- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (LCID) Board Gains Approval for Reverse Stock Split Proposal

Reviewed by Simply Wall St

Lucid Group (LCID) recently held a special meeting to amend its Certificate of Incorporation, allowing for a potential reverse stock split. Over the past week, Lucid's share price declined by 6.88%, a move contrary to broader market trends, as major indices like the Dow and S&P 500 posted gains due to optimism around potential rate cuts. The company's governance changes could have weighed on investor perceptions, contributing to LCID's downturn even as overall market sentiment improved, highlighting investor concerns over corporate restructuring amidst a generally positive economic outlook.

The recent governance changes at Lucid Group, including the proposal for a reverse stock split, might impact investor confidence, potentially affecting its market positioning. Over the past year, Lucid's total shareholder return was a 51.67% decline, highlighting a more substantial drop compared to broader market returns, which posted a gain of 15.7%. Additionally, Lucid underperformed the US Auto industry, which experienced a 45.3% gain in the same period.

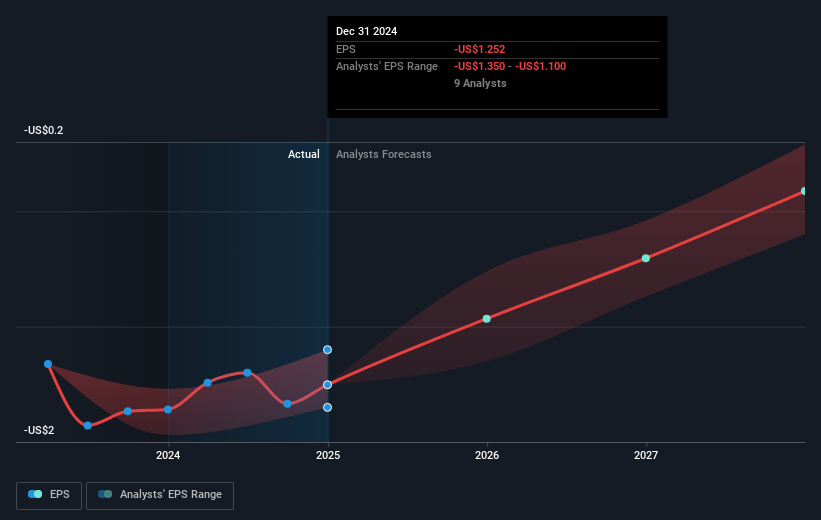

The proposed reverse stock split could have implications for Lucid's revenue and earnings forecasts. With current revenues at US$928.99 million and earnings at US$3.06 billion loss, the company's ability to pivot towards profitability remains in question. The anticipated partnerships and product launches could potentially boost revenue, but these are counterbalanced by existing financial challenges and a heavy reliance on external capital. The potential reverse stock split may aim to stabilize share price, currently at US$2.03, which lags behind the consensus analyst price target of US$2.50—a mere 0.47 difference indicating modest upside potential.

Explore Lucid Group's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives