- Italy

- /

- Diversified Financial

- /

- BIT:BFF

3 Stocks Estimated To Be Undervalued By Up To 40.9% Offering Potential Value

Reviewed by Simply Wall St

As global markets continue to grapple with inflationary pressures and interest rate uncertainties, U.S. stock indexes are climbing toward record highs, driven by growth stocks outperforming value shares. In this environment, identifying undervalued stocks can be a strategic move for investors seeking potential value opportunities amidst market volatility and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.99 | 49.6% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥36.50 | CN¥72.75 | 49.8% |

| Nuvoton Technology (TWSE:4919) | NT$96.00 | NT$191.23 | 49.8% |

| People & Technology (KOSDAQ:A137400) | ₩41600.00 | ₩81998.88 | 49.3% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38250.00 | ₫76325.14 | 49.9% |

| Kraft Bank (OB:KRAB) | NOK9.10 | NOK18.03 | 49.5% |

| Solum (KOSE:A248070) | ₩17660.00 | ₩34915.02 | 49.4% |

| Hensoldt (XTRA:HAG) | €40.78 | €81.50 | 50% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. operates in non-recourse factoring and credit management for public administration bodies and private hospitals across several European countries, with a market cap of approximately €1.54 billion.

Operations: The company's revenue from financial services in the commercial sector amounts to €486.98 million.

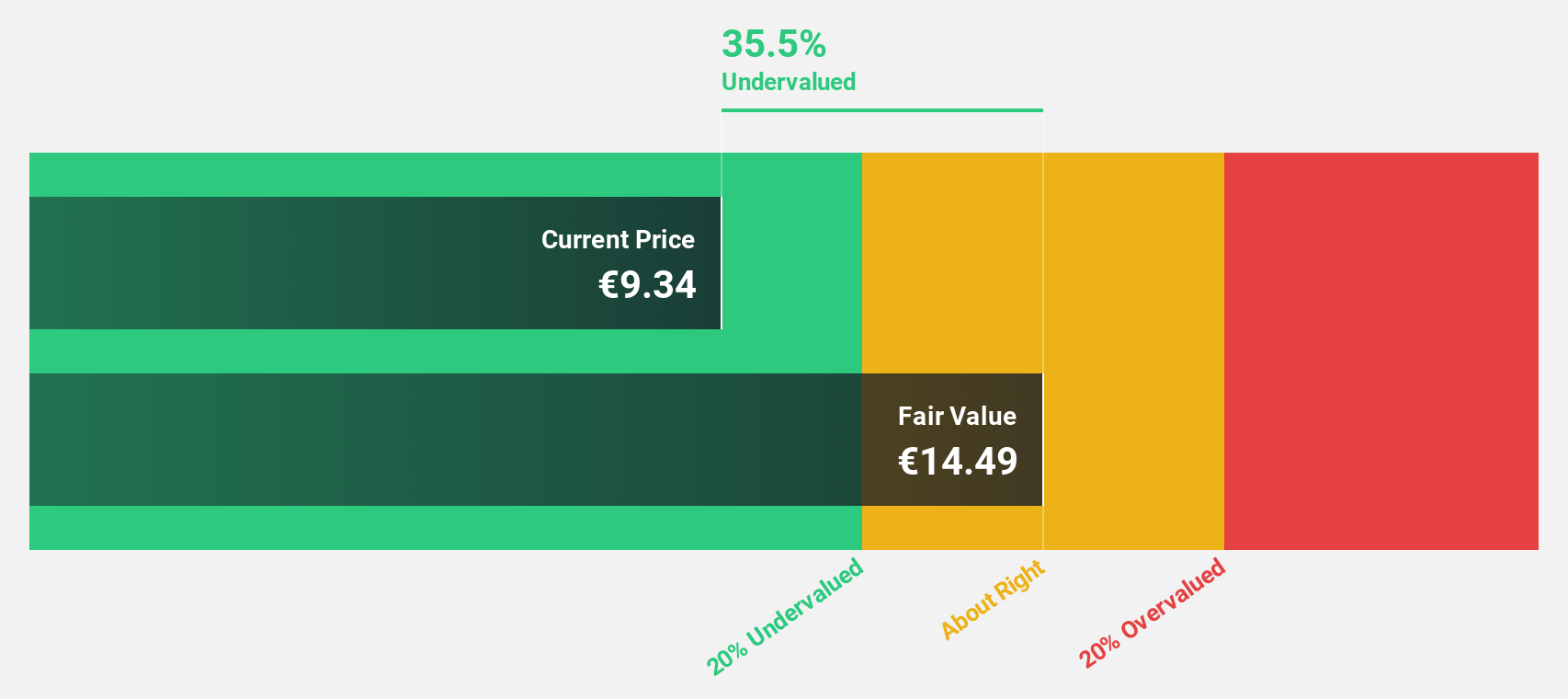

Estimated Discount To Fair Value: 40.9%

BFF Bank is trading at €8.21, significantly below its estimated fair value of €13.88, indicating it might be undervalued based on discounted cash flow analysis. Despite a high level of debt and unsustainable dividend coverage by free cash flows, BFF's earnings are expected to grow 8.27% annually, outpacing the Italian market's growth rate. Recent earnings showed net income rising to €215.68 million from €171.66 million last year, reflecting strong profitability trends.

- According our earnings growth report, there's an indication that BFF Bank might be ready to expand.

- Dive into the specifics of BFF Bank here with our thorough financial health report.

Fortune Electric (TWSE:1519)

Overview: Fortune Electric Co., Ltd. is engaged in the manufacturing, processing, and sale of transformers, inverters, power distribution boards, and high-low voltage switches both in Taiwan and internationally with a market cap of NT$150.47 billion.

Operations: The company's revenue is derived from two main segments: General Contracting, contributing NT$1.69 billion, and Mechanical and Electrical, accounting for NT$16.96 billion.

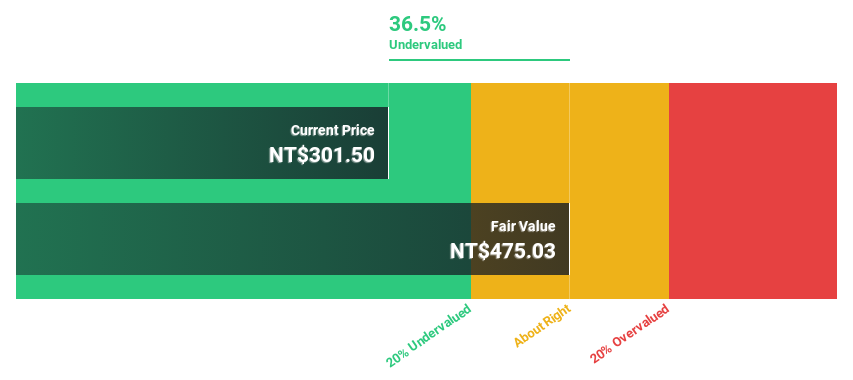

Estimated Discount To Fair Value: 10.6%

Fortune Electric, trading at NT$524, is slightly below its fair value estimate of NT$586.19. Despite high share price volatility recently, earnings are expected to grow significantly at 32.3% annually, surpassing the Taiwan market growth rate. Revenue is also projected to outpace the market with a 24.7% annual increase. While not highly undervalued based on discounted cash flow analysis, Fortune Electric shows potential for robust profit and revenue growth in coming years.

- Our growth report here indicates Fortune Electric may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Fortune Electric.

Chenbro Micom (TWSE:8210)

Overview: Chenbro Micom Co., Ltd. specializes in the research, development, design, manufacture, processing, and trading of computer peripherals and systems in various international markets including the United States, China, Taiwan, and Singapore with a market cap of NT$33.94 billion.

Operations: The company's revenue is primarily derived from its computer peripherals segment, which generated NT$15.38 billion.

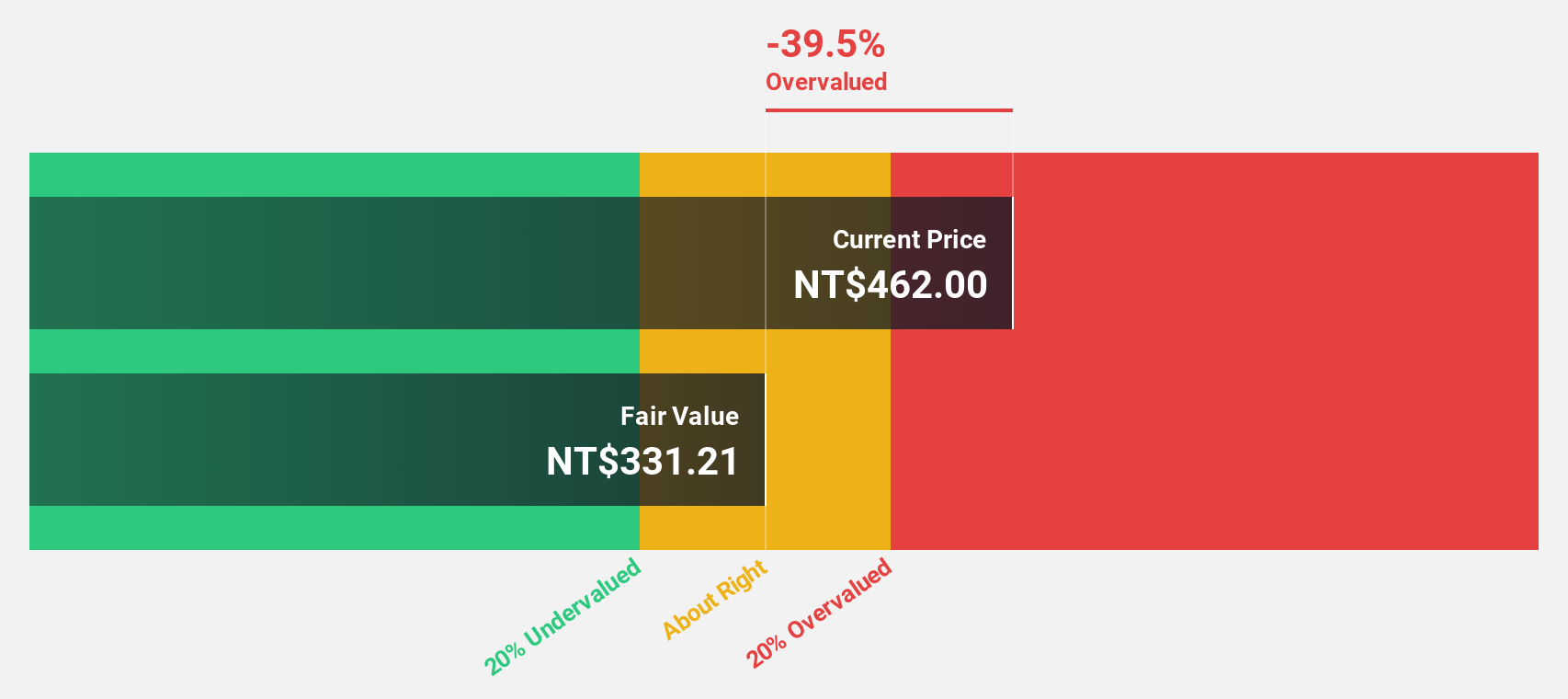

Estimated Discount To Fair Value: 40.7%

Chenbro Micom, trading at NT$280.5, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of NT$473.08. Despite high share price volatility recently, the stock shows promise as it trades 40.7% below its estimated fair value and offers good relative value compared to peers. Revenue is forecast to grow at 20.2% annually, faster than the Taiwan market's 11.2%, though earnings growth lags slightly behind market expectations at 15.9%.

- Our earnings growth report unveils the potential for significant increases in Chenbro Micom's future results.

- Click to explore a detailed breakdown of our findings in Chenbro Micom's balance sheet health report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 922 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Undervalued with solid track record.

Market Insights

Community Narratives