- United States

- /

- Auto Components

- /

- NasdaqGS:LAZR

Will Recent Governance Turmoil at Luminar (LAZR) Reshape Management Credibility or Investor Perception?

Reviewed by Sasha Jovanovic

- Earlier this year, Luminar Technologies announced that founder Austin Russell resigned as President, CEO, and Chairperson following a Code of Business Conduct and Ethics inquiry, and Pomerantz LLP initiated an investigation into potential securities law violations by the company and certain executives.

- These governance and legal matters have drawn heightened scrutiny, raising questions about leadership stability and investor confidence at a crucial time for Luminar’s operational evolution.

- We’ll examine how these leadership and compliance concerns may now influence Luminar’s investment narrative and future prospects.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Luminar Technologies Investment Narrative Recap

For investors considering Luminar Technologies, the key belief centers on the long-term adoption of LiDAR technology in automotive and mobility markets, driving demand for the company’s integrated hardware and software solutions. The recent CEO resignation and related legal inquiries may challenge short-term leadership stability but do not materially alter the primary catalyst: accelerating shipments of Luminar’s LiDAR systems to new and existing automotive customers. The largest risk now shifts toward potential delays in new contract execution or shipment scaling, partly due to executive turnover and heightened scrutiny.

Among recent announcements, Luminar’s lowered 2025 revenue guidance directly relates to operational execution risks, now potentially magnified by the change in executive leadership. The revised projection of US$67 million to US$74 million in annual revenue acknowledges shipment timing challenges, which could be pressured further if management disruptions affect customer relationships or project milestones.

By contrast, investors should keep a close eye on any signs of shipment delays or adjustments to customer rollout timelines, as these...

Read the full narrative on Luminar Technologies (it's free!)

Luminar Technologies' narrative projects $235.6 million revenue and $10.7 million earnings by 2028. This requires 46.2% yearly revenue growth and a $283.8 million earnings increase from current earnings of -$273.1 million.

Uncover how Luminar Technologies' forecasts yield a $2.67 fair value, a 32% upside to its current price.

Exploring Other Perspectives

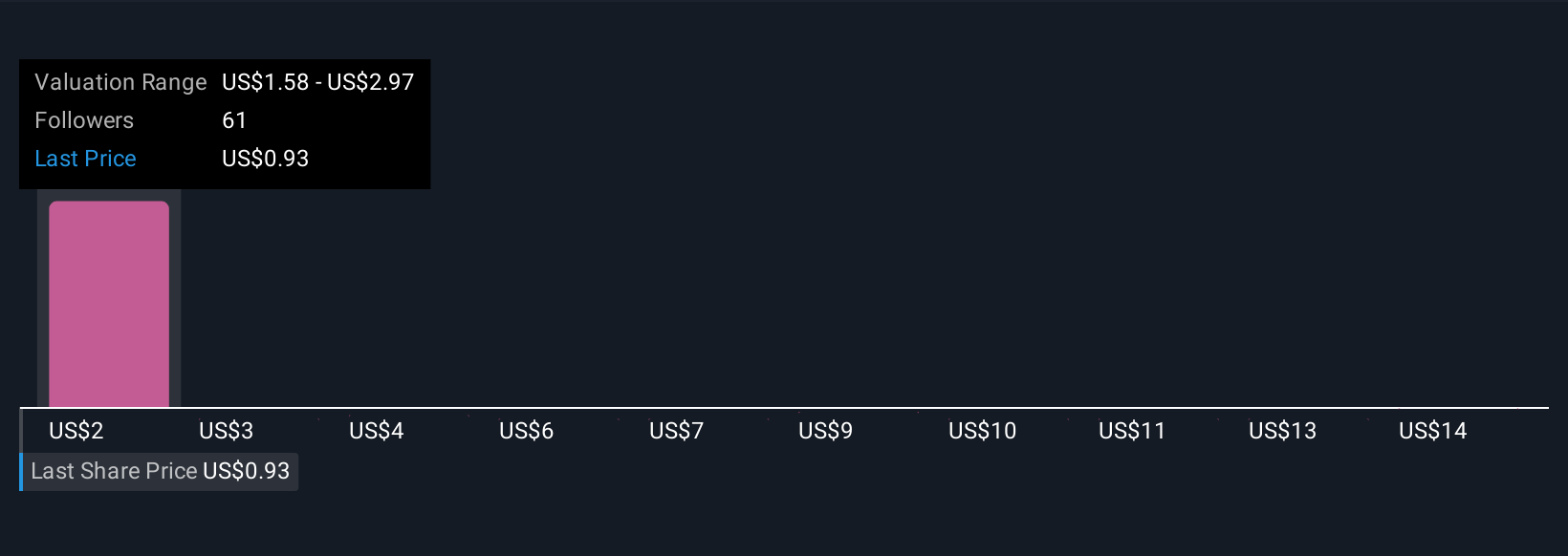

Seven perspectives from the Simply Wall St Community value Luminar shares anywhere from US$1.58 to US$15.50. With leadership changes and ongoing legal risks, the performance outlook could shift quickly, so consider multiple viewpoints before deciding.

Explore 7 other fair value estimates on Luminar Technologies - why the stock might be worth 22% less than the current price!

Build Your Own Luminar Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luminar Technologies research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Luminar Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luminar Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAZR

Luminar Technologies

An automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East.

Medium-low risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026