- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

A Look at Hesai Group (NasdaqGS:HSAI) Valuation After Producing 1 Million Lidar Units and Securing New Auto Design Wins

Reviewed by Kshitija Bhandaru

Hesai Group (NasdaqGS:HSAI) just hit a major milestone, announcing production of its 1,000,000th lidar unit for 2025. This achievement makes Hesai the first lidar firm to reach that annual scale and highlights real momentum in vehicle tech adoption.

See our latest analysis for Hesai Group.

Hesai’s achievement comes amid a standout run, with the 1-year total shareholder return surging 338.8%. Momentum has sharply accelerated thanks to high-profile design wins for 2026 models. While the share price dipped 22.8% over the past month, confidence in the lidar tech leader’s long-term growth story is clearly building as industry adoption picks up.

If Hesai’s rapid ascent in auto tech has you thinking broader, there’s never been a better moment to discover See the full list for free.

With Hesai’s recent production feat and strong design wins already lined up, the key question now is whether the stock still has room to run or if the current price already reflects those bullish prospects.

Most Popular Narrative: 25.5% Undervalued

Hesai Group’s last close of $22.05 sits well below the fair value implied by the most popular narrative, which projects far stronger future earnings and market expansion. With a robust pipeline and ongoing international growth, the implied upside suggests a valuation story shaped by rapid adoption trends.

The growth of the ADAS market and LiDAR adoption in EVs is expected to rise from 8% in 2023 to 20% in 2025 and 56% by 2030. This could potentially increase future revenue and market share. Expanding into the global market with new design wins, including a top European OEM, highlights the company's growing international presence and potential revenue diversification.

Curious how these projections create such a dramatic value gap? The explanation lies in assumptions about future profit margins, expected revenue growth, and a bold earnings multiple that compares to the sector’s leaders. Wondering which metrics are most influential? Only the full narrative reveals what’s driving this high-growth valuation.

Result: Fair Value of $29.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including margin pressure from competitive pricing and exposure to major clients who could reduce orders or switch suppliers.

Find out about the key risks to this Hesai Group narrative.

Another View: The Market’s Price Tag

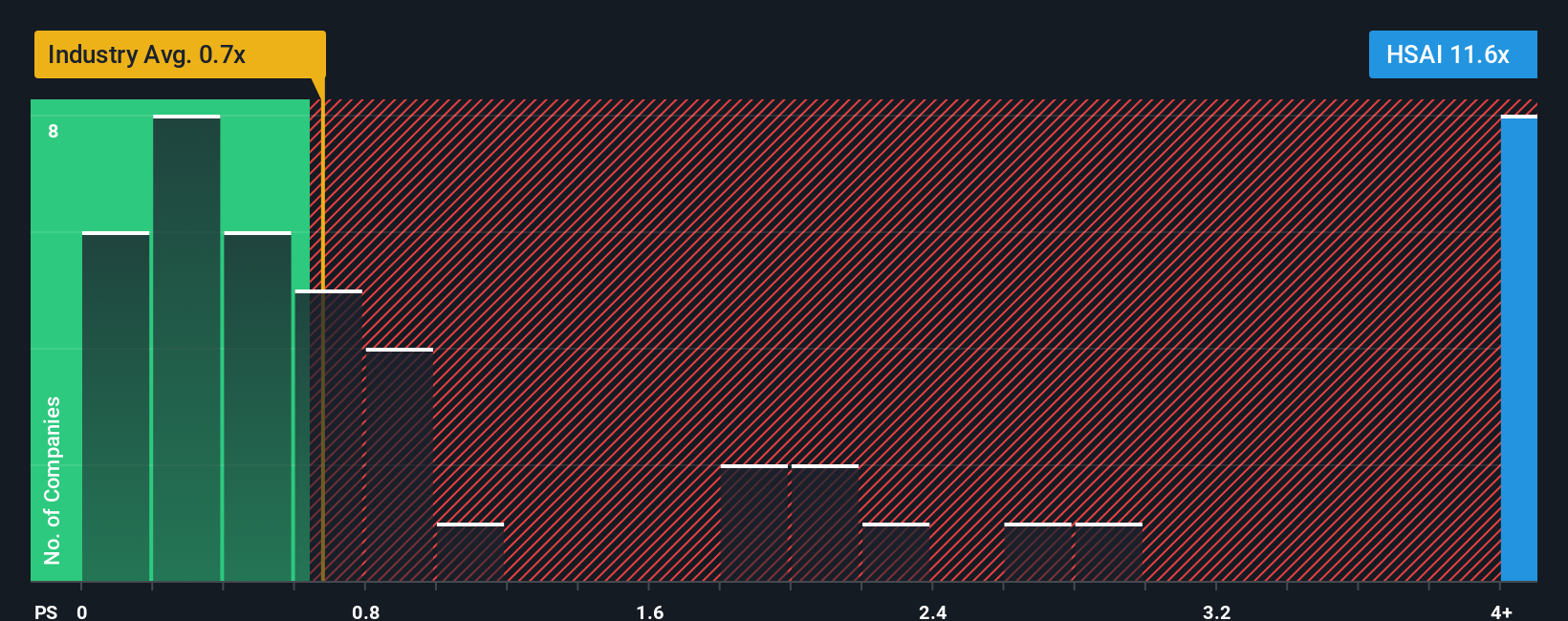

While DCF models point to Hesai being undervalued, a look at its sales ratio tells a different story. The company’s price-to-sales multiple is 11.6, much higher than the US Auto Components industry average of 0.7 and even above the peer average of 1.4. The fair ratio sits at 8.4, suggesting the market price could retreat if sentiment turns. Could this premium signal confidence in Hesai’s growth story, or is it a warning about valuation risks ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hesai Group Narrative

If you think there’s more to the story or want to put your own outlook to the test, you can build a personalized narrative in just minutes, too. Do it your way

A great starting point for your Hesai Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are constantly seeking new trends and hidden gems, so don’t let the perfect opportunity slip away. Put your strategy in motion now with these ideas:

- Tap into markets on the verge of explosive growth by checking out these 892 undervalued stocks based on cash flows, which have strong upside potential and robust cash flows.

- Boost your income stream instantly by seeing these 19 dividend stocks with yields > 3%, featuring high-yield companies offering reliable returns above 3%.

- Be at the forefront of healthcare breakthroughs as you investigate these 33 healthcare AI stocks, which is reshaping the industry with cutting-edge AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives