- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Exploring High Growth Tech Stocks Including Talant Optronics (Suzhou)

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets experienced some volatility with major indices like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Despite these fluctuations, small-cap stocks have demonstrated resilience, which is particularly relevant as we explore high-growth tech stocks such as Talant Optronics (Suzhou). In this environment, identifying promising stocks often involves assessing their ability to innovate and adapt amidst broader market uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Talant Optronics (Suzhou) (SZSE:301045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Talant Optronics (Suzhou) Co., Ltd. focuses on the R&D, production, and sale of photoelectric light guide plates and related components both in China and internationally, with a market cap of CN¥2.54 billion.

Operations: The company generates revenue through the production and sale of photoelectric light guide plates and associated components, serving both domestic and international markets. A key financial metric to note is the net profit margin, which stands at 12.5%.

Talant Optronics (Suzhou) has demonstrated robust financial performance with a notable increase in sales to CNY 496.21 million and net income rising to CNY 19.97 million over nine months, reflecting year-over-year growth of 10.15% and 39.8%, respectively. This growth trajectory is underscored by an impressive earnings forecast, expected to surge by 87.2% annually, significantly outpacing the broader Chinese market's projection of 26.3%. Furthermore, the company's revenue growth rate at 30.3% annually not only exceeds the industry average but also positions it well above the national market forecast of 14%. These figures highlight Talant Optronics' potential in leveraging its R&D investments effectively amidst a competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Talant Optronics (Suzhou).

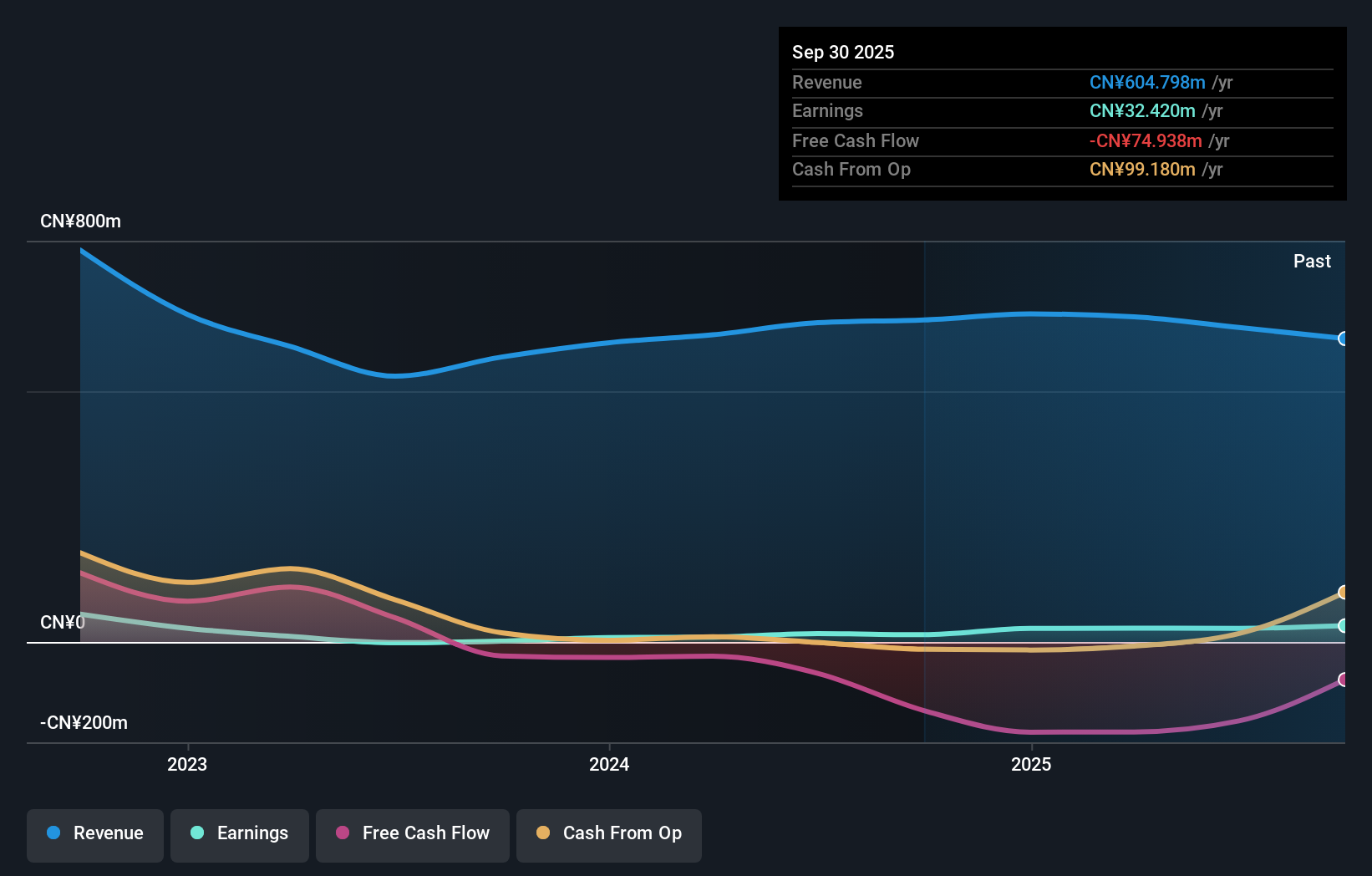

Learn about Talant Optronics (Suzhou)'s historical performance.

Jiayuan Science and TechnologyLtd (SZSE:301117)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiayuan Science and Technology Co., Ltd. specializes in offering network information security products and comprehensive information solutions, with a market cap of CN¥3.08 billion.

Operations: Jiayuan Science and Technology Co., Ltd. focuses on delivering network information security products and comprehensive information solutions. The company operates with a market cap of approximately CN¥3.08 billion, reflecting its position in the industry.

Jiayuan Science and TechnologyLtd, navigating a challenging fiscal period, reported a dip in net income to CNY 17.85 million from a previous CNY 32.32 million, reflecting market volatilities and strategic realignments. Despite these hurdles, the company's commitment to innovation is evident with R&D expenses maintaining a steady pace, crucial for its long-term positioning in the tech sector. Notably, revenue growth projections remain robust at 36.5% annually, outpacing the broader Chinese market forecast of 14%. This growth is underpinned by an anticipated surge in earnings by approximately 83.6% per year over the next three years—a testament to Jiayuan’s potential to leverage its technological advancements despite current profitability challenges.

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally with a market cap of NT$16.29 billion.

Operations: The company generates revenue primarily from its operations in the United States and domestic business, with the U.S. segment contributing NT$6.03 billion and domestic business adding NT$2.48 billion to its total revenue.

Posiflex Technology has demonstrated a robust financial trajectory with a significant 17.3% annual revenue growth, outstripping the broader Taiwanese market's 12.3% pace. This performance is anchored by their strategic R&D investments, which have not only fueled innovations but also led to a notable earnings forecast of 32% growth per year, eclipsing the market average of 19%. Recent presentations and leadership enhancements further underscore their commitment to sustainable development and technological advancement, positioning them favorably within the tech landscape despite some challenges in maintaining consistent profit margins.

- Unlock comprehensive insights into our analysis of Posiflex Technology stock in this health report.

Gain insights into Posiflex Technology's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1284 more companies for you to explore.Click here to unveil our expertly curated list of 1287 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Flawless balance sheet with solid track record.