- Taiwan

- /

- Tech Hardware

- /

- TWSE:8163

3 Dividend Stocks To Consider With Yields Up To 8.6%

Reviewed by Simply Wall St

In the wake of a significant political shift in the U.S., global markets have been buoyed by optimism around potential growth and tax reforms, with major indices like the S&P 500 reaching record highs. As investors navigate this evolving landscape, dividend stocks offer a compelling option for those seeking income stability amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

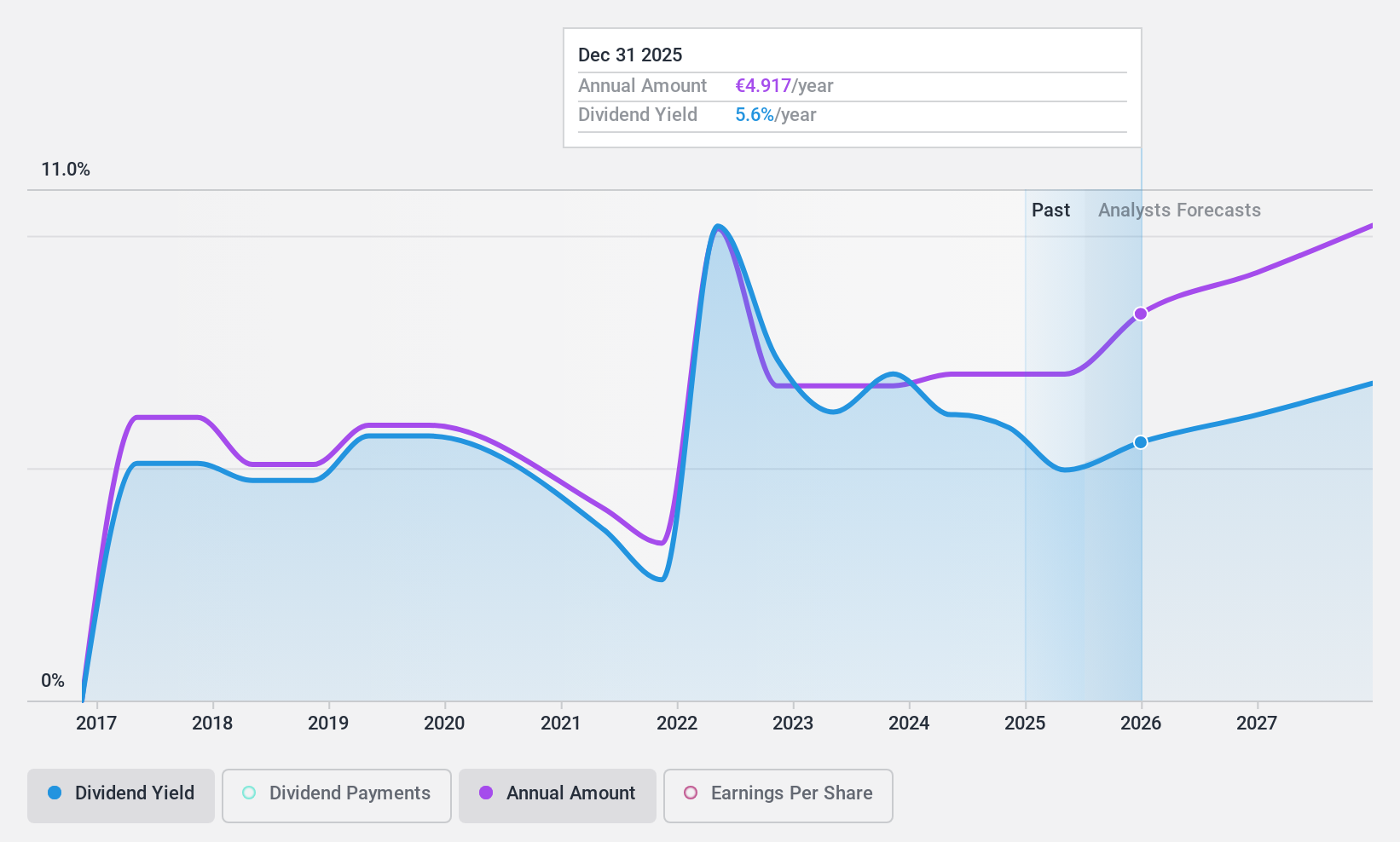

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV offers integrated bank-insurance services targeting retail, private banking, small and medium-sized enterprises, and mid-cap clients, with a market cap of €27.75 billion.

Operations: KBC Group's revenue is primarily derived from its Belgium Business segment (€6.39 billion), followed by the Czech Republic Business (€2.29 billion), and International Markets including Hungary (€1.13 billion), Bulgaria (€791 million), and Slovakia (€486 million).

Dividend Yield: 5.9%

KBC Group's dividend payments have grown over the past decade, yet they remain volatile and somewhat unreliable. The current payout ratio of 57.8% indicates dividends are covered by earnings, with forecasts suggesting continued coverage in three years at a 61.2% payout ratio. KBC trades at a significant discount to its estimated fair value but has a high level of bad loans (2.2%). Recent earnings showed stable net interest income but declining net income year-over-year for nine months ending September 2024.

- Click to explore a detailed breakdown of our findings in KBC Group's dividend report.

- The valuation report we've compiled suggests that KBC Group's current price could be quite moderate.

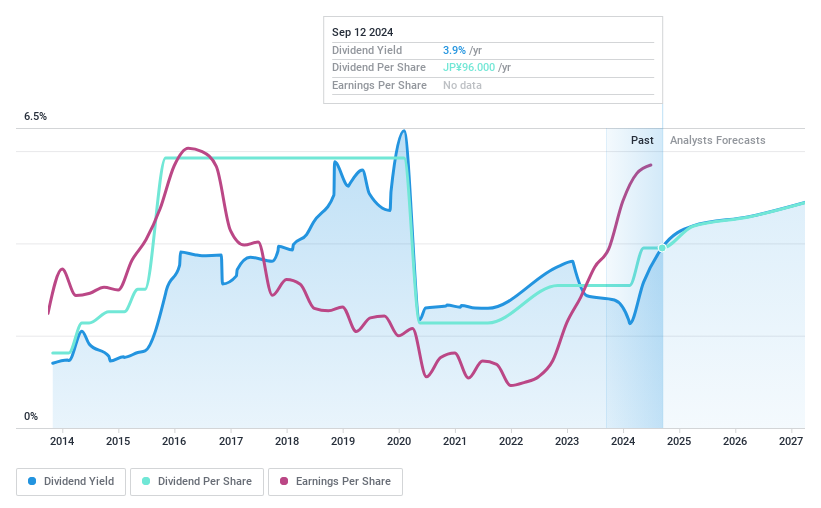

Subaru (TSE:7270)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Subaru Corporation manufactures and sells automobiles and aerospace products across Japan, Asia, North America, Europe, and internationally, with a market cap of ¥1.81 trillion.

Operations: Subaru Corporation generates revenue from its automotive and aerospace product segments, serving markets in Japan, Asia, North America, Europe, and globally.

Dividend Yield: 3.9%

Subaru's dividend yield is among the top 25% in Japan, supported by a low payout ratio of 9%, indicating sustainability. However, its dividend history is unreliable and volatile over the past decade. Despite strong earnings growth of 45.2% last year and trading significantly below estimated fair value, future earnings are projected to decline by 3.3% annually over three years. Recent share buybacks and strategic alliances may influence future performance.

- Click here to discover the nuances of Subaru with our detailed analytical dividend report.

- Our expertly prepared valuation report Subaru implies its share price may be lower than expected.

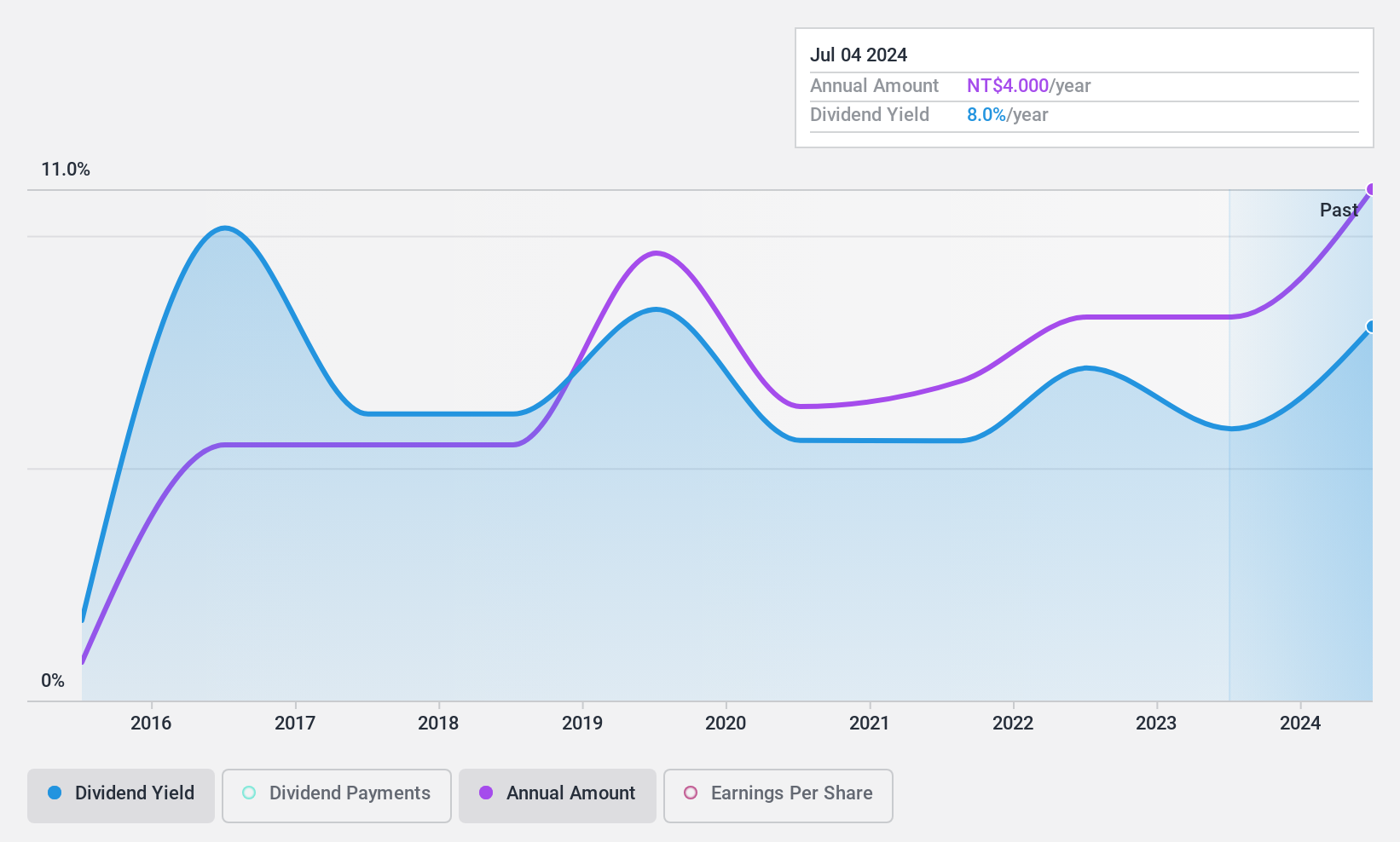

Darfon Electronics (TWSE:8163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Darfon Electronics Corp. specializes in eco-friendly technologies for IT peripherals, passive components, and green energy solutions, with a market cap of NT$12.92 billion.

Operations: Darfon Electronics Corp.'s revenue is primarily derived from Intelligent Products, contributing NT$12.40 billion, and Green Energy Products, which account for NT$9.87 billion.

Dividend Yield: 8.6%

Darfon Electronics offers a high dividend yield, ranking in the top 25% of Taiwan's market. However, its dividends are not well covered by earnings due to a high payout ratio of 156.6%, though cash flows sufficiently cover them with a lower cash payout ratio of 39.6%. The company's dividend history is volatile and unreliable over the past decade. Recent financial results show declining sales and net income, impacting overall profitability and potentially affecting future dividends.

- Unlock comprehensive insights into our analysis of Darfon Electronics stock in this dividend report.

- Our valuation report unveils the possibility Darfon Electronics' shares may be trading at a discount.

Key Takeaways

- Investigate our full lineup of 1952 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8163

Darfon Electronics

Provides eco-friendly technologies for IT peripherals, passive components, and green energy solutions.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives