As global markets continue to navigate through geopolitical tensions and economic uncertainties, U.S. indexes are approaching record highs with broad-based gains, fueled by positive labor market reports and stabilizing mortgage rates. In this context of market resilience, identifying growth companies with high insider ownership can be particularly appealing as it often indicates strong confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Let's take a closer look at a couple of our picks from the screened companies.

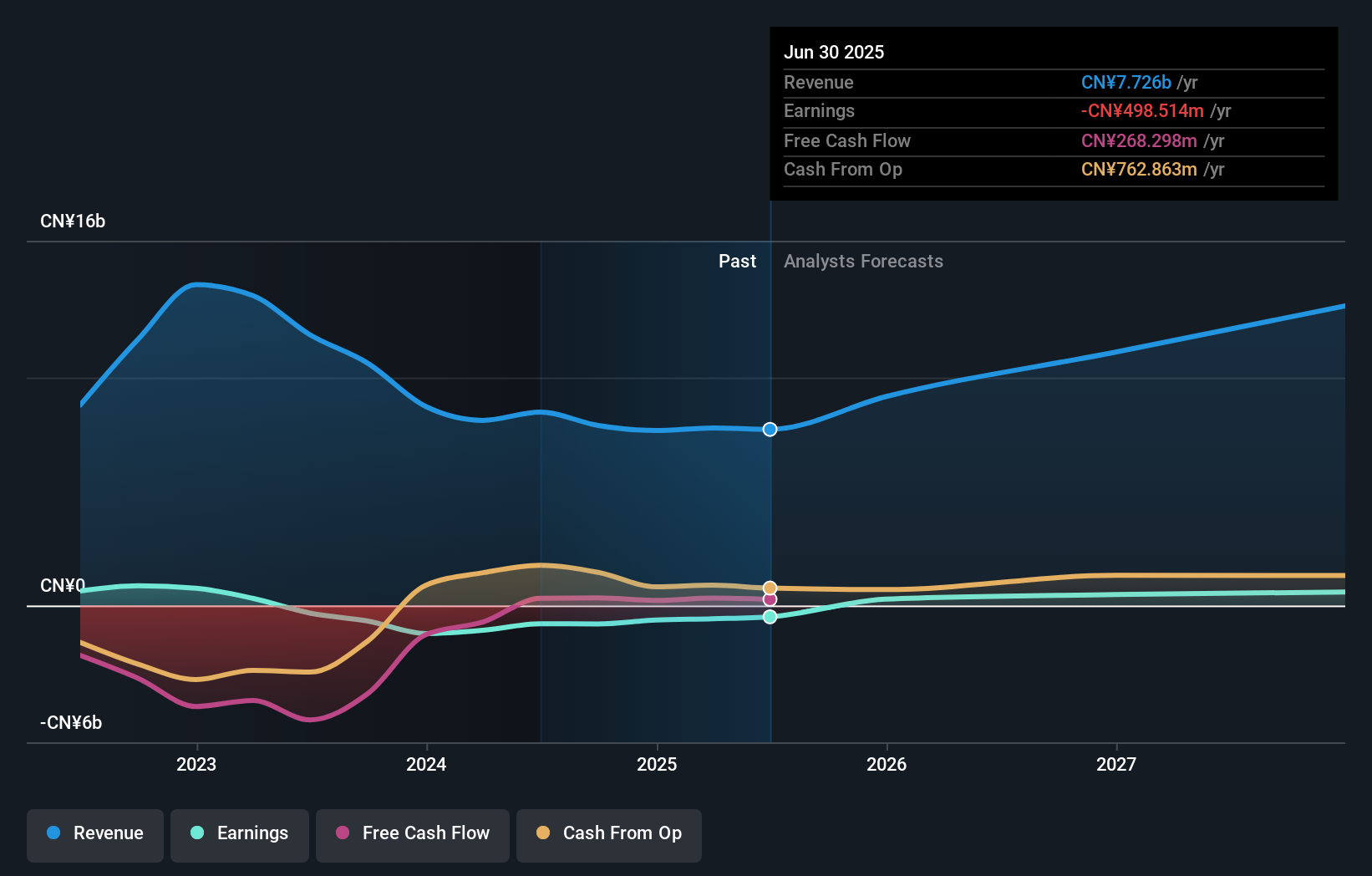

Jiangsu Lopal Tech (SHSE:603906)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Lopal Tech Co., Ltd. is involved in the R&D, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles both in China and internationally, with a market cap of CN¥6.05 billion.

Operations: The company's revenue is derived from the development, production, and sale of lithium iron phosphate cathode materials and vehicle environmental protection fine chemicals.

Insider Ownership: 35.8%

Earnings Growth Forecast: 125.9% p.a.

Jiangsu Lopal Tech exhibits characteristics of a growth company with significant insider ownership, trading at 67.4% below its estimated fair value. Despite recent shareholder dilution due to follow-on equity offerings totaling HKD 550 million, the company is forecasted to achieve profitability within three years with revenue growth expected at 25.7% annually—outpacing the Chinese market average. However, its return on equity is projected to remain low at 17.4%.

- Unlock comprehensive insights into our analysis of Jiangsu Lopal Tech stock in this growth report.

- According our valuation report, there's an indication that Jiangsu Lopal Tech's share price might be on the cheaper side.

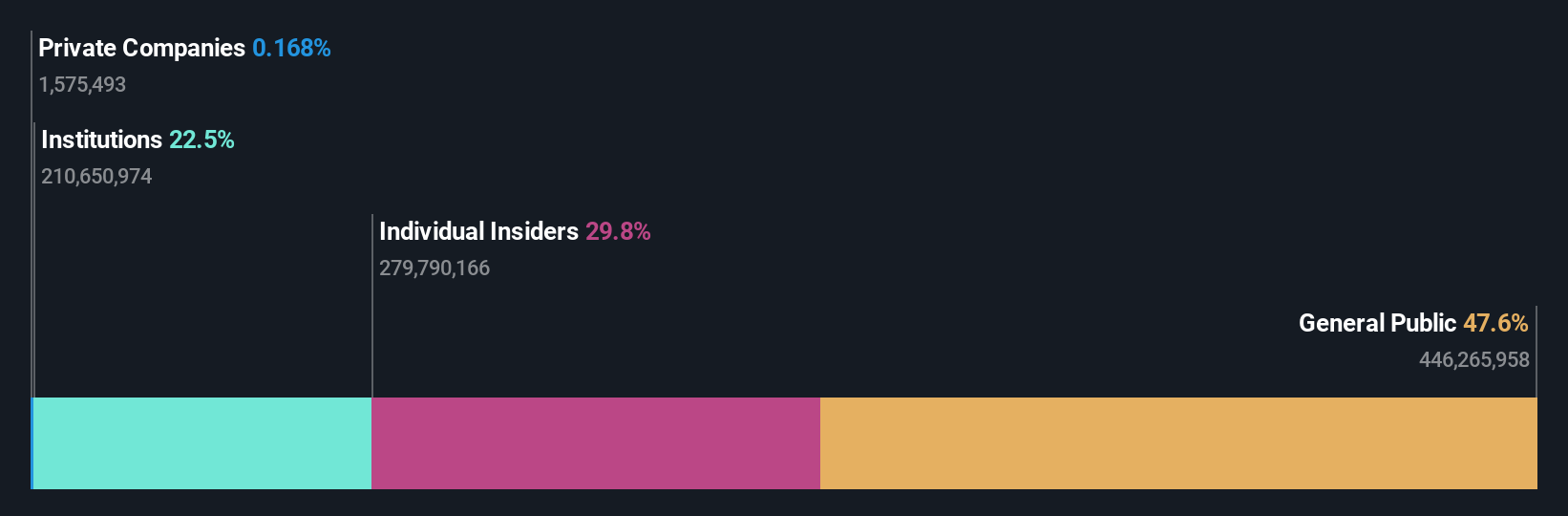

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Dinglong Co., Ltd. specializes in the research, development, production, and service of integrated circuit chip design and semiconductor materials, with a market cap of CN¥25.14 billion.

Operations: The company generates revenue from the Photoelectric Imaging Display and Semiconductor Process Materials Industry, amounting to CN¥3.20 billion.

Insider Ownership: 29.9%

Earnings Growth Forecast: 32.6% p.a.

Hubei Dinglong's revenue is projected to grow at 17.4% annually, outpacing the Chinese market average of 13.8%, while earnings are expected to increase significantly at 32.6%. Recent results show a strong performance with sales reaching ¥2.43 billion and net income growing to ¥376.32 million for the first nine months of 2024, compared to last year’s figures. Analysts anticipate a potential stock price rise of 21.7%.

- Take a closer look at Hubei DinglongLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hubei DinglongLtd's share price might be on the expensive side.

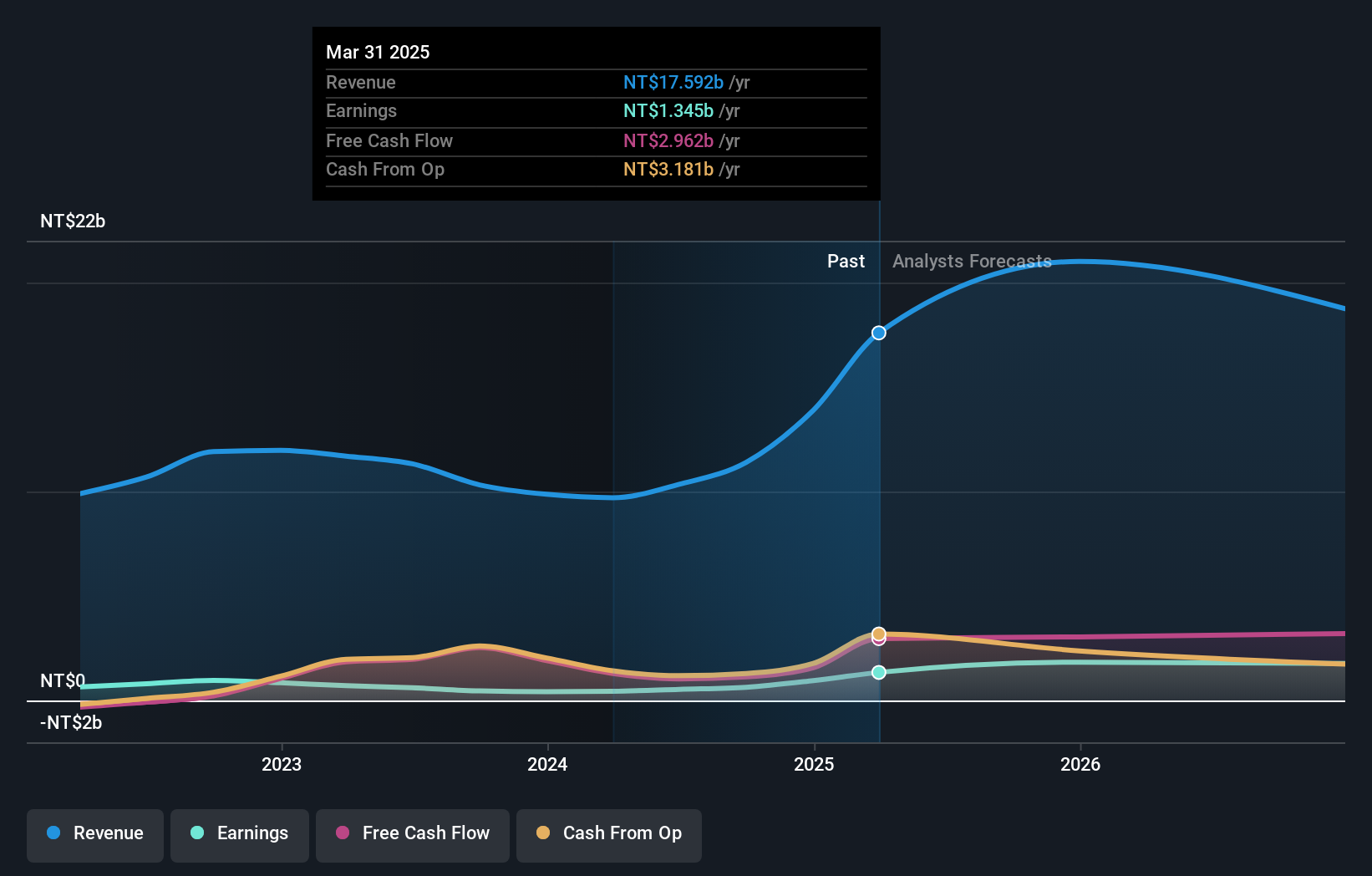

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$22.60 billion.

Operations: The company's revenue is derived from the manufacture and sale of industrial computers and peripheral equipment across Taiwan, the United States, and international markets.

Insider Ownership: 10%

Earnings Growth Forecast: 22.4% p.a.

Posiflex Technology's revenue is forecast to grow at 14.4% annually, surpassing the Taiwan market average of 12.5%, with earnings expected to rise significantly at 22.4%. Recent financials show robust growth, with third-quarter sales increasing to TWD 3.6 billion and net income reaching TWD 294.67 million compared to last year’s figures. Despite high share price volatility, its Return on Equity is projected to be strong in three years at 27.9%.

- Click to explore a detailed breakdown of our findings in Posiflex Technology's earnings growth report.

- Upon reviewing our latest valuation report, Posiflex Technology's share price might be too optimistic.

Taking Advantage

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1529 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603906

Jiangsu Lopal Tech

Engages in the research and development, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles in China and internationally.

Undervalued with high growth potential.