- Taiwan

- /

- Infrastructure

- /

- TWSE:2607

Global Dividend Stocks: 3 Top Picks For Your Portfolio

Reviewed by Simply Wall St

Amid heightened geopolitical tensions and economic uncertainties, global markets have experienced notable fluctuations, with U.S. stock indexes declining due to renewed trade tensions and concerns over a prolonged government shutdown. As investors seek stability in this volatile environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk while capitalizing on market opportunities.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.16% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.77% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.95% | ★★★★★★ |

| NCD (TSE:4783) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Daicel (TSE:4202) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.46% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.81% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.45% | ★★★★★★ |

Click here to see the full list of 1377 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

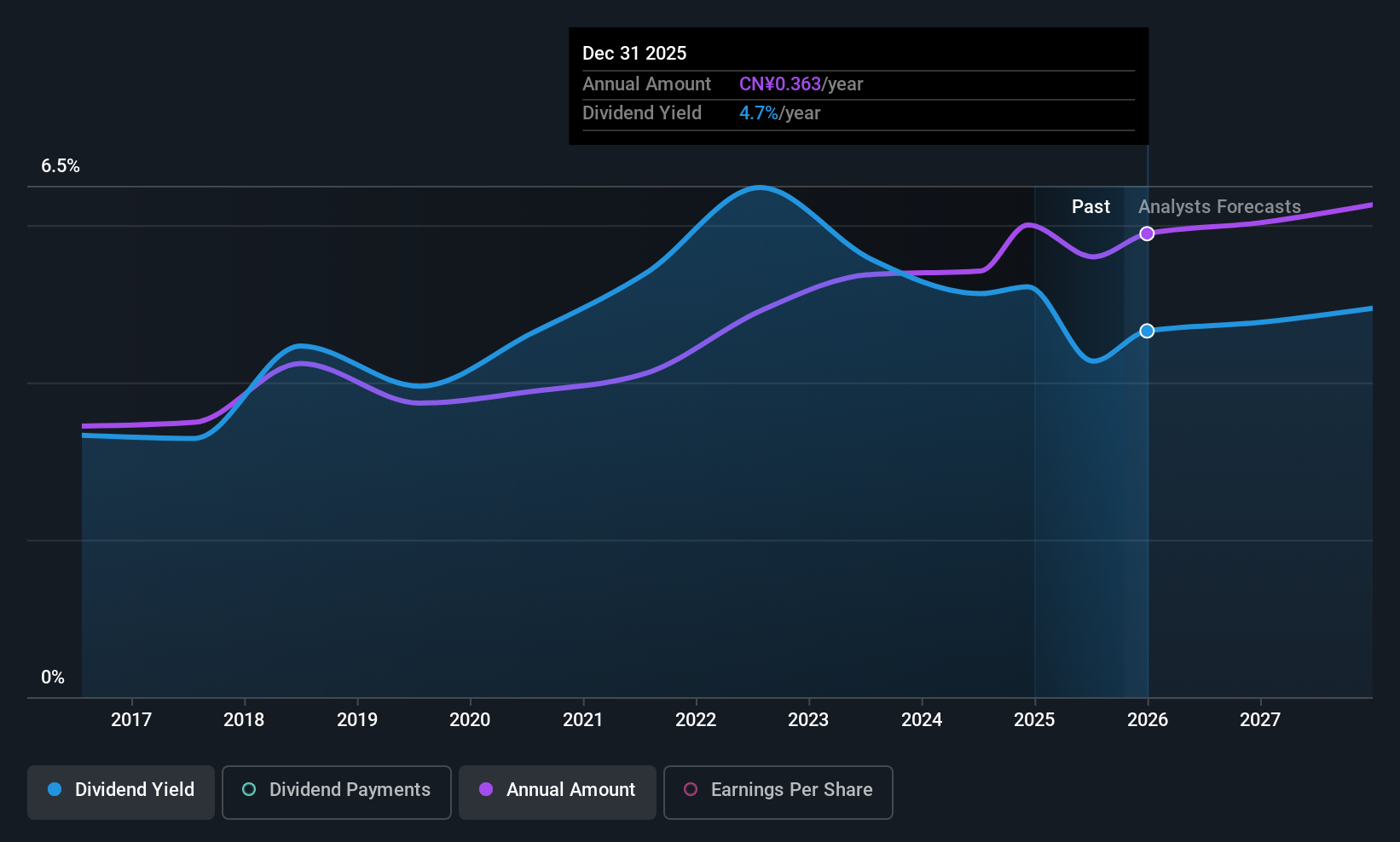

China CITIC Bank (SHSE:601998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both in the People’s Republic of China and internationally, with a market cap of CN¥441.09 billion.

Operations: China CITIC Bank's revenue is primarily derived from its Corporate Banking segment at CN¥82.48 billion, followed by Retail Banking at CN¥45.13 billion and Financial Markets Business at CN¥28.75 billion.

Dividend Yield: 4.4%

China CITIC Bank's recent proposal to increase its interim dividend to RMB 1.88 per 10 shares highlights its commitment to returning value to shareholders. Despite a short dividend history of less than ten years, the bank maintains a stable payout with a low payout ratio of 30.4%, ensuring dividends are well-covered by earnings. With its dividend yield ranking in the top 25% of the Chinese market, it presents an appealing option for income-focused investors.

- Take a closer look at China CITIC Bank's potential here in our dividend report.

- Our expertly prepared valuation report China CITIC Bank implies its share price may be too high.

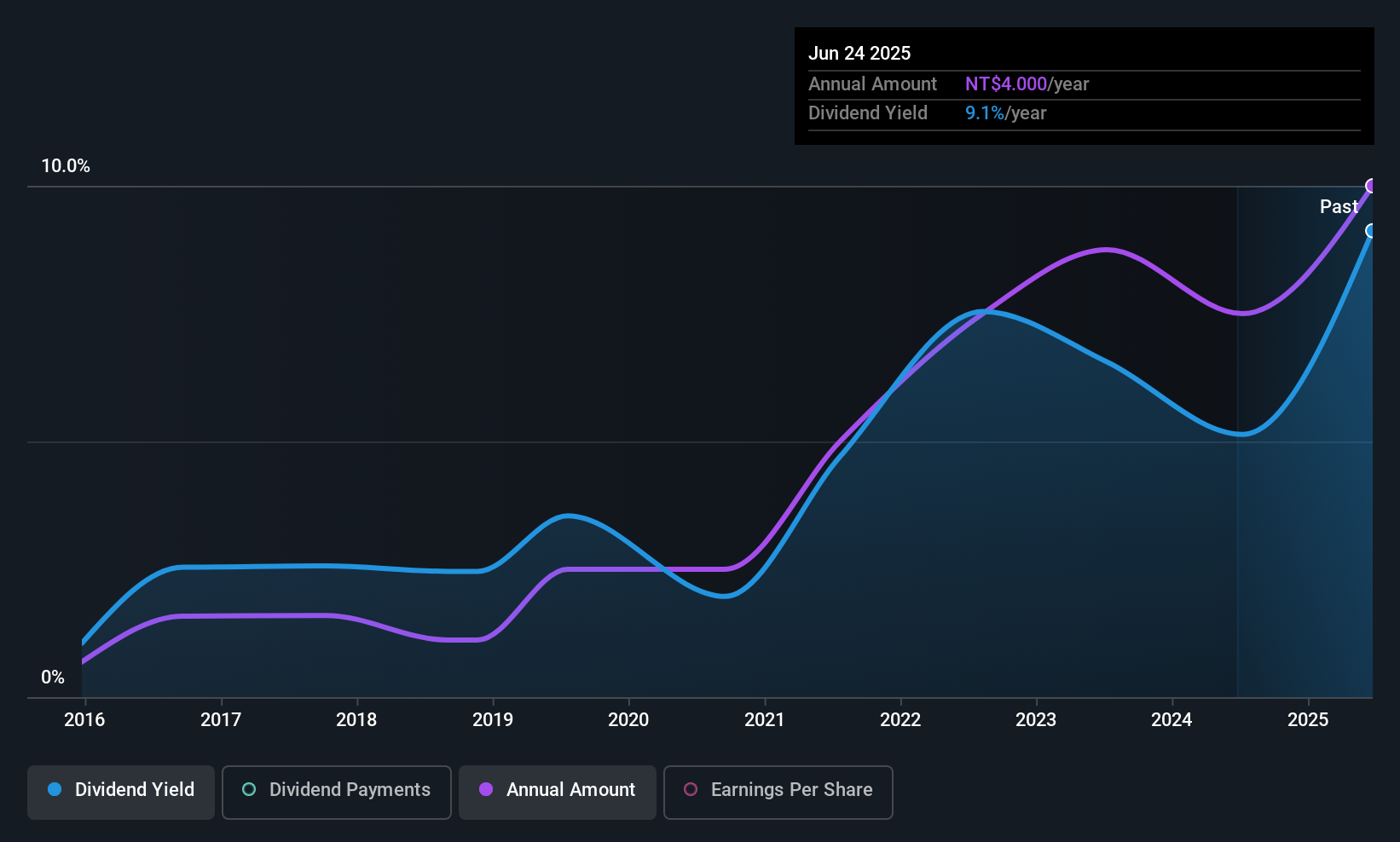

Sunrex Technology (TWSE:2387)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sunrex Technology Corporation manufactures and sells laptop computer keyboards globally, with a market cap of NT$8.05 billion.

Operations: Sunrex Technology Corporation generates revenue primarily from its operations in Taiwan (NT$12.50 billion), the Central Region of Mainland China (NT$18.98 billion), and the Southern Region of Mainland China (NT$1.21 billion).

Dividend Yield: 9.2%

Sunrex Technology's dividend yield ranks in the top 25% of the Taiwanese market, offering a notable 9.25%. Despite this attractive yield, its dividend history is marked by volatility with annual drops over 20% in the past decade. However, current dividends are covered by both earnings and cash flows with payout ratios of 67.6% and 51%, respectively. Recent earnings reports show declining sales and net income, which may impact future dividend stability.

- Navigate through the intricacies of Sunrex Technology with our comprehensive dividend report here.

- Our valuation report here indicates Sunrex Technology may be undervalued.

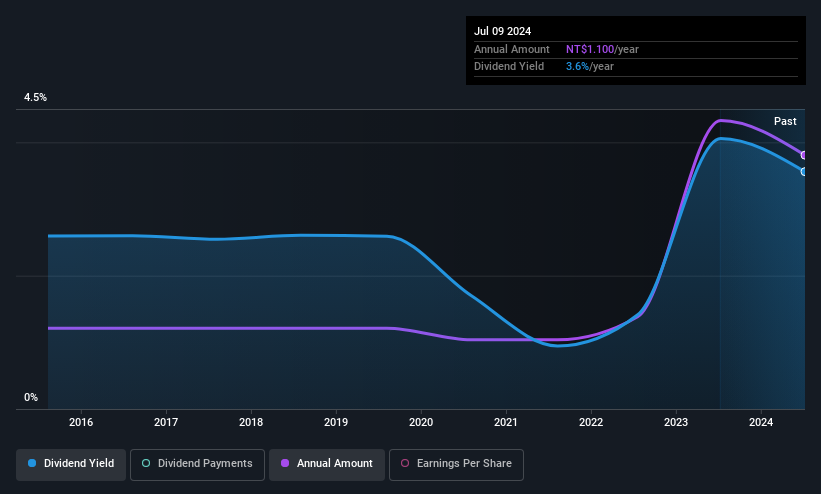

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations across Taiwan, America, and internationally with a market cap of NT$31.48 billion.

Operations: Evergreen International Storage & Transport Corporation's revenue is primarily derived from cargo shipment (NT$15.56 billion), international sea transportation (NT$2.47 billion), inland transport (NT$1.88 billion), container yard operations (NT$958.30 million), and gas stations (NT$410.73 million).

Dividend Yield: 4.4%

Evergreen International Storage & Transport offers a stable dividend yield of 4.38%, supported by a low payout ratio of 44.5% and consistent earnings growth, with profits rising 31.7% over the past year. The company's dividends have been reliably growing and stable over the last decade, though its yield is below Taiwan's top quartile of dividend payers. Recent events include a stock split on September 25, 2025, which may influence investor perception and liquidity positively.

- Delve into the full analysis dividend report here for a deeper understanding of Evergreen International Storage & Transport.

- According our valuation report, there's an indication that Evergreen International Storage & Transport's share price might be on the expensive side.

Taking Advantage

- Click this link to deep-dive into the 1377 companies within our Top Global Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergreen International Storage & Transport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2607

Evergreen International Storage & Transport

Provides inland container transport and container terminal operations in Taiwan, America, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives