- Taiwan

- /

- Wireless Telecom

- /

- TWSE:4904

Far EasTone Telecommunications (TWSE:4904) Has Announced A Dividend Of NT$3.25

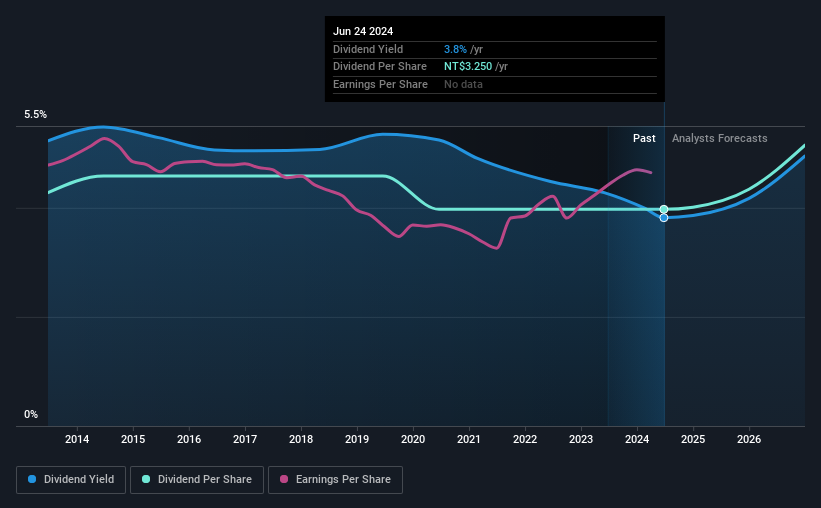

Far EasTone Telecommunications Co., Ltd.'s (TWSE:4904) investors are due to receive a payment of NT$3.25 per share on 7th of August. This payment means that the dividend yield will be 3.8%, which is around the industry average.

Check out our latest analysis for Far EasTone Telecommunications

Far EasTone Telecommunications' Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, Far EasTone Telecommunications' profits didn't cover the dividend, but the company was generating enough cash instead. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS is forecast to expand by 22.1%. If recent patterns in the dividend continues, the payout ratio in 12 months could be 83% which is a bit high but can definitely be sustainable.

Far EasTone Telecommunications Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of NT$3.50 in 2014 to the most recent total annual payment of NT$3.25. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

Investors could be attracted to the stock based on the quality of its payment history. Earnings have grown at around 2.3% a year for the past five years, which isn't massive but still better than seeing them shrink. The company is paying out a lot of its profits, even though it is growing those profits pretty slowly. This gives limited room for the company to raise the dividend in the future.

We should note that Far EasTone Telecommunications has issued stock equal to 11% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Far EasTone Telecommunications' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Far EasTone Telecommunications that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4904

Far EasTone Telecommunications

Engages in the provision of telecommunications and digital application services in Taiwan.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives