- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (LI) Is Up 6.6% After June Deliveries and Li i8 Launch Announcement - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Li Auto recently reported it delivered 36,279 vehicles in June 2025, bringing year-to-date cumulative deliveries to 1.34 million, and announced the upcoming launch of its first pure electric SUV, the Li i8, set for July 29.

- The Li i8 launch arrives as NIO's Onvo sub-brand intensifies competition in China's battery electric vehicle segment, putting Li Auto's efforts to regain momentum under added scrutiny after a year-on-year decline in deliveries.

- We'll examine how the Li i8 launch amid rising competition with NIO's Onvo may shift Li Auto's investment narrative.

Li Auto Investment Narrative Recap

To believe in Li Auto as a shareholder right now, you need confidence in its ability to compete effectively in China’s fast-evolving new energy vehicle (NEV) market, particularly as it expands into pure electric offerings with the Li i8. The recent delivery update and upcoming launch of the Li i8 have kept attention on the company's growth catalysts but have not meaningfully reduced the key risk, the increasing intensity of competition, especially with NIO’s Onvo entering the segment, which could pressure sales and margins in the months ahead. Among recent announcements, Li Auto’s commitment to growing its supercharging network, now with 2,826 stations across China, stands out as especially relevant. With the Li i8 launch scheduled this month, a well-established charging infrastructure becomes crucial for customer adoption and could support Li Auto’s position as it counters both range anxiety and new rivals in the pure electric SUV space. On the other hand, investors should be aware that competitive pressure could affect average selling prices and margins if not managed effectively...

Read the full narrative on Li Auto (it's free!)

Li Auto's outlook anticipates CN¥258.4 billion in revenue and CN¥19.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 21.4% and an earnings increase of CN¥11.3 billion from the current CN¥8.0 billion.

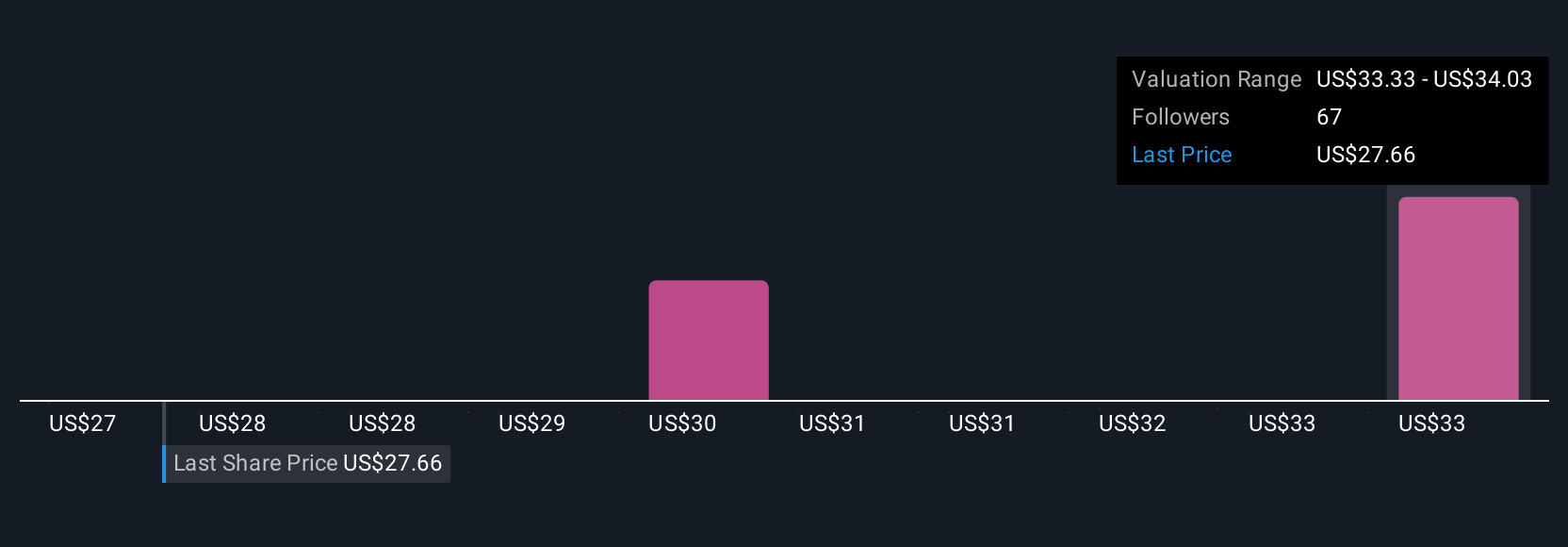

Uncover how Li Auto's forecasts yield a $34.03 fair value, a 23% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed five unique fair value estimates for Li Auto, ranging from US$26.99 to US$34.03 per share. While you compare these diverse perspectives, keep in mind that increasing competition in the NEV market is raising the stakes for future earnings and market share.

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

No Opportunity In Li Auto?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives