- Taiwan

- /

- Telecom Services and Carriers

- /

- TPEX:6170

Chongqing Department StoreLtd And 2 Other Reliable Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, including declining consumer confidence and fluctuating stock indices, investors are increasingly seeking stability in their portfolios. Amidst these conditions, dividend stocks like Chongqing Department Store Ltd offer a reliable income stream, providing potential resilience against market volatility while delivering consistent returns to shareholders.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

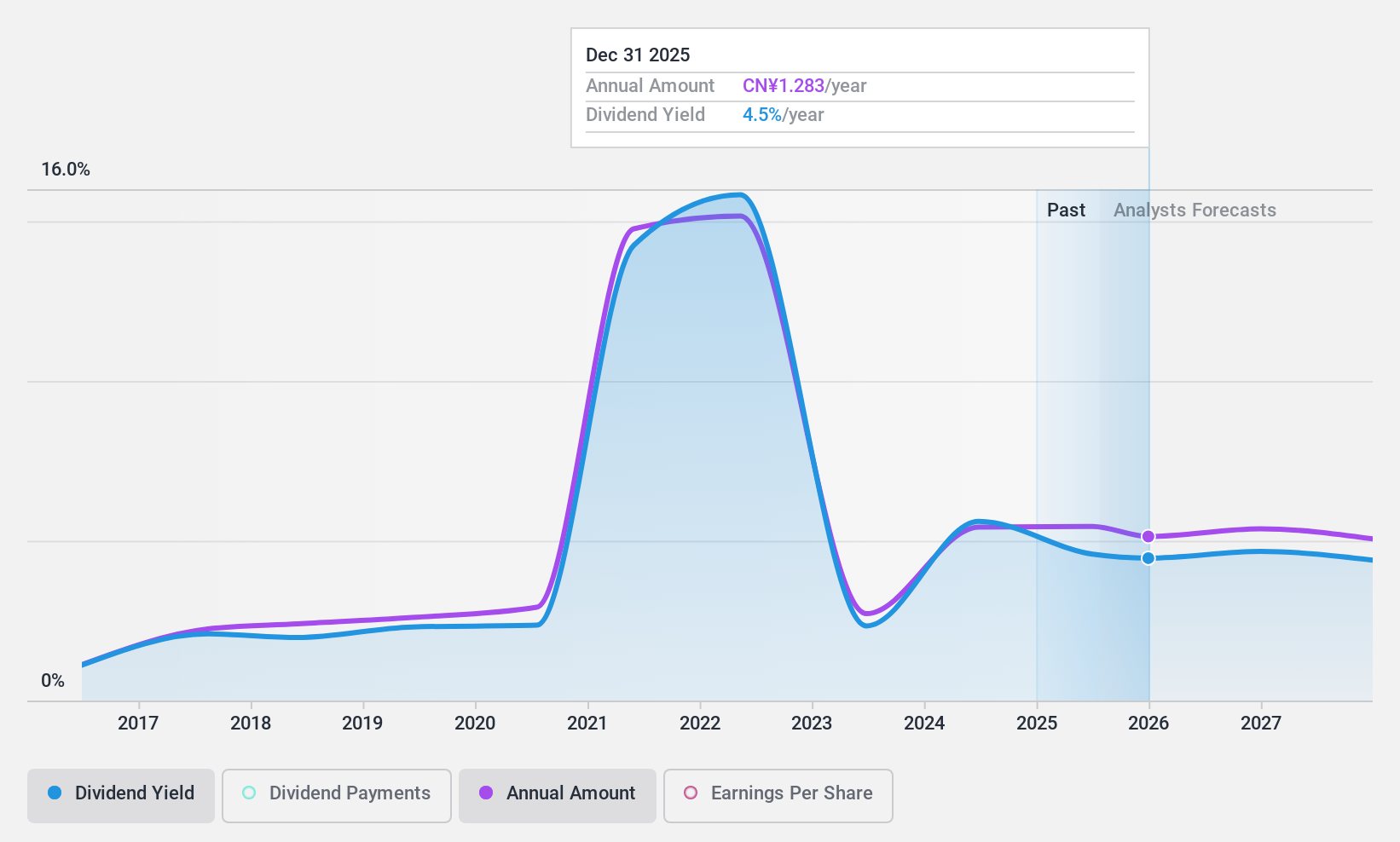

Chongqing Department StoreLtd (SHSE:600729)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Department Store Co., Ltd. operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China with a market cap of CN¥12.89 billion.

Operations: Chongqing Department Store Co., Ltd.'s revenue is derived from its operations in department stores, supermarkets, and electrical appliances stores across the People's Republic of China.

Dividend Yield: 4.4%

Chongqing Department Store Ltd. offers a dividend yield in the top 25% of the CN market, trading at 55.7% below its estimated fair value. Its dividends are well-covered by earnings and cash flows with payout ratios around 49% and 47.7%, respectively, though past payments have been volatile and unreliable over the last decade. Recent earnings showed a decline in revenue to CNY 13 billion from CNY 14.78 billion year-on-year, impacting net income and EPS figures.

- Click here to discover the nuances of Chongqing Department StoreLtd with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Chongqing Department StoreLtd's share price might be too pessimistic.

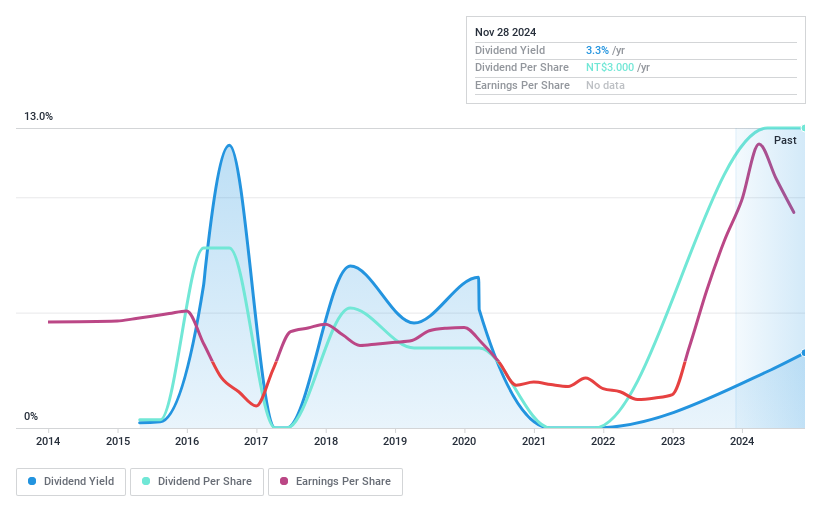

Richmond International Travel & ToursLtd (TPEX:2743)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Richmond International Travel & Tours Co., Ltd operates as a travel agency in Taiwan and has a market cap of NT$3.54 billion.

Operations: Richmond International Travel & Tours Co., Ltd generates revenue primarily from its travel services segment, amounting to NT$6.94 billion.

Dividend Yield: 2.9%

Richmond International Travel & Tours Ltd. trades at 87.8% below its estimated fair value, but its dividend yield of 2.88% is lower than the top quartile in the TW market. Despite a decade-long increase in dividends, payments have been volatile and unreliable. The payout ratios are sustainable, with earnings and cash flows covering dividends at 33.6% and 19.3%, respectively, despite a recent drop in net income to TWD 21 million for Q3 from TWD 93.11 million last year.

- Click to explore a detailed breakdown of our findings in Richmond International Travel & ToursLtd's dividend report.

- According our valuation report, there's an indication that Richmond International Travel & ToursLtd's share price might be on the cheaper side.

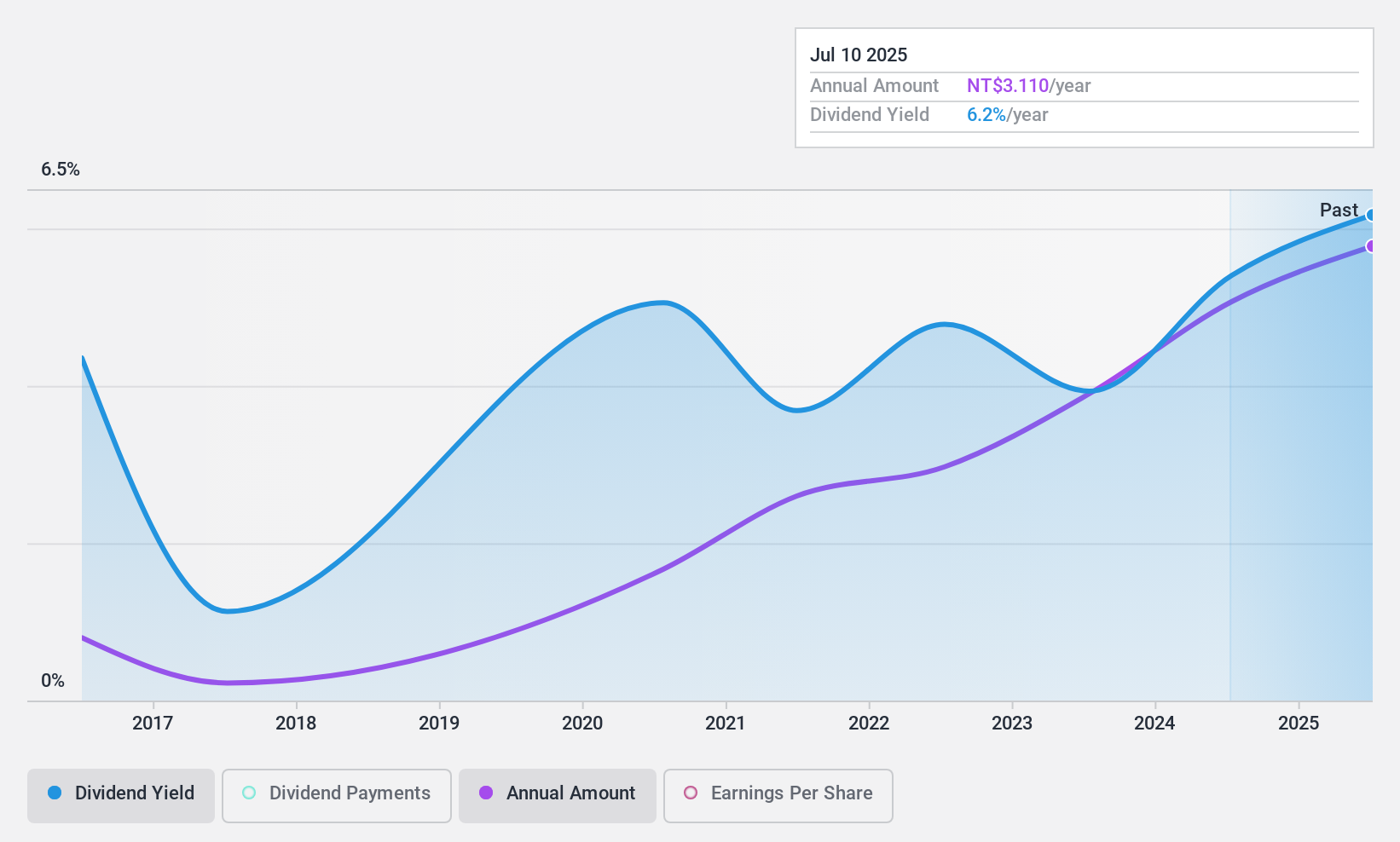

Welldone (TPEX:6170)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Welldone Company, along with its subsidiaries, operates in the telecommunication and digital entertainment sectors primarily in Taiwan, with a market capitalization of approximately NT$4.67 billion.

Operations: Welldone Company's revenue is derived from its Communications Service Department, which contributes NT$2.17 billion, and the IC and Other Channel Segment, which adds NT$582 million.

Dividend Yield: 5.4%

Welldone's dividend yield of 5.4% ranks in the top quartile of the TW market. However, its high payout ratio of 133.5% indicates dividends are not covered by earnings, though cash flows provide adequate coverage with a low cash payout ratio of 19.4%. Despite a decade-long increase, dividend reliability is compromised by volatility and past inconsistencies. Recent earnings show decreased net income to TWD 49.26 million for Q3, despite increased sales to TWD 736.87 million year-over-year.

- Unlock comprehensive insights into our analysis of Welldone stock in this dividend report.

- The valuation report we've compiled suggests that Welldone's current price could be quite moderate.

Next Steps

- Access the full spectrum of 1946 Top Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Welldone, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Welldone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6170

Welldone

Engages in telecommunication, and digital entertainment businesses primarily in Taiwan.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives