- United States

- /

- Auto

- /

- NasdaqGS:LCID

Is Lucid’s Uber Deal and European Gravity Launch Reshaping the Investment Case for LCID?

Reviewed by Simply Wall St

- Lucid Group announced a major partnership with Uber Technologies, securing US$300 million in funding and an agreement to provide at least 20,000 Gravity SUVs equipped with autonomous technology over the next six years, while also launching European pre-orders for its all-electric Gravity SUV with deliveries set for early 2026.

- This dual announcement highlights Lucid’s move to expand both its enterprise and consumer market reach, linking large-scale fleet deployments with direct entry into the European luxury SUV segment.

- We'll explore how the Uber collaboration, bringing autonomous technology and substantial funding, shapes Lucid's broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Lucid Group Investment Narrative Recap

For shareholders, the Lucid narrative is all about believing in the company's ability to scale production, secure lasting partnerships, and turn rapid revenue growth into eventual profitability, despite substantial ongoing losses. While Lucid’s new partnership with Uber adds substantial funding and a high-profile fleet commitment, this does not materially remove the most pressing near-term risk: Lucid’s steeply negative margins and its urgent need for additional capital to cover ongoing operating losses and planned expansion. Among the recent updates, the August 29, 2025, reverse stock split stands out. This move, combined with authorized share reduction, directly links to Lucid’s ongoing capital-raising efforts and dilution risk, something the Uber deal does little to alleviate in the short term, even as it may help long-term revenue catalysts. In contrast, investors should also be aware that continued dilution and high interest expense could…

Read the full narrative on Lucid Group (it's free!)

Lucid Group's narrative projects $5.6 billion in revenue and $285.8 million in earnings by 2028. This requires 82.4% yearly revenue growth and a $3.39 billion increase in earnings from current earnings of -$3.1 billion.

Uncover how Lucid Group's forecasts yield a $24.28 fair value, a 26% upside to its current price.

Exploring Other Perspectives

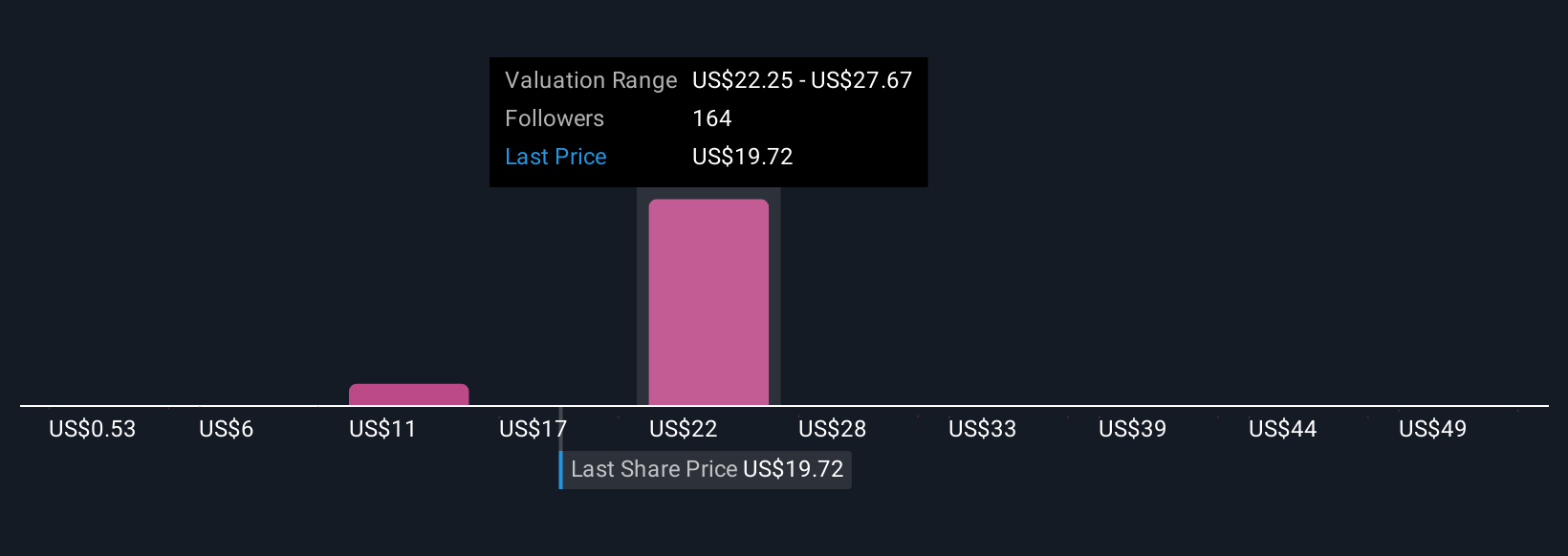

Seventeen fair value estimates from the Simply Wall St Community span from US$0.53 to US$54.82, showing sharply different views on Lucid’s prospects. Many still point to the growing need for external capital as a key factor influencing the company’s future performance.

Explore 17 other fair value estimates on Lucid Group - why the stock might be worth less than half the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives