- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Garrett Motion (GTX): Valuation in Focus After New Buy Rating and Rising Institutional Interest

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 11.6% Undervalued

The leading narrative in the market sees Garrett Motion as trading notably below its calculated fair value, suggesting meaningful upside based on current forecasts and assumptions.

Ongoing innovation and proof-of-concept awards in zero-emission technologies (E-Powertrain, E-Cooling, and fuel cell compressors), along with expansion in industrial and non-automotive end markets, are positioning Garrett to capture higher-margin business opportunities and diversified growth. This is supporting both revenue and future margin expansion.

What is the secret formula behind this bullish target? The narrative’s valuation relies on a unique blend of steady profit growth, operational discipline, and a future earnings multiple well below typical sector giants. Interested in discovering the actual projections and profit assumptions these analysts believe could drive shares higher? The answers, and potentially some surprises, are hidden in the numbers behind this story.

Result: Fair Value of $15.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, margin pressure from an unfavorable sales mix and the ongoing shift toward electric vehicles could still disrupt Garrett Motion’s projected earnings momentum.

Find out about the key risks to this Garrett Motion narrative.Another View: SWS DCF Model Puts Valuation to the Test

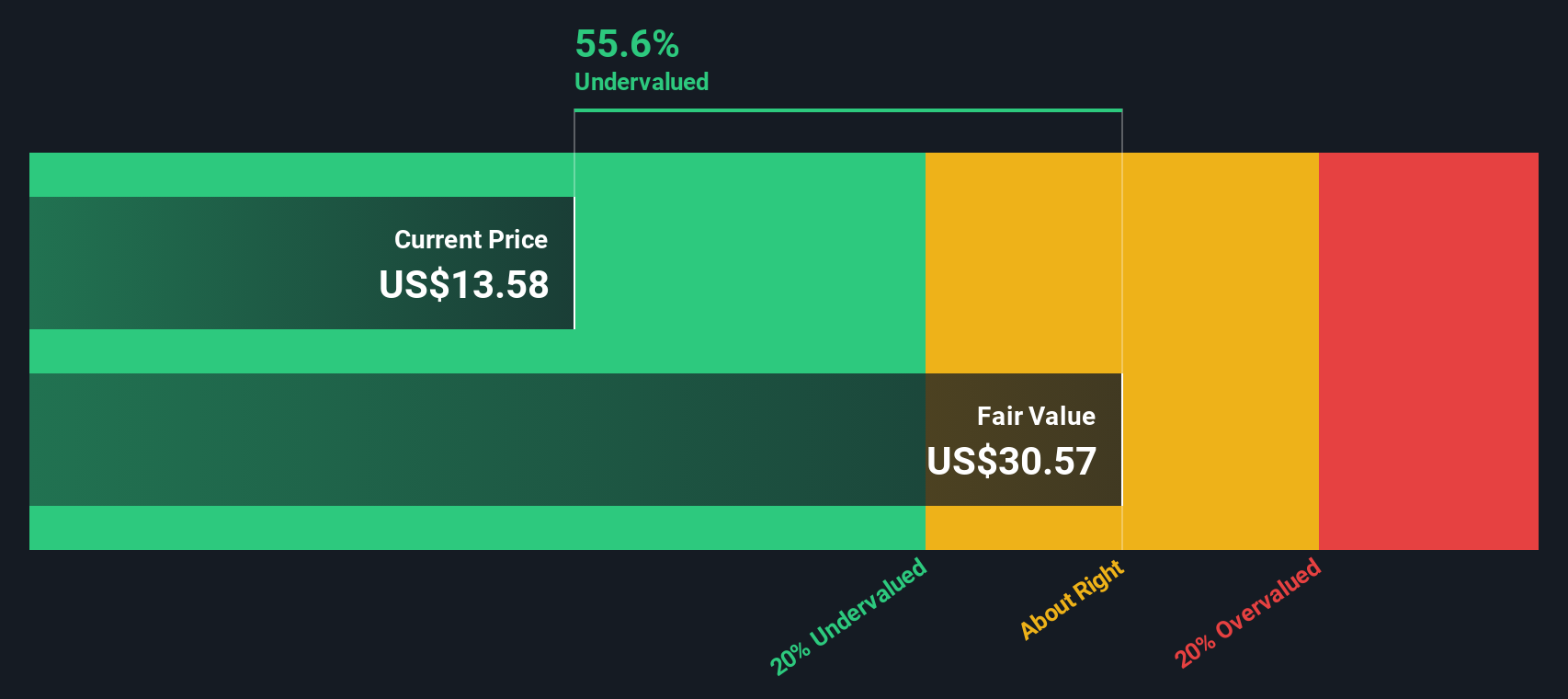

While analysts focus on price targets based on future earnings, our DCF model approaches the numbers from a different perspective. It still points to undervaluation, but the question remains whether it will stand up to changing market conditions ahead.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Garrett Motion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Garrett Motion Narrative

If you want a different perspective, or would rather investigate the details directly, you can shape your own view and narrative in just a few minutes. Do it your way

A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by acting on unique opportunities thousands of investors miss every day. Give yourself the edge by checking out these standout stock ideas now:

- Catch early momentum with companies on the move in fast-changing markets and spot tomorrow's leaders with our penny stocks with strong financials.

- Unlock future potential by seeing which trailblazers are powering up the healthcare revolution. Start your search with healthcare AI stocks.

- Boost your income and stability by targeting shares offering reliable payouts above 3%, all within our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives