- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

Amidst ongoing global economic uncertainties, including trade policy concerns and fluctuating market indices, Asian tech markets have shown resilience with promising growth opportunities. In this dynamic environment, identifying high-growth tech stocks involves assessing companies that demonstrate strong innovation capabilities and adaptability to changing market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 40.38% | 52.94% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

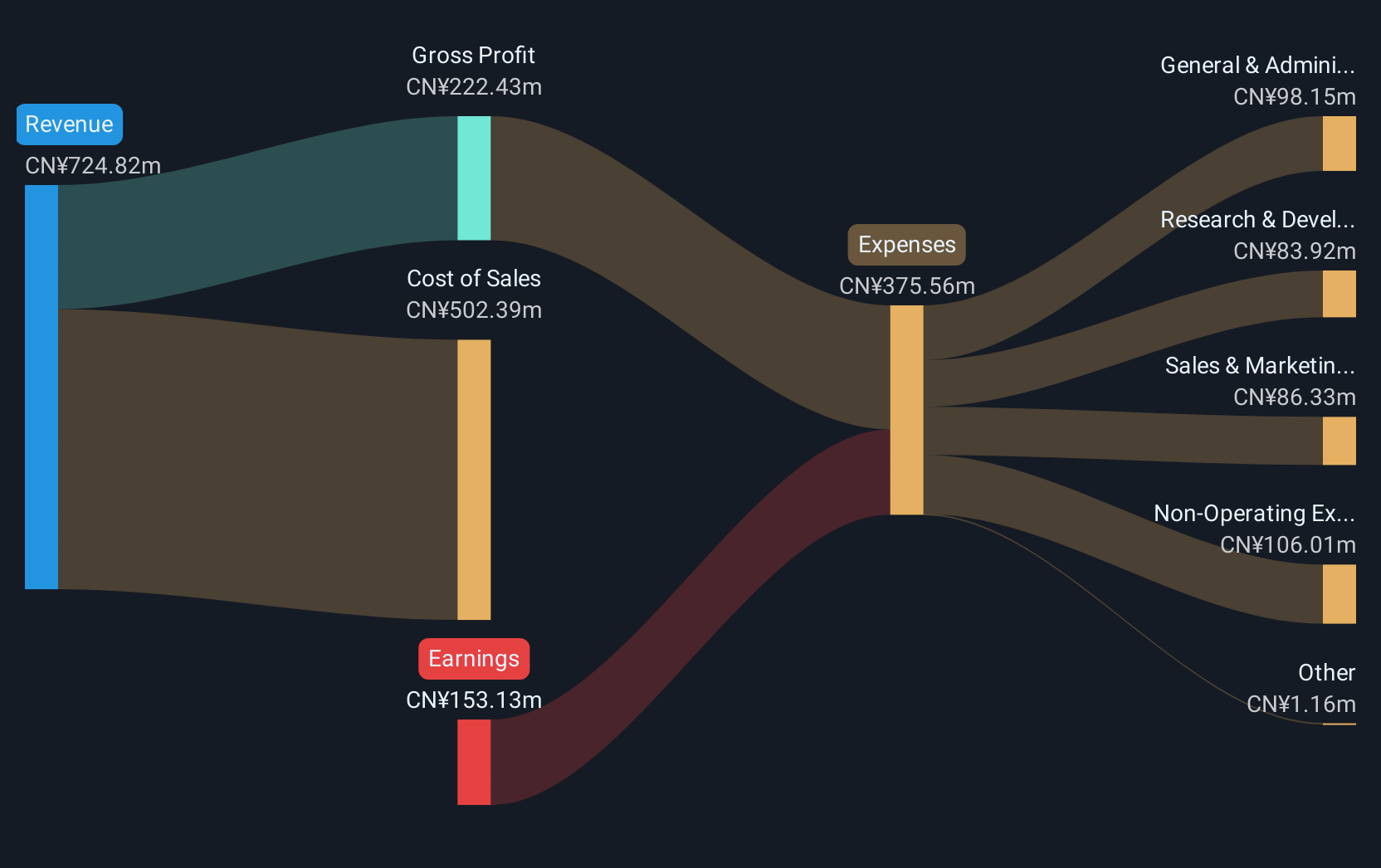

Overview: Beijing Beetech Inc. specializes in the production and sale of smart sensors and optoelectronic instruments, with a market capitalization of CN¥3.92 billion.

Operations: Beijing Beetech focuses on smart sensors and optoelectronic instruments, with a market cap of approximately CN¥3.92 billion.

Beijing Beetech's trajectory in the high-growth tech sector is underscored by its impressive financial performance, with a notable annual revenue growth rate of 19.3% and an even more striking earnings growth at 55.3% per year, both outpacing the broader Chinese market averages of 13.3% and 25.4%, respectively. The company's commitment to innovation is evident from its significant investment in R&D, crucial for maintaining competitive edge in rapidly evolving tech landscapes. Despite a low forecasted return on equity of 8.1% in three years, these robust growth figures combined with positive free cash flow signal strong underlying fundamentals and potential for sustained growth amidst volatile market conditions.

- Navigate through the intricacies of Beijing Beetech with our comprehensive health report here.

Gain insights into Beijing Beetech's past trends and performance with our Past report.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

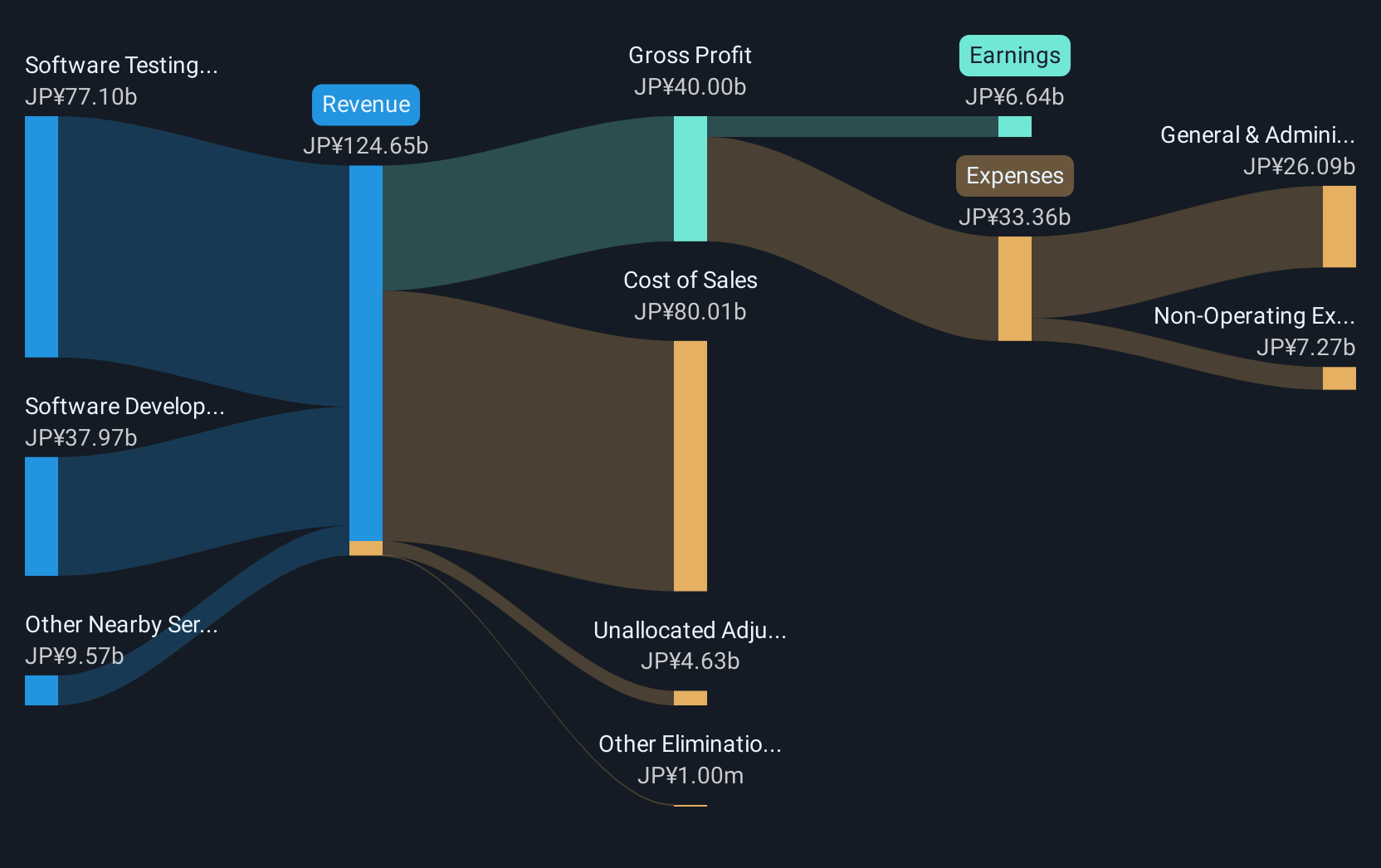

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market cap of ¥312.81 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing related services, amounting to ¥74.26 billion, and software development related services, contributing ¥36.57 billion. The company focuses on providing specialized solutions in the realm of software quality assurance within Japan.

SHIFT Inc. is carving out a niche in the high-growth tech sector in Asia, particularly with its recent strategic expansion into aerospace and defense consulting, signaling diversification and potential new revenue streams. This move complements its robust financial metrics: an expected annual revenue growth of 16.8% and earnings surge by 29.8%, both figures notably above Japan's market averages of 4.2% and 8.1% respectively. Moreover, the company's commitment to innovation is reflected in its R&D spending trends which are crucial for sustaining this growth trajectory amidst a competitive landscape marked by rapid technological advancements.

- Click to explore a detailed breakdown of our findings in SHIFT's health report.

Gain insights into SHIFT's historical performance by reviewing our past performance report.

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★★☆

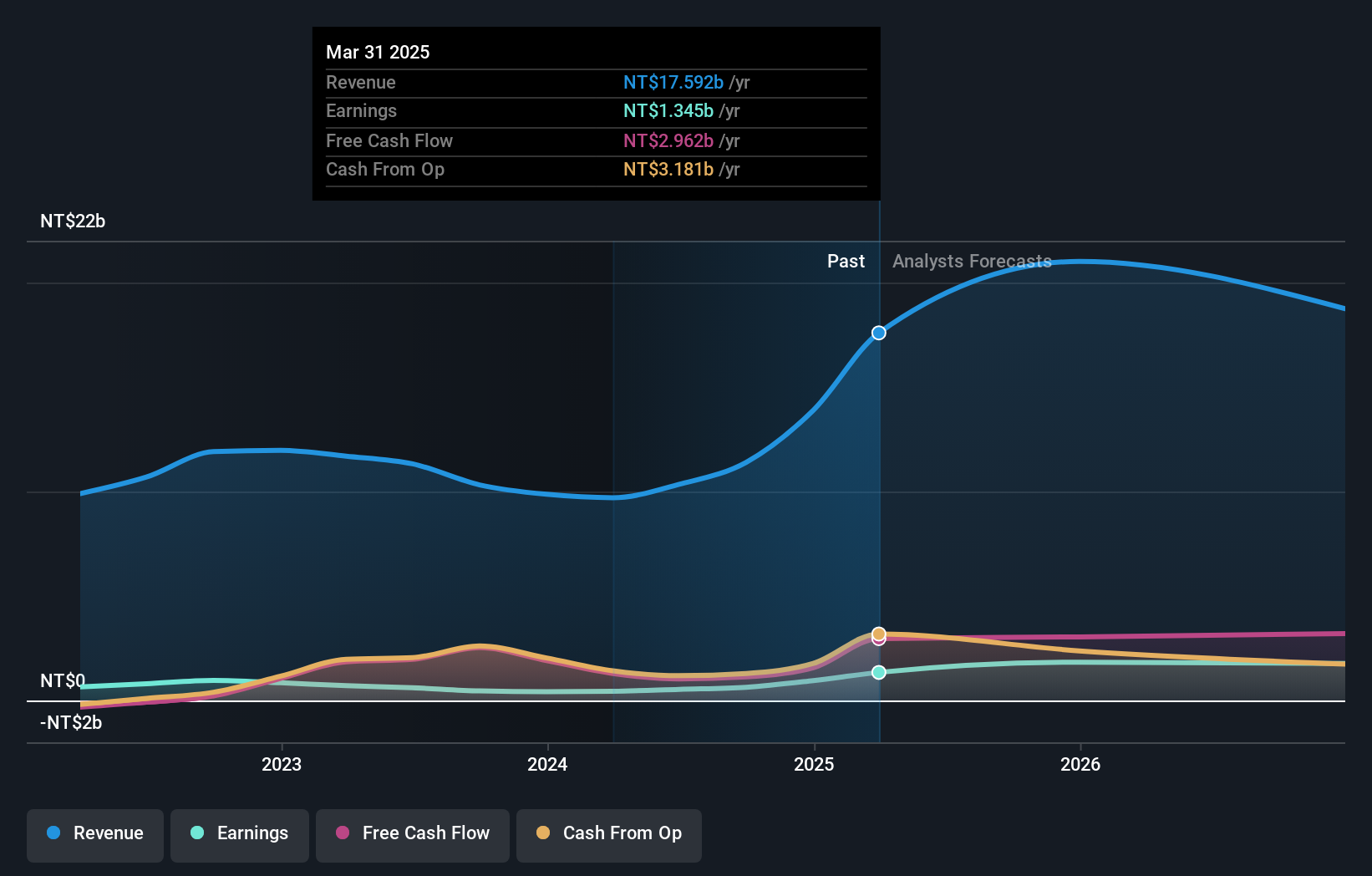

Overview: Posiflex Technology, Inc. is involved in the manufacture and sale of industrial computers and peripheral equipment across Taiwan, the United States, and international markets, with a market cap of NT$35.99 billion.

Operations: The company generates revenue primarily from the United States and domestic markets, with NT$7 billion and NT$2.51 billion respectively.

Posiflex Technology, amid a volatile market, showcases robust growth with a 13.8% increase in annual revenue and an impressive 28.2% rise in earnings forecast per year. This performance is bolstered by strategic R&D investments, which are critical for maintaining its competitive edge in the tech sector. With earnings growth last year surpassing the electronic industry's average by 38.8%, Posiflex is effectively leveraging its technological advancements to expand its market footprint, despite facing substantial shareholder dilution recently. These financial dynamics indicate a promising yet challenging trajectory for Posiflex in Asia's high-growth tech landscape.

Taking Advantage

- Embark on your investment journey to our 514 Asian High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Posiflex Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives