- Taiwan

- /

- Wireless Telecom

- /

- TWSE:4904

Far EasTone Telecommunications Co., Ltd.'s (TWSE:4904) Business Is Yet to Catch Up With Its Share Price

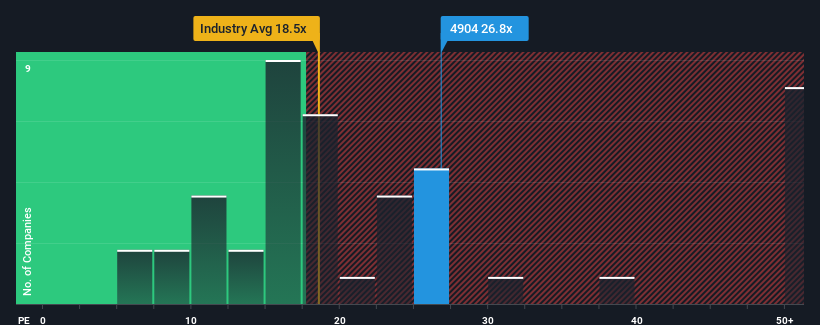

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 23x, you may consider Far EasTone Telecommunications Co., Ltd. (TWSE:4904) as a stock to potentially avoid with its 26.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Far EasTone Telecommunications certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Far EasTone Telecommunications

Is There Enough Growth For Far EasTone Telecommunications?

There's an inherent assumption that a company should outperform the market for P/E ratios like Far EasTone Telecommunications' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 9.7%. The solid recent performance means it was also able to grow EPS by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.9% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

With this information, we find it concerning that Far EasTone Telecommunications is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Far EasTone Telecommunications' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Far EasTone Telecommunications is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Far EasTone Telecommunications. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Far EasTone Telecommunications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4904

Far EasTone Telecommunications

Engages in the provision of telecommunications and digital application services in Taiwan.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives