- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

Gentex and Anduril's AI Military Helmet Collaboration Might Change The Case For Investing In Gentex (GNTX)

Reviewed by Sasha Jovanovic

- Gentex Corporation recently announced the advancement of its partnership with Anduril Industries to develop EagleEye, an AI-enabled, integrated headborne system for military applications, embedding command, control, and advanced situational awareness directly into helmet platforms for the U.S. Army and allied forces.

- This collaboration underscores Gentex’s expanding footprint in advanced defense technologies, transforming traditional protective equipment into networked, intelligent systems that integrate digital vision and mission command capabilities at the soldier level.

- We’ll examine how Gentex’s deeper role in AI-driven military headgear integration could influence the company’s investment narrative moving forward.

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

Gentex Investment Narrative Recap

Investors in Gentex need to believe in the company’s ability to defend and expand its leadership in high-value, advanced vision and communications systems as core automotive markets face margin pressures and evolving technology demands. While the partnership with Anduril on EagleEye underlines Gentex’s diversification into defense, the near-term impact on automotive-focused catalysts and the company’s biggest risks, namely, exposure to automotive decontenting trends and China, appears limited for now.

Among recent announcements, the June 30 launch of the next-generation Ops-Core FAST SF Helmet System with new accessory integration stands out as most relevant. It showcases Gentex’s ongoing expansion in advanced military headgear, highlighting an area that could offset some of the pressures the company is experiencing in its core automotive segment by adding new revenue streams tied to next-generation defense technologies.

Yet, in contrast, ongoing pressures from decontenting in the China automotive market remain an issue investors should be aware of, especially if…

Read the full narrative on Gentex (it's free!)

Gentex's narrative projects $3.0 billion revenue and $529.5 million earnings by 2028. This requires 7.4% yearly revenue growth and a $134.7 million earnings increase from $394.8 million today.

Uncover how Gentex's forecasts yield a $30.56 fair value, a 18% upside to its current price.

Exploring Other Perspectives

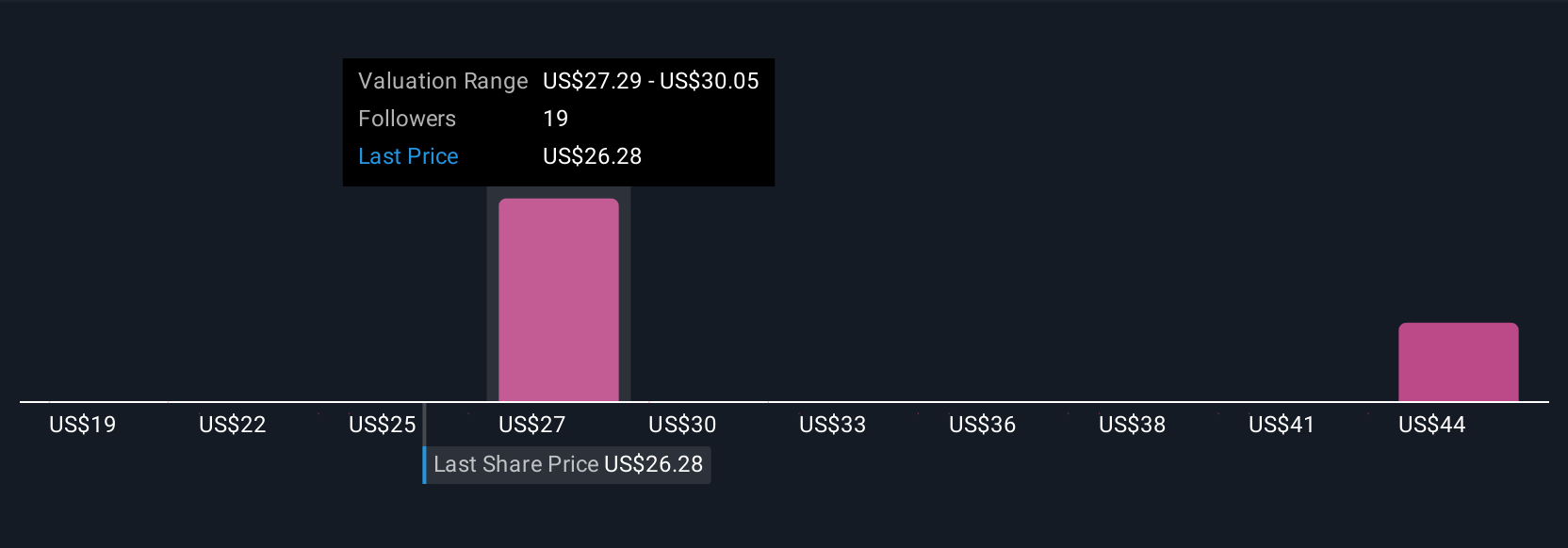

Simply Wall St Community members offered five fair value estimates for Gentex, ranging from US$19 to US$40.58 per share. Your view may differ, especially considering concerns about Gentex’s exposure to lower-content trends in China that may limit future sales growth.

Explore 5 other fair value estimates on Gentex - why the stock might be worth 27% less than the current price!

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives