- United States

- /

- Auto

- /

- NasdaqGM:PSNY

What Polestar Automotive Holding UK (PSNY)’s Q3 Sales Growth and Fleet Telematics Launch Mean For Shareholders

Reviewed by Sasha Jovanovic

- In October 2025, Polestar announced its third-quarter retail sales reached an estimated 14,192 vehicles, up 13% year-over-year, and unveiled its new Fleet Telematics service providing real-time EV fleet data and predictive insights without additional hardware.

- This combination of accelerating sales and a push into connected fleet services indicates Polestar's commitment to expanding both its product offerings and potential revenue streams in the electric vehicle sector.

- We'll explore how strong EV sales growth and the Fleet Telematics launch may shift the outlook for Polestar's long-term prospects.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Polestar Automotive Holding UK Investment Narrative Recap

To own Polestar shares, you have to believe the company can translate growing electric vehicle sales and innovative services into future profitability, even as sustained losses and a perilously low share price remain immediate hurdles. While robust third-quarter sales and the launch of Fleet Telematics are positive for revenue potential, they do not materially ease the core short term risk: ongoing heavy losses that place Polestar’s Nasdaq listing and financial position under real pressure right now. Of Polestar’s announcements, its Q3 sales growth best connects to near-term catalysts, reaffirming healthy demand and broadening its vehicle footprint. However, this momentum faces the unresolved challenge of persistent net losses and a limited cash runway, which continue to shape short-term expectations. Yet, despite these positive headlines, it is crucial for investors to consider the ongoing threat to Polestar’s listing status and...

Read the full narrative on Polestar Automotive Holding UK (it's free!)

Polestar Automotive Holding UK’s narrative projects $11.0 billion revenue and $559.6 million earnings by 2028. This requires 63.1% yearly revenue growth and a $3.26 billion increase in earnings from current earnings of $-2.7 billion.

Uncover how Polestar Automotive Holding UK's forecasts yield a $1.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

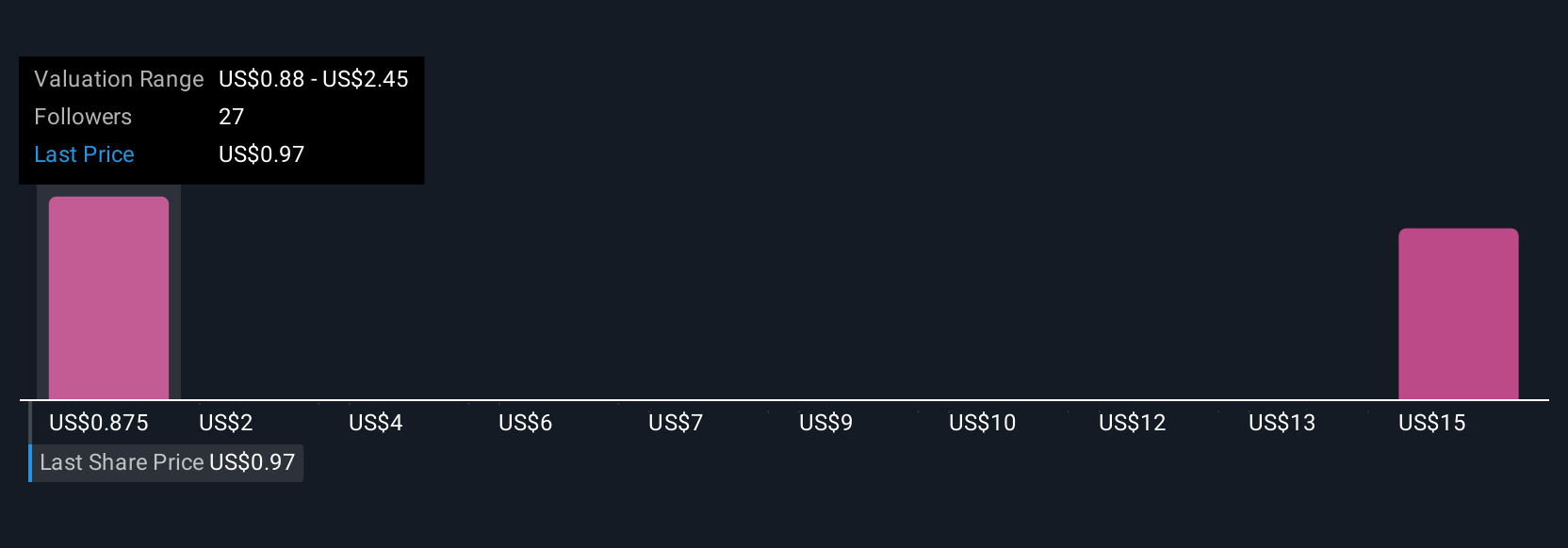

Nine individual fair value estimates from the Simply Wall St Community range from US$1.00 to US$16.60. While this wide gap includes both optimistic and cautious forecasts, the ongoing risk of significant net losses and limited cash runway gives all these outlooks added weight.

Explore 9 other fair value estimates on Polestar Automotive Holding UK - why the stock might be a potential multi-bagger!

Build Your Own Polestar Automotive Holding UK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Polestar Automotive Holding UK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polestar Automotive Holding UK's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives