- United States

- /

- Auto

- /

- NasdaqGS:LI

How Li i6 Launch and VLA Driver Upgrade Could Shape Li Auto (LI) Investor Expectations

Reviewed by Simply Wall St

- Earlier this month, Li Auto introduced the Li i6 battery electric SUV, priced between RMB 250,000 and RMB 300,000, and rolled out its VLA Driver advanced assisted driving system to all Li AD Max users via OTA 8.0, while also evolving its Li Xiang Tong Xue Agent smart cockpit features.

- Li Auto's August vehicle deliveries exceeded 28,500 units, and its Q2 figures surpassed revised guidance, reflecting strong operational execution amid product innovation and a temporary sales system upgrade.

- We'll examine how the Li i6 launch and VLA Driver rollout could influence Li Auto's investment narrative and future growth assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Li Auto Investment Narrative Recap

To believe in Li Auto as a shareholder today, you need confidence in the company's ability to transition from its extended-range models to pure battery electric vehicles and to scale its intelligent driving technology, all while facing mounting competition and heavy investments in R&D. The recent launch of the Li i6 and VLA Driver update supports the narrative of product innovation, but does not materially change the importance of scaling BEV sales or ease concerns about pressure on profit margins and liquidity in the short term.

The August delivery update, which saw Li Auto deliver 28,529 vehicles and Q2 deliveries surpass revised guidance, stands out as particularly relevant to near-term catalysts. This level of operational execution, even after a temporary sales system upgrade, reinforces the company's capability to meet demand, but the company’s lowered Q3 guidance and rising cost base highlight why sustaining momentum is still the primary question.

By contrast, investors should also be aware that rising capex paired with heavy cash outflows could challenge Li Auto’s ability to ...

Read the full narrative on Li Auto (it's free!)

Li Auto's outlook anticipates CN¥232.1 billion in revenue and CN¥15.2 billion in earnings by 2028. This implies a 17.4% annual revenue growth rate and an earnings increase of CN¥7.1 billion from the current level of CN¥8.1 billion.

Uncover how Li Auto's forecasts yield a $29.30 fair value, a 20% upside to its current price.

Exploring Other Perspectives

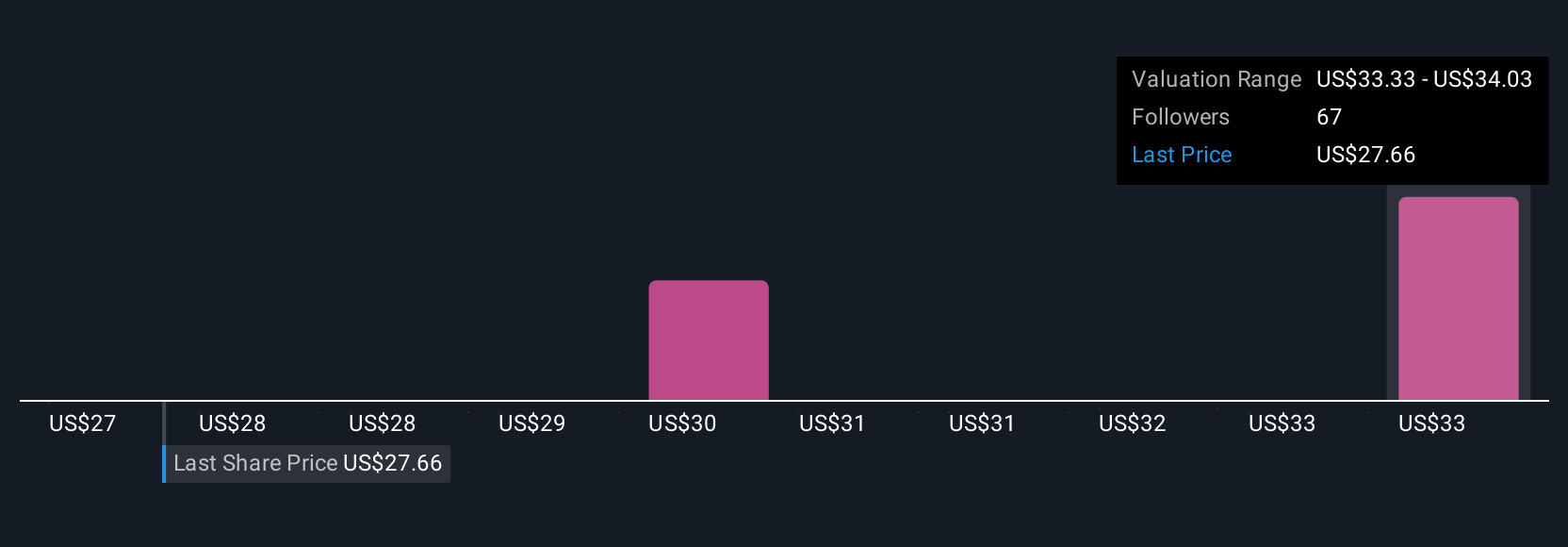

Five Simply Wall St Community members estimate fair value between RMB 27.31 and RMB 33.52 per share. Their diverse outlooks meet the reality of intensifying NEV competition, inviting you to explore how opinions and risks may influence future performance.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth as much as 37% more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives