- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid (LCID): Revisiting the EV Maker’s Valuation After a Steep Share Price Slide

Reviewed by Simply Wall St

Lucid Group (LCID) has been grinding through a rough stretch in the market, and that slide is forcing investors to revisit the core EV thesis. Let us break down what the latest performance actually signals.

See our latest analysis for Lucid Group.

Over the past year, Lucid’s shrinking 1 year total shareholder return and steep year to date share price decline suggest momentum is clearly fading as investors reassess execution risk and the pace of future growth.

If Lucid’s recent volatility has you rethinking your EV exposure, it could be worth scanning other auto manufacturers to spot where the market sees more durable momentum and stronger fundamentals.

With the share price deeply in the red and analyst targets sitting far higher, investors are left weighing whether Lucid is now trading below its true potential or if the market already reflects its long road to profitable growth.

Most Popular Narrative Narrative: 37.5% Undervalued

With Lucid Group trading at $11.52 against a most popular narrative fair value near $18.43, the story hinges on aggressive long term scaling and margins.

The upcoming launch of Lucid's midsized EV platform in late 2026 targets a much broader customer base with lower cost, high volume vehicles, directly expanding Lucid's addressable market and providing operating leverage for stronger top line revenue growth and improved net margins as scale increases.

Curious how fast revenue must climb, how margins must swing positive, and what future earnings multiple ties it all together? The full narrative reveals the bold roadmap behind that valuation.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and ongoing capital needs, including potential future dilution, could derail margin expansion and challenge the long term undervaluation case.

Find out about the key risks to this Lucid Group narrative.

Another View: Market Multiples Flash a Different Signal

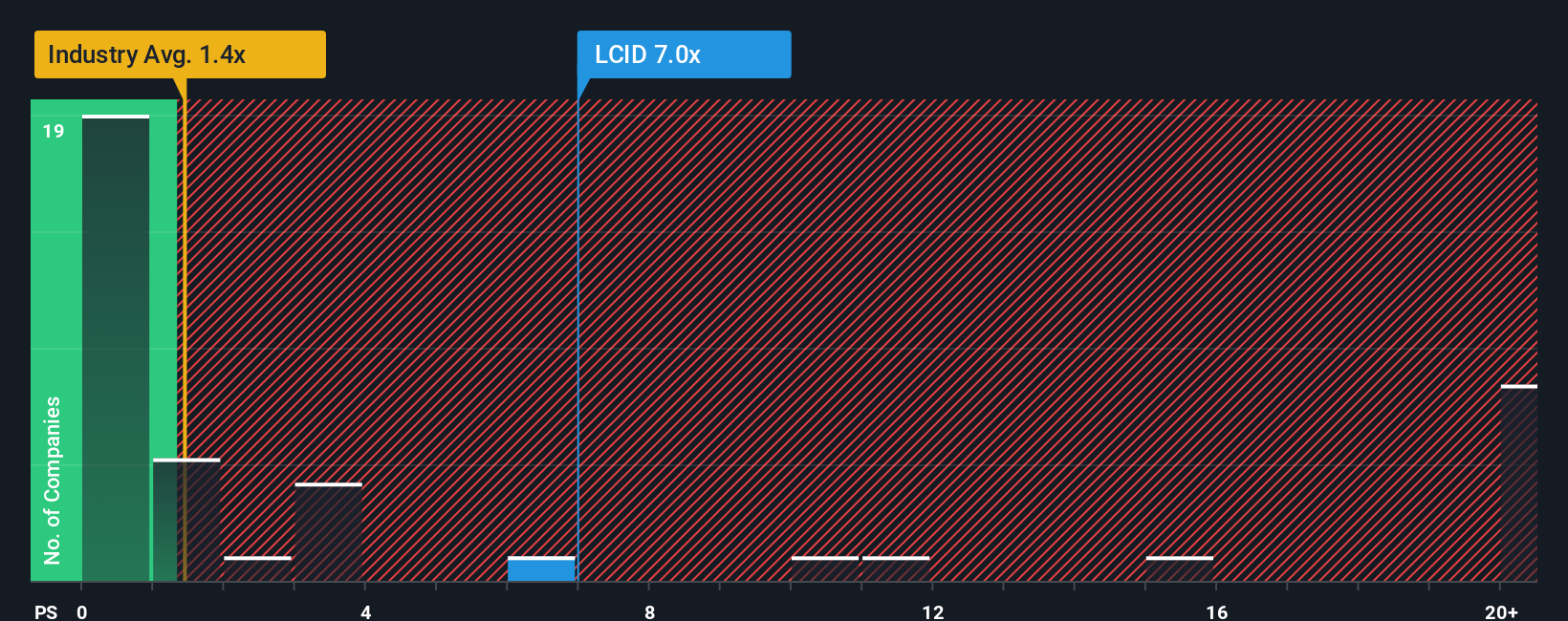

While the narrative model points to Lucid being undervalued, the market is telling a tougher story. At about 3.5 times sales versus 0.7 times for the US auto sector and 1.4 times for peers, and above a fair ratio of 0, buyers are paying a big premium for a still unprofitable business. Is that gap a contrarian opportunity or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If you want to challenge this view or dig into the numbers yourself, you can build a fresh Lucid story in just minutes: Do it your way.

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single EV thesis; use the Simply Wall St Screener now to explore additional opportunities.

- Scan these 3640 penny stocks with strong financials that combine small market caps with balance sheets and cash flows that appear strong enough to support meaningful business development.

- Research these 26 AI penny stocks that use machine learning and automation to reshape industries and potentially drive long-term business growth.

- Review these 12 dividend stocks with yields > 3% that offer yields above 3 percent and appear supported by payout ratios and cash generation that look sustainable over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)