- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

October 2024's Top Growth Companies With Insider Ownership

Reviewed by Simply Wall St

As global markets navigate varied economic signals, with the S&P 500 and Nasdaq Composite indices showing robust gains driven by sectors like utilities, real estate, and AI-related stocks, investors are keeping a keen eye on growth opportunities. In this environment of fluctuating consumer spending and industrial output, companies with significant insider ownership often stand out as potentially strong contenders for growth due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here's a peek at a few of the choices from the screener.

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both within China and internationally, with a market cap of CN¥2.38 billion.

Operations: The company generates revenue of CN¥482.77 million from its instrumentation industry segment.

Insider Ownership: 23.3%

Earnings Growth Forecast: 37.8% p.a.

Hunan Sundy Science and Technology is experiencing significant growth, with revenue expected to increase 26.5% annually, surpassing the Chinese market average. Earnings are projected to grow significantly at 37.8% per year. Recent earnings reports show improved net income of CNY 78.05 million for the first nine months of 2024, up from CNY 52.69 million last year, despite a decline in profit margins from 22.3% to 12.3%. The stock trades below estimated fair value but has an unstable dividend history and low forecasted return on equity at 19.4%.

- Click to explore a detailed breakdown of our findings in Hunan Sundy Science and Technology's earnings growth report.

- Our valuation report here indicates Hunan Sundy Science and Technology may be undervalued.

Focus Hotmelt (SZSE:301283)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Focus Hotmelt Company Ltd. specializes in the research, development, production, and sale of special hot melt adhesives for absorbent hygiene products in China, with a market capitalization of CN¥2.17 billion.

Operations: The company generates revenue primarily from its Hygiene Hot Melt Adhesive segment, amounting to CN¥1.82 billion.

Insider Ownership: 36.6%

Earnings Growth Forecast: 29.4% p.a.

Focus Hotmelt demonstrates strong growth potential, with earnings expected to rise significantly at 29.4% annually, outpacing the Chinese market average. Revenue is also anticipated to grow robustly at 25.5% per year. The company reported a net income increase to CNY 57.38 million for H1 2024 from CNY 42.51 million last year, indicating solid performance despite its dividend not being well-covered by free cash flows and high non-cash earnings levels impacting quality assessments.

- Delve into the full analysis future growth report here for a deeper understanding of Focus Hotmelt.

- Insights from our recent valuation report point to the potential undervaluation of Focus Hotmelt shares in the market.

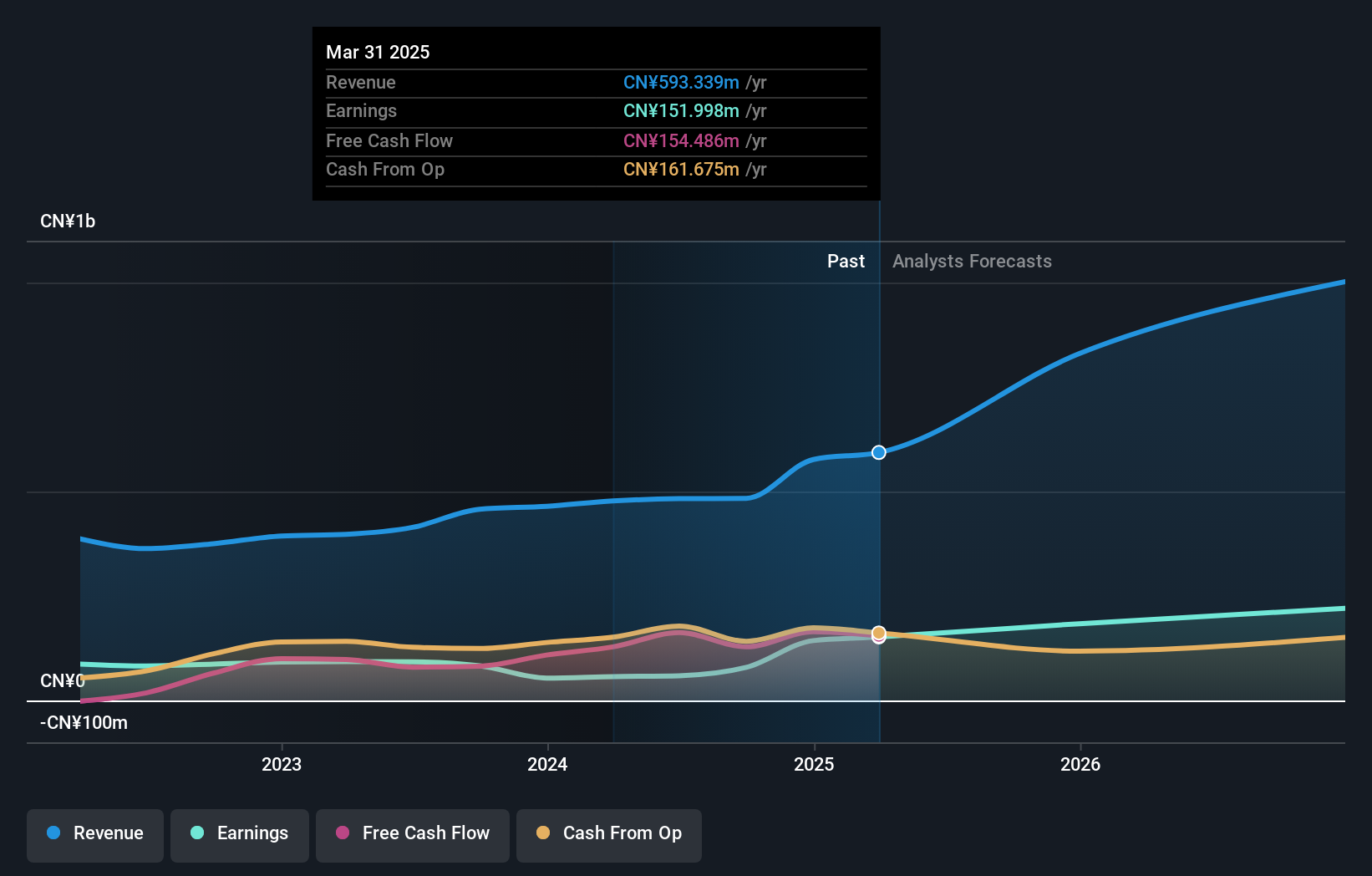

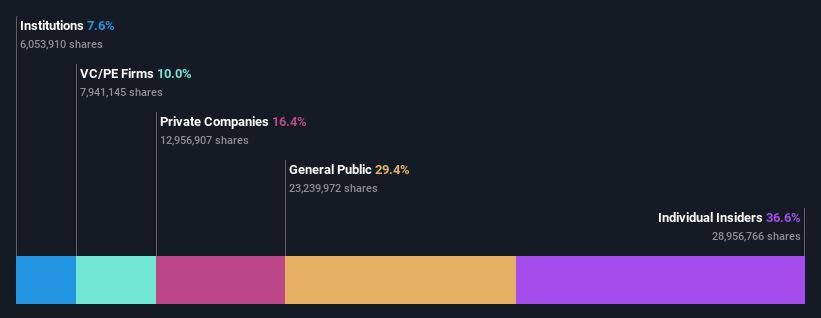

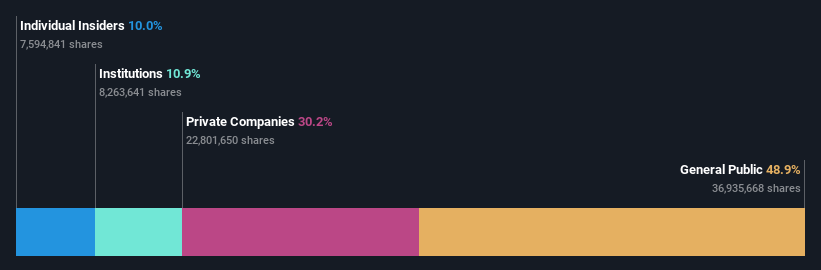

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$16.56 billion.

Operations: The company's revenue segments consist of NT$6.03 billion from the United States and NT$2.48 billion from domestic business operations.

Insider Ownership: 10%

Earnings Growth Forecast: 32% p.a.

Posiflex Technology shows promising growth potential, with earnings projected to grow significantly at 32% annually, surpassing the TW market average. Revenue is expected to increase by 17.3% per year, outpacing the broader market's growth rate. Recent financial results revealed a net income rise to TWD 351.41 million for H1 2024 from TWD 226.21 million last year, reflecting strong performance despite a high debt level and an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Posiflex Technology stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Posiflex Technology shares in the market.

Make It Happen

- Click through to start exploring the rest of the 1486 Fast Growing Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives