- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

Hesai Group (NasdaqGS:HSAI): Valuation Insights Following New Lidar Launches and Motional Robotaxi Partnership

Reviewed by Simply Wall St

Hesai Group (NasdaqGS:HSAI) has grabbed investor attention recently, thanks to a string of major announcements. The company is set to showcase its next-generation lidar products, such as the ultra-long-range ETX and solid-state FTX, at the upcoming IAA Mobility 2025 in Munich, a stage where the world’s top automotive minds gather. This is not just about having a booth; ETX sets new records in channel count and range, while recent news of being named Motional’s exclusive robotaxi lidar partner cements Hesai’s reputation as a go-to sensor supplier for autonomous vehicles worldwide.

These headlines have fueled a sharp surge in Hesai’s stock price over the past month, with strong momentum building since the start of the year. The company is up nearly 77% in 2025, outpacing many peers, as investors respond to breakthroughs in performance and real-world wins like the Motional partnership. While there is no shortage of buzz, the consistent share price climb suggests the market is starting to factor in Hesai’s new growth drivers and its expanding footprint in both established and emerging autonomous vehicle projects.

But after such a run, is Hesai’s stock still a bargain, or has the excitement around lidar innovation and major customer wins already been priced into future growth?

Most Popular Narrative: Fairly Valued

The latest, most widely followed narrative sees Hesai Group trading right around its estimated fair value, with the current share price only a fraction above the consensus target.

The projection of 2025 LiDAR shipments reaching 1.2 million to 1.5 million units, with nearly 200,000 high-margin robotic LiDAR units, is expected to significantly boost revenue. Anticipated net revenues of RMB 3 billion to RMB 3.5 billion for 2025, driven by strong demand and mass market adoption, indicate potential growth in revenue.

Want to know what is fueling this precise price call? This narrative hinges on a few bold forecasts about Hesai’s future margins and revenue leaps, using a discount approach usually reserved for star growth stocks. Ever wonder what happens if those projections actually play out? Uncover the secret assumptions and see how they power the current valuation story.

Result: Fair Value of $28.49 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as aggressive pricing pressure and heavy reliance on a few major clients could challenge Hesai's current growth assumptions and valuation outlook.

Find out about the key risks to this Hesai Group narrative.Another View: Discounted Cash Flow Paints a Different Picture

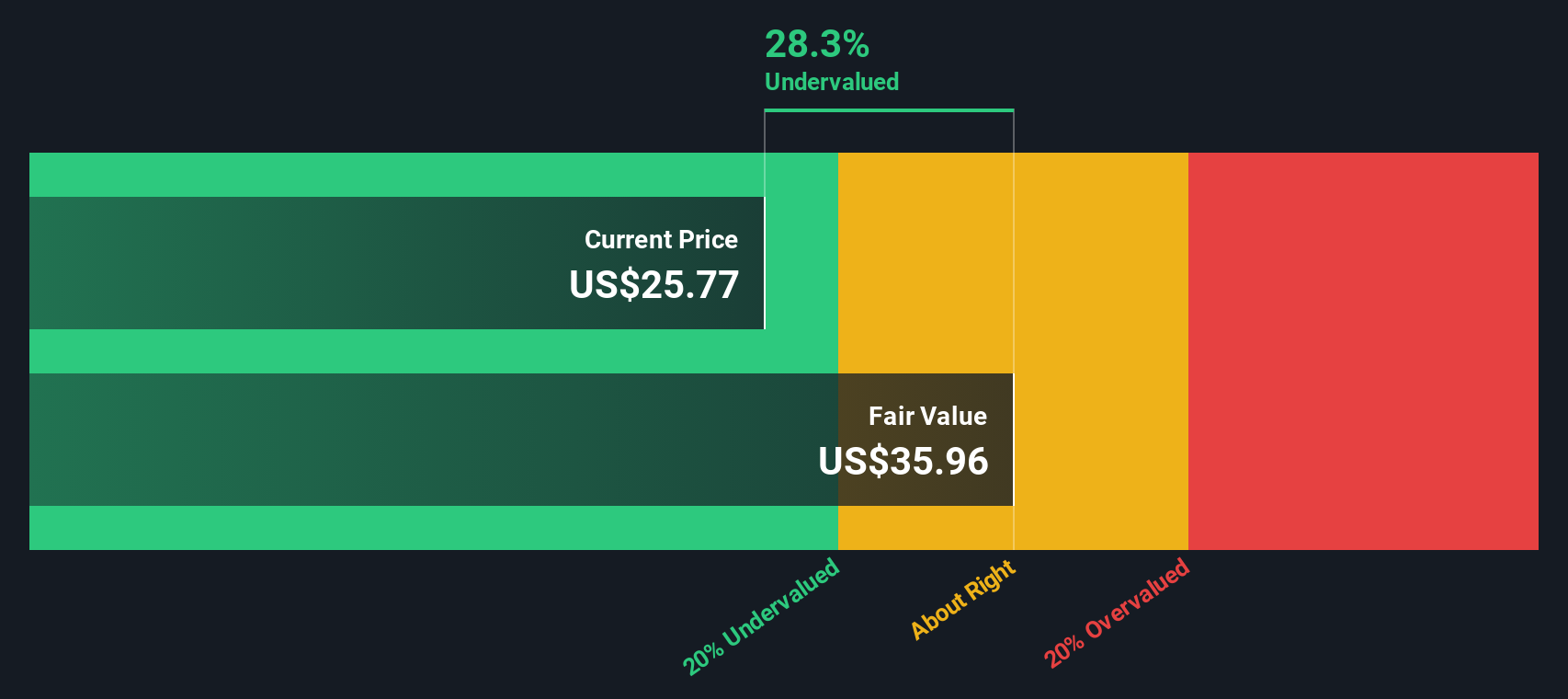

The SWS DCF model looks at Hesai’s cash flows and suggests the stock might be undervalued, which challenges the consensus that shares are fairly priced. Could the market be overlooking future potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hesai Group Narrative

If you want to take a different angle or dig deeper into the numbers, it’s easy to build your own view of Hesai Group’s outlook in just a few minutes. Do it your way.

A great starting point for your Hesai Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity when there is a world of standout companies to consider. Give yourself the edge by seeing what you might be missing and open up your portfolio to fresh sources of growth and returns.

- Find new potential by searching for penny stocks with strong fundamentals using our penny stocks with strong financials.

- Fuel your portfolio’s growth by tapping into innovations from companies leading artificial intelligence advancements through our AI penny stocks.

- Maximize value and stretch your investment dollar further by targeting stocks that look undervalued on current cash flows in our unique undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)