- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Releases Q2 2025 Production And Delivery Figures

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) demonstrated its operational strength by announcing the production of 3,863 vehicles and delivery of 3,309 vehicles for Q2 2025. Despite this solid performance, the company's shares declined by 4% last week. This movement contrasts with broader market trends, as the S&P 500 and Nasdaq reached new heights, boosted by a robust jobs report and ongoing tech stock rallies. While Lucid's production numbers highlight steady growth, the overall market exuberance driven by tech gains and economic optimism might have diluted the immediate positive impact of Lucid's announcements on its share price.

The recent announcement by Lucid Group regarding its Q2 vehicle production and delivery figures underscores the company's operational capabilities. However, despite this operational progress, the longer-term performance of Lucid's shares shows a decline of 30.51% over the past year. This significant decrease highlights shareholder concerns amidst broader market conditions. Notably, Lucid's one-year performance underperformed the S&P 500's 13.2% gain and the US Auto industry's 23.2% rise, indicating challenges relative to its peers.

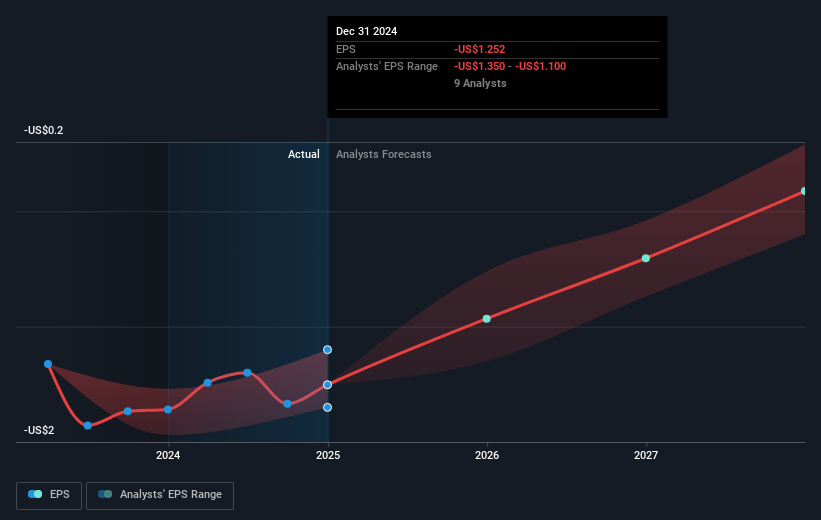

Lucid's recent production achievements could bolster analyst expectations for revenue growth and moderate losses, aiming for an annual profit increase in the coming years. The launch of the Lucid Gravity SUV is anticipated to contribute to revenue expansion, though production constraints remain a potential hurdle. Analysts foresee improvements in operational efficiency, which might benefit future earnings forecasts if successfully implemented.

The current share price of US$2.56 contrasts with the analyst consensus price target of US$2.53, a slight 1.3% difference, suggesting that the market perceives the stock as approximately fairly valued currently. This close alignment to the price target indicates expectations of steady prospects, assuming successful execution of planned growth strategies. Investors should be mindful of industry competitiveness and strategic shifts as they assess future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives