- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Should Polestar’s (PSNY) New Loan and Price Cut Amid Tesla Rivalry Spur Investor Action?

Reviewed by Sasha Jovanovic

- Polestar Automotive lowered the starting price of its newest SUV to compete with Tesla and Rivian, while also securing a three-year loan facility from 12 international banks to support its operations and growth.

- The recent analyst downgrade highlighted concerns around pricing pressure and anti-China sentiment, underlining 2024 as a crucial turning point for Polestar's future direction.

- We will examine how Polestar’s new international loan facility and aggressive pricing approach could influence the company’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Polestar Automotive Holding UK Investment Narrative Recap

To be a shareholder in Polestar Automotive, you need to believe that the company can scale production and sales profitably while defending market share amid intensifying EV competition. The combination of aggressive SUV price cuts and new loan facility secures near-term liquidity, which could be key to stabilizing operations, though the biggest risk in the short term, persistent net losses and doubts about going concern, remains under scrutiny and is not materially resolved by this update.

Among the latest developments, Polestar’s successful closing of a three-year loan facility with 12 international banks stands out. This financing is crucial given that recent earnings results reflected ongoing heavy losses, highlighting the importance of focused cost management and operational execution as the company pursues ambitious growth catalysts in new markets.

In contrast, the ongoing questions about Polestar’s financial sustainability are information investors should be aware of, especially if...

Read the full narrative on Polestar Automotive Holding UK (it's free!)

Polestar Automotive Holding UK's narrative projects $11.0 billion revenue and $559.6 million earnings by 2028. This requires 63.1% yearly revenue growth and a $3.26 billion increase in earnings from current earnings of -$2.7 billion.

Uncover how Polestar Automotive Holding UK's forecasts yield a $1.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

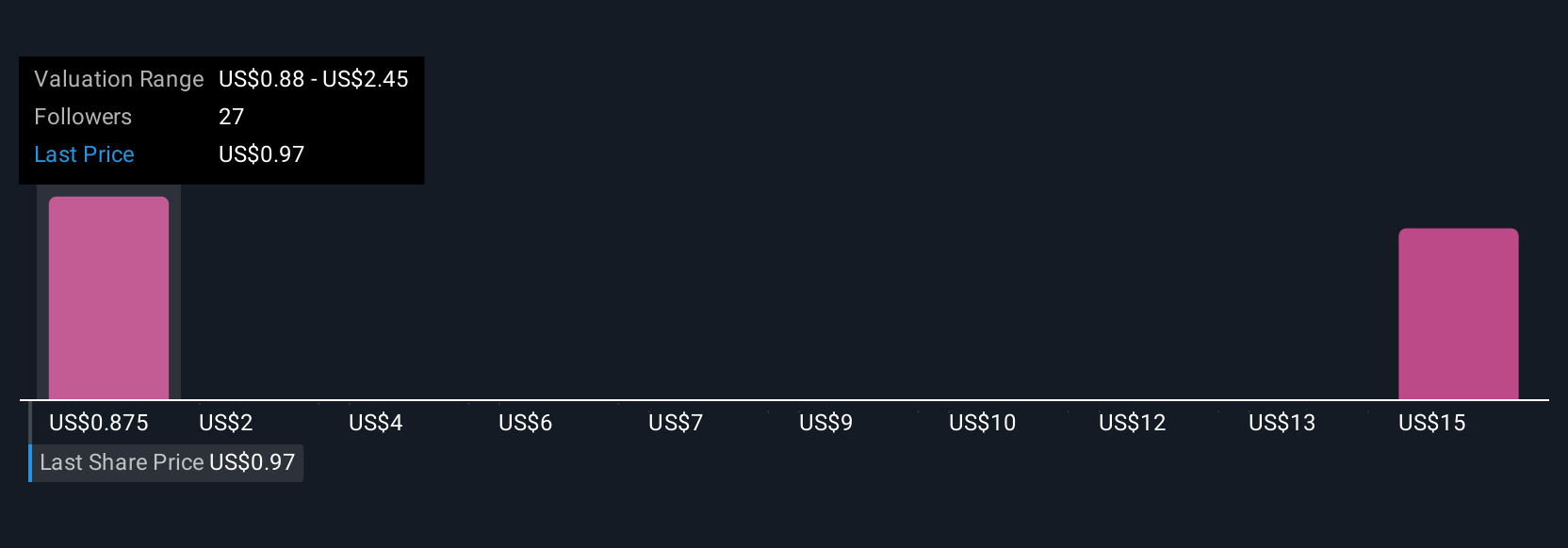

Eight members of the Simply Wall St Community estimate Polestar's fair value between US$1.00 and US$16.60 per share, underscoring wide-ranging outlooks. Persistent net losses and going concern doubts highlight why market participants can hold such opposing views on Polestar’s long-term potential.

Explore 8 other fair value estimates on Polestar Automotive Holding UK - why the stock might be worth just $1.00!

Build Your Own Polestar Automotive Holding UK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Polestar Automotive Holding UK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polestar Automotive Holding UK's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives