As global markets navigate a complex landscape marked by dovish Federal Reserve comments and mixed economic signals, investor attention is increasingly turning toward dividend stocks as a source of stability. With U.S. jobless claims at their lowest since April and consumer confidence showing signs of strain, the appeal of dividend-paying stocks lies in their potential to provide consistent income amidst uncertain economic conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| NCD (TSE:4783) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1326 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

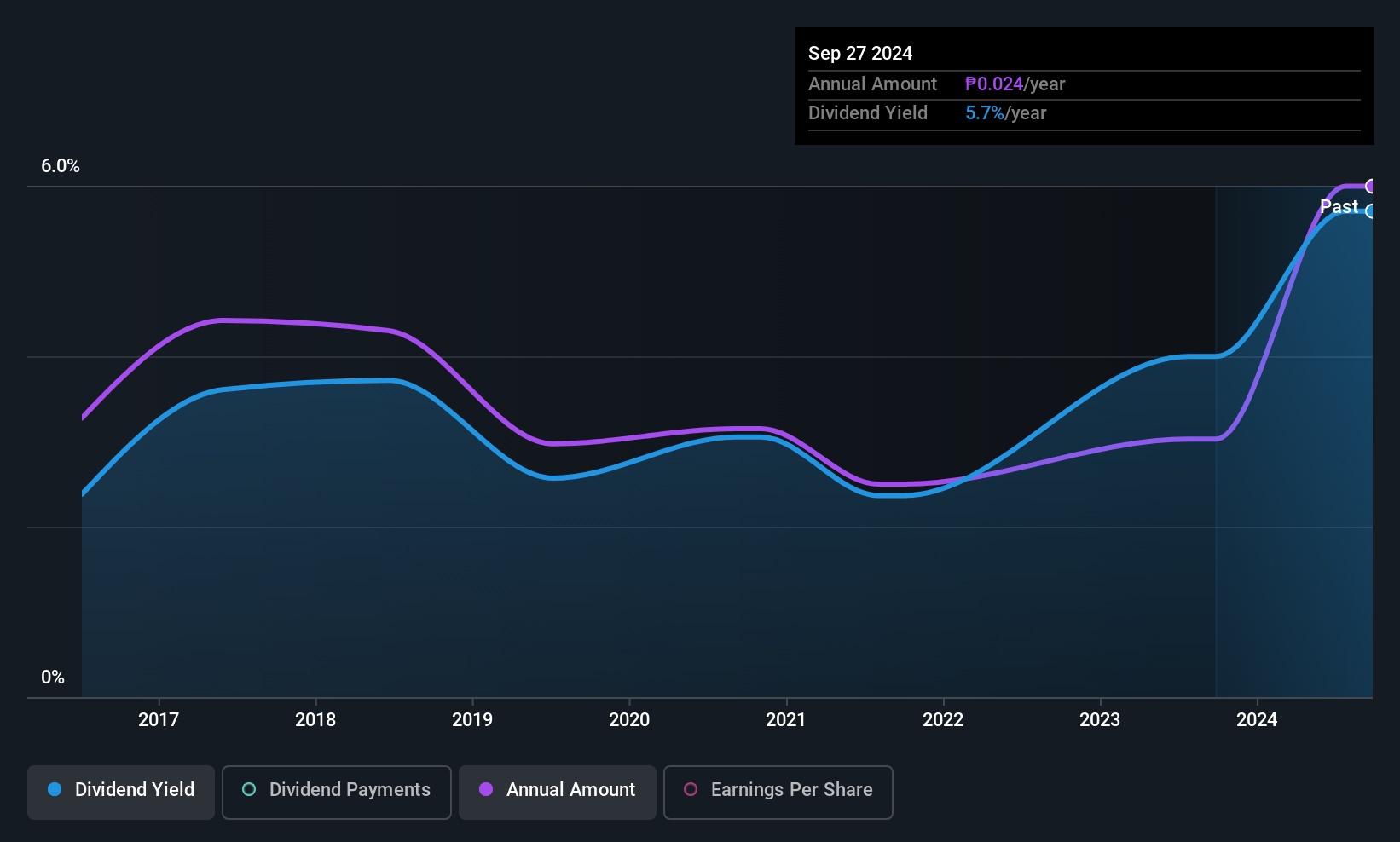

Century Properties Group (PSE:CPG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Century Properties Group, Inc. is a real estate company in the Philippines with a market capitalization of ₱7.77 billion.

Operations: Century Properties Group, Inc. generates revenue from its real estate development segment at ₱14.60 billion, leasing activities at ₱944.39 million, and property and hotel management services at ₱757.90 million.

Dividend Yield: 7.5%

Century Properties Group's dividend yield of 7.52% ranks in the top 25% of Philippine market payers, yet its dividends are marked by volatility and unreliability over the past decade. Despite a low payout ratio of 18.6%, dividends aren't covered by free cash flows, raising sustainability concerns. Recent earnings showed revenue growth but declining sales figures for Q3, while a new CFO appointment may influence future financial strategies.

- Dive into the specifics of Century Properties Group here with our thorough dividend report.

- The analysis detailed in our Century Properties Group valuation report hints at an inflated share price compared to its estimated value.

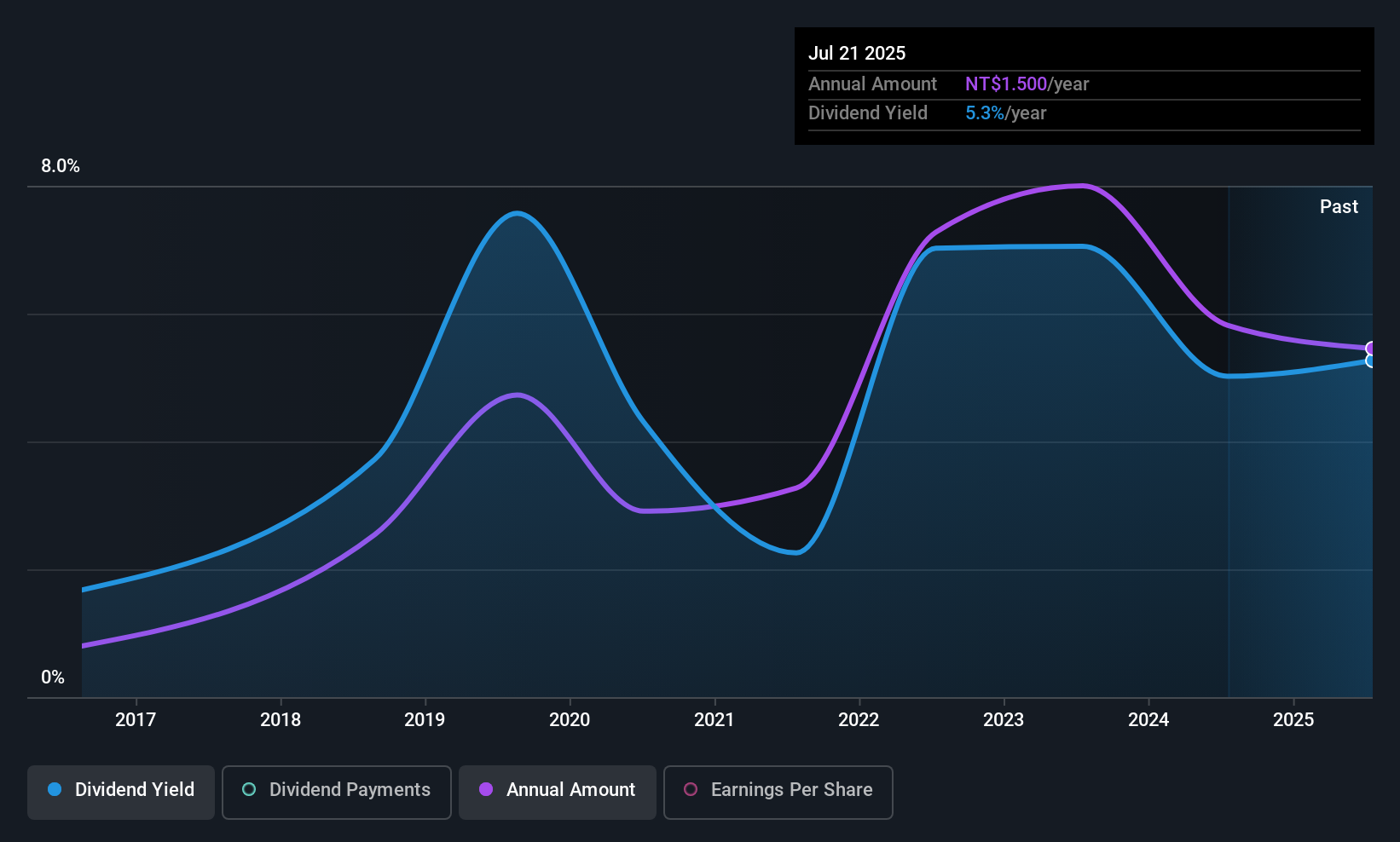

Taiwan Navigation (TWSE:2617)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Navigation Co., Ltd., along with its subsidiaries, offers shipping services in Taiwan and has a market capitalization of NT$13.40 billion.

Operations: Taiwan Navigation Co., Ltd. generates revenue primarily from its Cargo Transportation and Shipping Agency segment, totaling NT$4.22 billion.

Dividend Yield: 4.5%

Taiwan Navigation's recent earnings report shows increased net income despite a slight decline in sales, with basic earnings per share rising to TWD 1.35 from TWD 0.96 year-on-year for Q3. While its dividend yield of 4.46% is below the top quartile in Taiwan, the dividends are well-covered by both earnings and cash flows due to low payout ratios of 48.5% and 34.4%, respectively, though past volatility raises concerns about reliability and stability over the long term.

- Navigate through the intricacies of Taiwan Navigation with our comprehensive dividend report here.

- Our valuation report here indicates Taiwan Navigation may be overvalued.

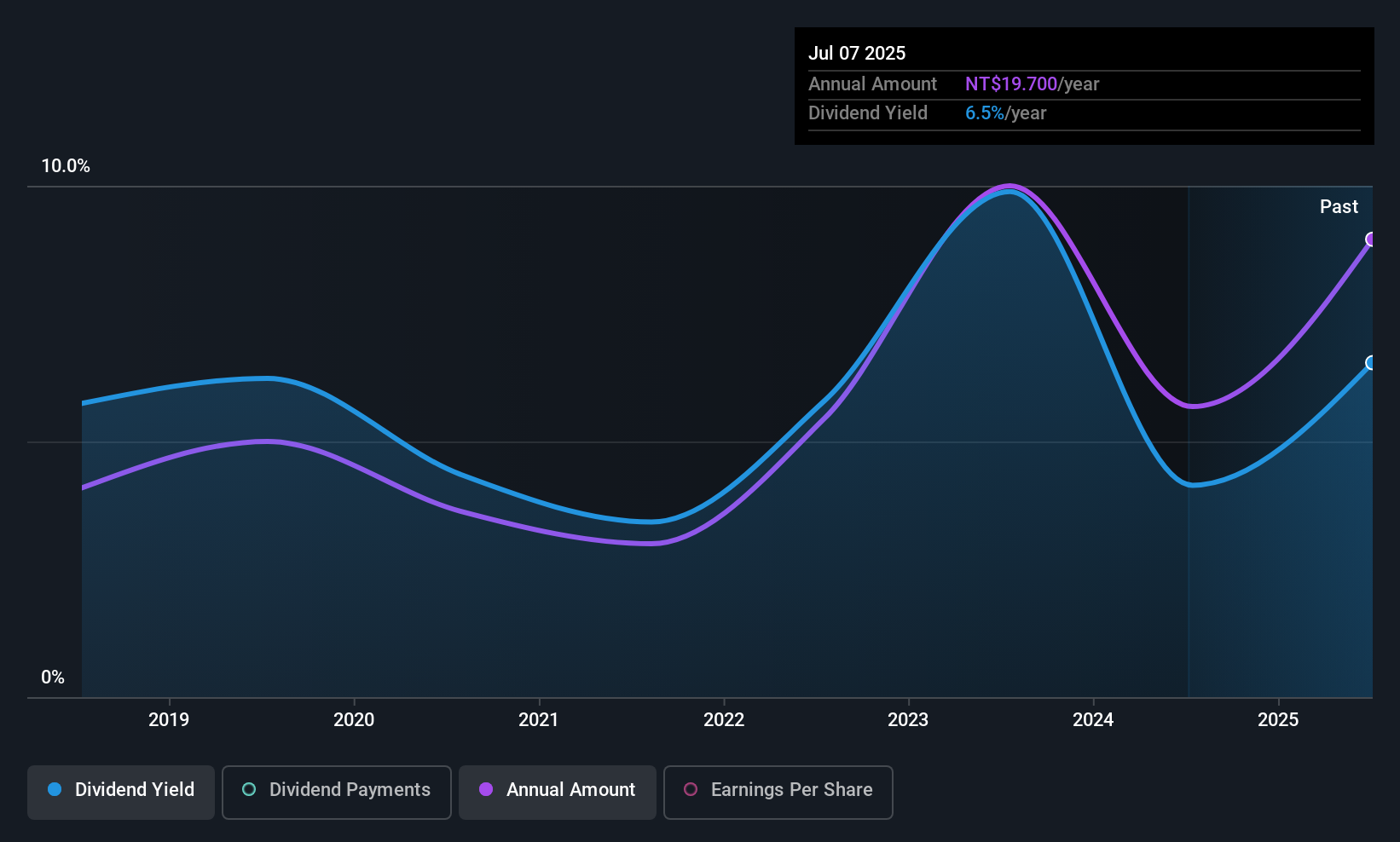

FuSheng Precision (TWSE:6670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors both in Japan and internationally, with a market cap of NT$34.57 billion.

Operations: FuSheng Precision Co., Ltd. generates its revenue from the golf and sports equipment sectors across Japan and international markets.

Dividend Yield: 7.6%

FuSheng Precision's dividend yield of 7.62% ranks in Taiwan's top 25%, though its eight-year track record is marked by volatility. Despite trading at a significant discount to fair value, recent earnings reveal challenges, with Q3 net income dropping to TWD 485.8 million from TWD 827.11 million year-on-year. Dividends are covered by earnings (82.1% payout ratio) and cash flows (59.9%), yet the unstable history may concern investors prioritizing reliability over high yields.

- Take a closer look at FuSheng Precision's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of FuSheng Precision shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 1323 Top Global Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6670

FuSheng Precision

Engages in the golf and sports equipment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026