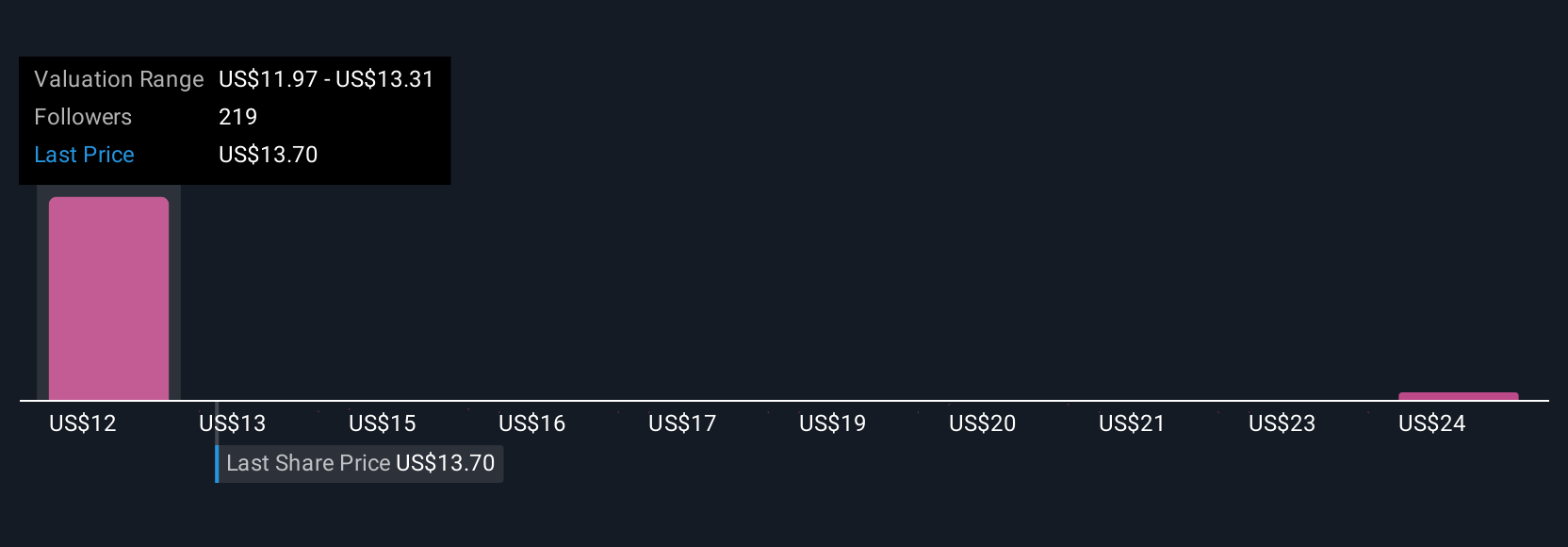

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple but powerful investing tool that allows you to connect your view of a company’s story, such as future product launches, strategy shifts, or industry trends, to your own estimates for its future revenue, earnings, and profit margins. By tying together those assumptions, Narratives help you translate your outlook into a financial forecast and a clear, personalized fair value for the stock.

Rather than relying solely on traditional models, Narratives let you track and test your convictions quickly and visually, making big decisions like when to buy or sell far more approachable. On Simply Wall St’s Community page, millions of investors are already using Narratives to express their perspectives and instantly compare them to the current share price. Because Narratives update dynamically as new news or earnings are released, you can easily see how the latest events change your fair value and conviction.

For example, some investors interpret Rivian Automotive’s acceleration in EV adoption and successful vertical integration as reasons to set a bullish fair value as high as $21.00, while others, focused on cash flow risks and competitive pressures, assign a more cautious fair value near $7.55. This highlights just how dynamic and personal investing through Narratives can be.

Do you think there's more to the story for Rivian Automotive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion