- United States

- /

- Auto

- /

- NasdaqGM:NIU

Niu Technologies (NasdaqGM:NIU): Evaluating Valuation After Latest Q3 and YTD 2025 Sales Report

Reviewed by Kshitija Bhandaru

Niu Technologies (NasdaqGM:NIU) just released its third quarter and year-to-date sales volumes for 2025, offering investors a look into how its business is performing both in China and worldwide.

See our latest analysis for Niu Technologies.

Fresh off its sales update, Niu Technologies has seen modest improvement with a 1-year total shareholder return just under 1%, and a share price that has edged higher year-to-date. While the company’s fundamental trends suggest growth is underway, recent market momentum has been relatively subdued compared to previous years.

If Niu’s steady progress has you thinking big picture, it could be the perfect moment to discover See the full list for free.

With growth numbers on the rise and the stock only modestly up this year, investors may be wondering: Is Niu Technologies trading below its true value, or is future growth already reflected in the price?

Most Popular Narrative: 35.1% Overvalued

With the most widely followed narrative assigning a fair value of $4.12, Niu Technologies’ last close at $5.56 sits noticeably above that benchmark. This difference reflects high expectations already built into the share price even as analysts project improving trends beneath the surface.

Expectations of continued robust sales growth in China, fueled by rapid urbanization and increasing demand for compact, efficient electric mobility solutions, are likely driving optimistic assumptions that revenue will remain elevated or accelerate further. There is also anticipation that global shifts toward lower emissions and stricter internal combustion vehicle regulations will strongly boost electric two-wheeler adoption, prompting the market to price in an extended period of above-average revenue growth and expansion opportunities.

Get a glimpse at the bullish foundations behind this verdict. What sales and margin figures are analysts banking on, and how do they compare to industry norms? The assumptions might surprise you. See which make-or-break forecasts hold the key to this valuation call.

Result: Fair Value of $4.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Niu’s profitability and expansion plans remain vulnerable to regulatory shifts or delays in scaling its overseas distribution network. These factors could quickly alter the outlook.

Find out about the key risks to this Niu Technologies narrative.

Another View: The Market Multiple Signals Value

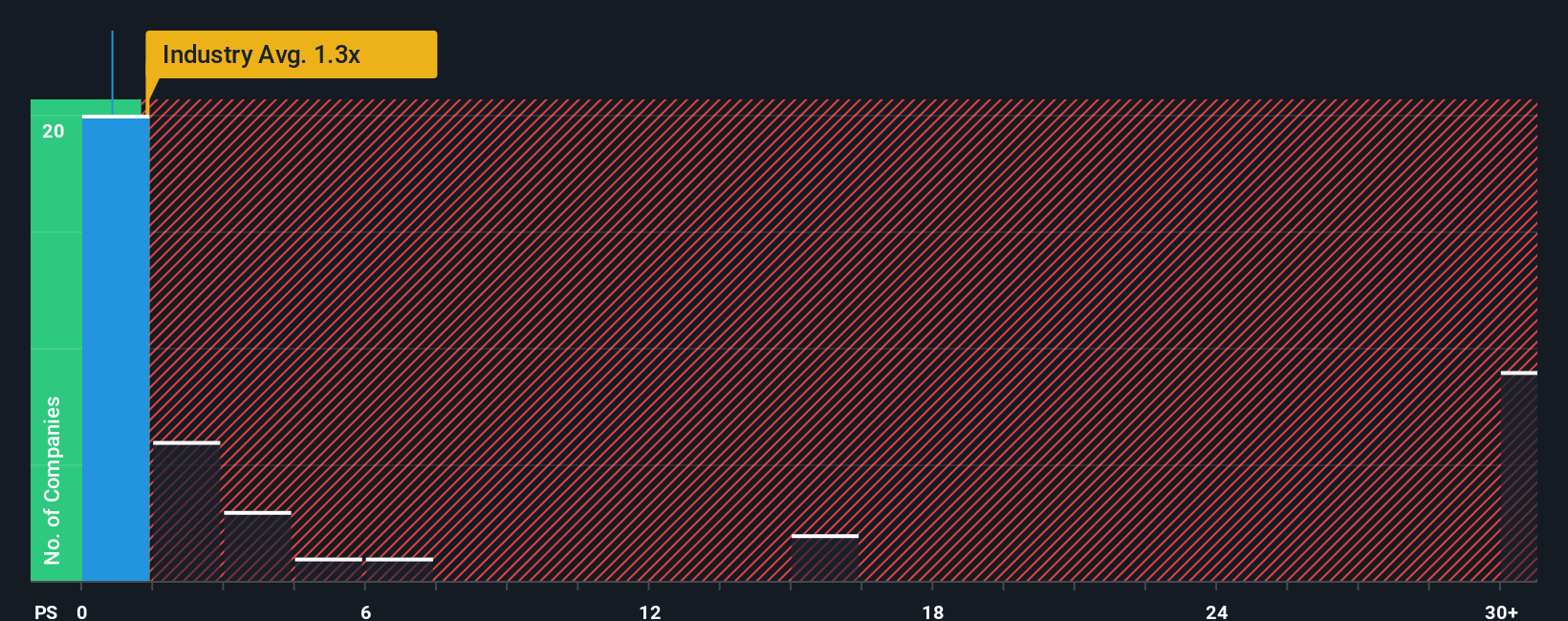

While the first approach suggests Niu Technologies is overvalued, looking at the price-to-sales ratio offers a different perspective. NIU trades at just 0.8 times sales, which is much lower than the US auto industry average of 1.4 and also well below its peer average of 11.3. The fair ratio is 1.4, suggesting that the market may be undervaluing NIU’s growth outlook. Could these low multiples mean the market is discounting NIU’s recovery and international expansion too steeply?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Niu Technologies Narrative

If you see the numbers differently or want to dig deeper for yourself, you can weigh the facts and build a complete story of your own in just a few minutes. Do it your way

A great starting point for your Niu Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why wait to find your next standout investment? Uncover stock opportunities that could shape your portfolio, powered by the smart insights of Simply Wall Street.

- Accelerate your returns by targeting companies with proven cash flow potential using these 894 undervalued stocks based on cash flows.

- Tap into the future of healthcare by evaluating innovative businesses advancing patient care through artificial intelligence with these 32 healthcare AI stocks.

- Capture income opportunities by searching for reliable yields above 3% among these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niu Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NIU

Niu Technologies

Designs, manufactures, and sells electric scooters in the People's Republic of China, Europe, and internationally.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives