- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Should Rising Institutional Interest After Analyst Upgrades Prompt Action From Garrett Motion (GTX) Investors?

Reviewed by Simply Wall St

- Garrett Motion recently drew heightened attention from institutional and hedge fund investors, following improved earnings forecasts and strong analyst support in the past week.

- This increased institutional ownership signals both confidence in the company’s future and the potential for closer scrutiny of management decisions.

- With fresh analyst coverage highlighting the company’s improved outlook, we’ll explore how this heightened investor interest can shape Garrett Motion’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Garrett Motion Investment Narrative Recap

To own shares of Garrett Motion, I would need to believe in the company’s ability to maintain profitable growth while navigating industry shifts toward electrification. The recent influx of institutional and hedge fund ownership, spurred by improved earnings guidance and strong analyst coverage, increases scrutiny and adds near-term support to the investment case. However, none of these developments materially change the most immediate catalyst, ongoing execution in expanding zero-emission product lines, or the biggest risk, which remains the company’s reliance on internal combustion engine (ICE) components as the global vehicle market evolves.

Among recent company announcements, Garrett’s upgraded 2025 guidance stands out: the company now expects net sales of US$3.4 billion to US$3.6 billion and net income between US$233 million and US$278 million. This reflects confidence in demand for both traditional turbochargers and newer technologies, supporting optimism around forward revenue visibility, one of the main short-term catalysts following the pickup in institutional interest.

Yet, in contrast to the recent positive momentum, investors should also be aware of ongoing risks tied to margin pressure and the pace of electrification in the auto industry, especially if...

Read the full narrative on Garrett Motion (it's free!)

Garrett Motion's narrative projects $3.8 billion in revenue and $339.1 million in earnings by 2028. This requires a 3.1% annual revenue growth rate and a $38.1 million increase in earnings from the current $301.0 million.

Uncover how Garrett Motion's forecasts yield a $15.83 fair value, a 16% upside to its current price.

Exploring Other Perspectives

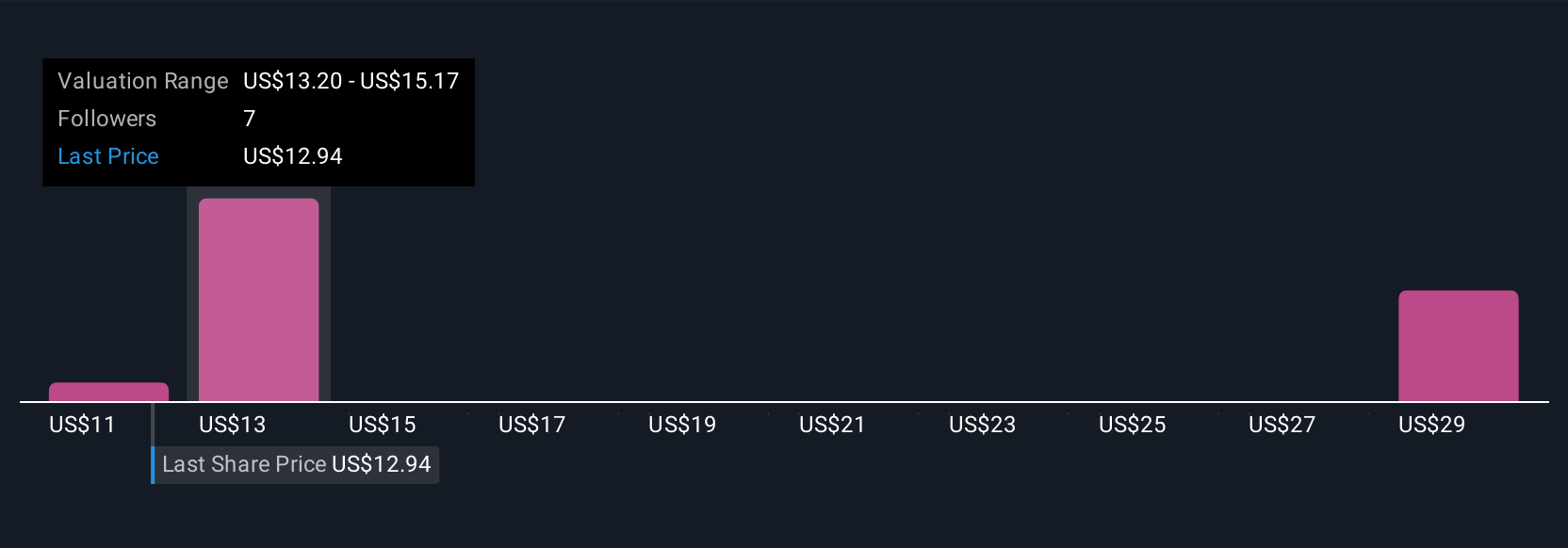

Three perspectives from the Simply Wall St Community place Garrett Motion’s fair value between US$11.24 and US$30.39 per share. While some expect stronger revenue diversification through new technologies, the company’s core reliance on ICE products still shapes broader debate over its long-term earnings stability.

Explore 3 other fair value estimates on Garrett Motion - why the stock might be worth over 2x more than the current price!

Build Your Own Garrett Motion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Garrett Motion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garrett Motion's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives