- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

Is Gentex’s HomeLink–Genie Smart Garage Integration Reshaping The Connected-Car Investment Case For GNTX?

Reviewed by Sasha Jovanovic

- In November 2025, Gentex Corporation and The Genie Company announced an agreement to integrate Genie's Aladdin Connect platform into Gentex's HomeLink system, enabling vehicle-based and app-based control of smart-enabled garage doors via the HomeLink cloud.

- The partnership extends Gentex's connected-car and smart-home footprint by allowing many existing garage doors to become smart-enabled through Genie's retrofit kits, deepening Gentex's role at the intersection of vehicles and home automation.

- We'll now examine how this expanded HomeLink–Genie integration could influence Gentex's investment narrative around connected car and smart home growth.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gentex Investment Narrative Recap

To own Gentex, you need to believe its mirror and connected car platforms can offset pressure from decontenting and trade friction, while new technologies and VOXX diversification gradually lift earnings. The Genie Aladdin Connect and HomeLink integration supports that thesis on the connected home side, but it does not materially change the key near term catalyst around advanced vision feature adoption or the central risk from shrinking content in China.

The most directly relevant announcement here is Gentex’s agreement with The Genie Company, which expands HomeLink’s reach into retrofit smart garage doors and reinforces Gentex’s push into connected car and smart home features. That push sits alongside margin initiatives and the VOXX acquisition as potential growth drivers, but it also increases Gentex’s exposure to any future shifts in OEM content decisions and consumer adoption of in cabin electronics.

Yet even as HomeLink expands, investors should be aware that Gentex still faces concentrated risk from...

Read the full narrative on Gentex (it's free!)

Gentex's narrative projects $3.0 billion revenue and $529.5 million earnings by 2028. This requires 7.4% yearly revenue growth and a $134.7 million earnings increase from $394.8 million today.

Uncover how Gentex's forecasts yield a $30.06 fair value, a 31% upside to its current price.

Exploring Other Perspectives

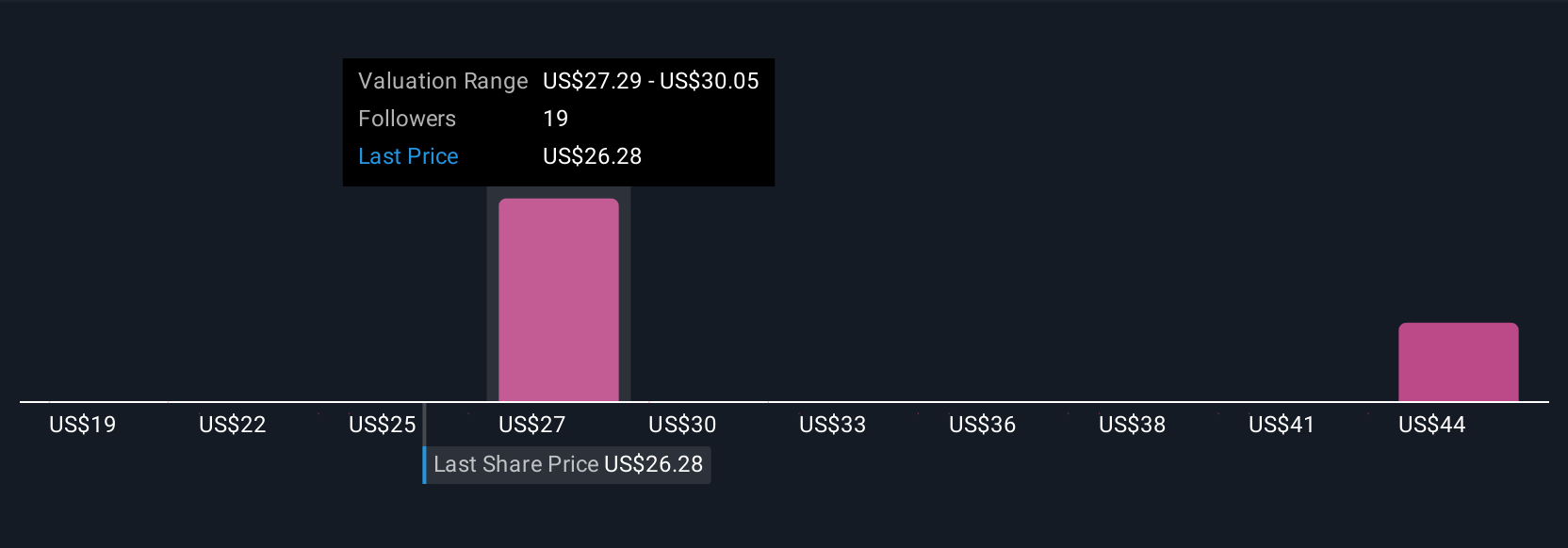

Four Simply Wall St Community valuations span roughly US$19 to about US$31.98, underlining how far apart individual expectations can be. When you set those side by side with Gentex’s exposure to China decontenting risk, it becomes clear why checking several viewpoints on the stock’s possible trajectory can matter for your own assessment.

Explore 4 other fair value estimates on Gentex - why the stock might be worth 17% less than the current price!

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026