- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Polestar Automotive Holding UK PLC (NASDAQ:PSNY) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, Polestar Automotive Holding UK PLC (NASDAQ:PSNY) shares are down a considerable 30% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

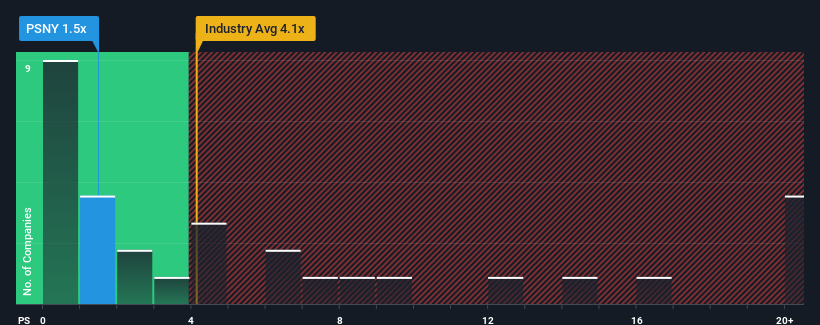

After such a large drop in price, Polestar Automotive Holding UK's price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the wider Auto industry in the United States, where around half of the companies have P/S ratios above 4.1x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Polestar Automotive Holding UK

How Has Polestar Automotive Holding UK Performed Recently?

Recent revenue growth for Polestar Automotive Holding UK has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Polestar Automotive Holding UK.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Polestar Automotive Holding UK's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 67% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 102% per annum, which is noticeably more attractive.

With this information, we can see why Polestar Automotive Holding UK is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Polestar Automotive Holding UK's P/S

Having almost fallen off a cliff, Polestar Automotive Holding UK's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Polestar Automotive Holding UK's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Polestar Automotive Holding UK (of which 3 make us uncomfortable!) you should know about.

If you're unsure about the strength of Polestar Automotive Holding UK's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Manufactures and sells premium electric vehicles.

Slight and fair value.