- United States

- /

- Auto

- /

- NasdaqGS:LI

How Strong Q3 Deliveries and Li i6 Launch at Li Auto (LI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Li Auto reported that it delivered 33,951 vehicles in September 2025 and 93,211 units for the third quarter, with cumulative deliveries reaching 1.43 million as of September 30, 2025.

- With the immediate market launch and deliveries of its new five-seat battery electric SUV, the Li i6, Li Auto advances its presence in China's high-end electric SUV segment.

- We'll examine how the robust September deliveries and swift Li i6 launch could enhance Li Auto's investment narrative and market momentum.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Li Auto Investment Narrative Recap

To be a Li Auto shareholder, one needs to believe that the company’s aggressive push into premium electric SUVs and accelerated BEV rollout will continue to drive adoption and protect market share, even as competition intensifies and investment requirements remain high. The recent delivery beat and rapid Li i6 launch may offer a short-term catalyst by supporting sales volumes and brand relevance, though these gains don’t materially ease the bigger pressure of scaling margins while managing negative free cash flow.

The most relevant recent update is the immediate market launch and delivery of the Li i6, a move that underscores Li Auto’s effort to transition its product mix toward pure BEVs and capture shifting consumer preferences, a critical step amid the ongoing risk of industrywide regulatory shifts away from hybrids and increased autonomous driving scrutiny.

By contrast, investors should be aware that even headline delivery growth does not eliminate the challenge of ...

Read the full narrative on Li Auto (it's free!)

Li Auto's narrative projects CN¥232.1 billion revenue and CN¥15.2 billion earnings by 2028. This requires 17.4% yearly revenue growth and a CN¥7.1 billion earnings increase from the current CN¥8.1 billion.

Uncover how Li Auto's forecasts yield a $29.30 fair value, a 13% upside to its current price.

Exploring Other Perspectives

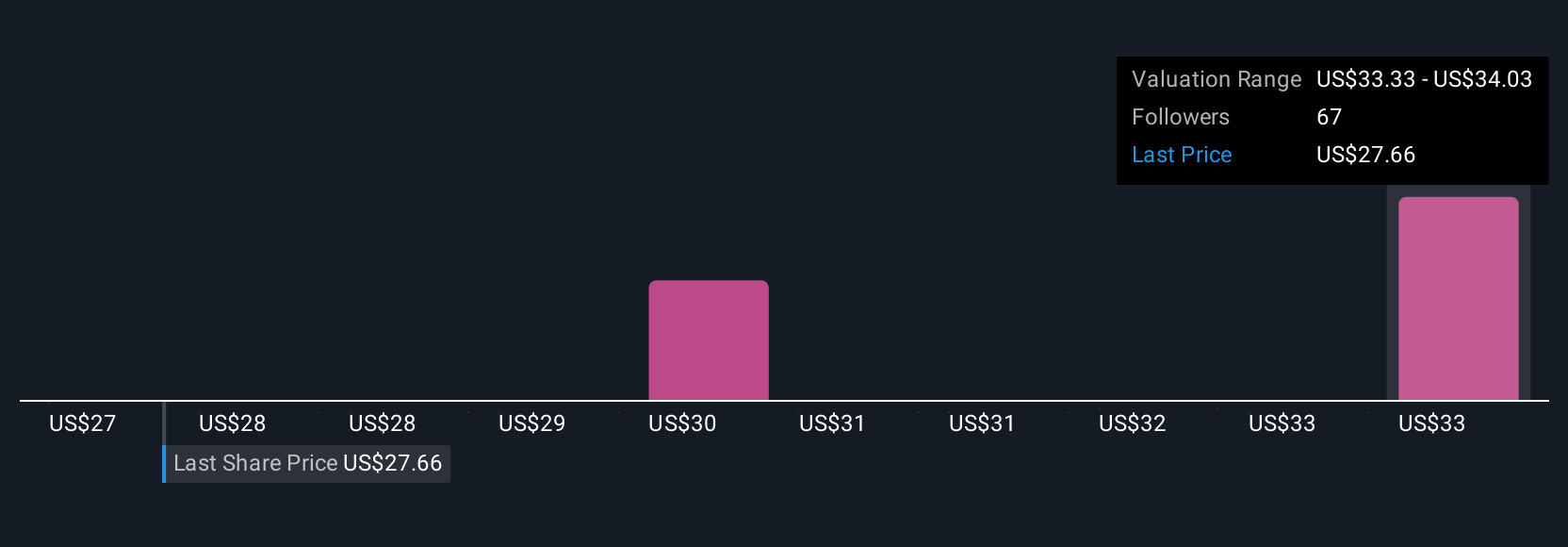

Five fair value estimates from the Simply Wall St Community span CN¥27.31 to CN¥33.08 per share. While perspectives vary, Li Auto’s large R&D and capital expenditure needs remain a key consideration shaping future potential, explore more viewpoints from community members to see the full picture.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth as much as 28% more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives