Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence dipping and European growth estimates revised lower, while major stock indices like the S&P 500 and Nasdaq Composite posted moderate gains. Amid these fluctuations, small-cap stocks often present unique opportunities for investors seeking potential growth in overlooked areas of the market. In this environment, identifying promising stocks involves looking for companies with solid fundamentals that can withstand economic headwinds and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Boditech Med (KOSDAQ:A206640)

Simply Wall St Value Rating: ★★★★★★

Overview: Boditech Med Inc. provides instruments and diagnostic reagents both in South Korea and internationally, with a market cap of ₩368.76 billion.

Operations: Boditech Med generates revenue primarily from its diagnostic kits and equipment, totaling ₩141.86 billion.

Boditech Med, a nimble player in the medical equipment field, is trading at 54% below its estimated fair value, suggesting potential undervaluation. Over the past five years, it has impressively reduced its debt to equity ratio from 19.2 to 1.7 and boasts earnings growth of 5.5%, outpacing the industry average of -16.5%. With a positive free cash flow and more cash than total debt, financial health seems robust. The company announced a KRW 3 billion share repurchase program aimed at enhancing shareholder value and stabilizing stock price through April 2025, reflecting confidence in its future prospects.

Shanghai AiyingshiLtd (SHSE:603214)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Aiyingshi Ltd (SHSE:603214) operates in the maternal and child products sector, offering a range of products and services mainly within China, with a market capitalization of approximately CN¥3.13 billion.

Operations: Shanghai Aiyingshi Ltd generates revenue primarily from the sale of maternal and infant products and related services, amounting to approximately CN¥3.38 billion.

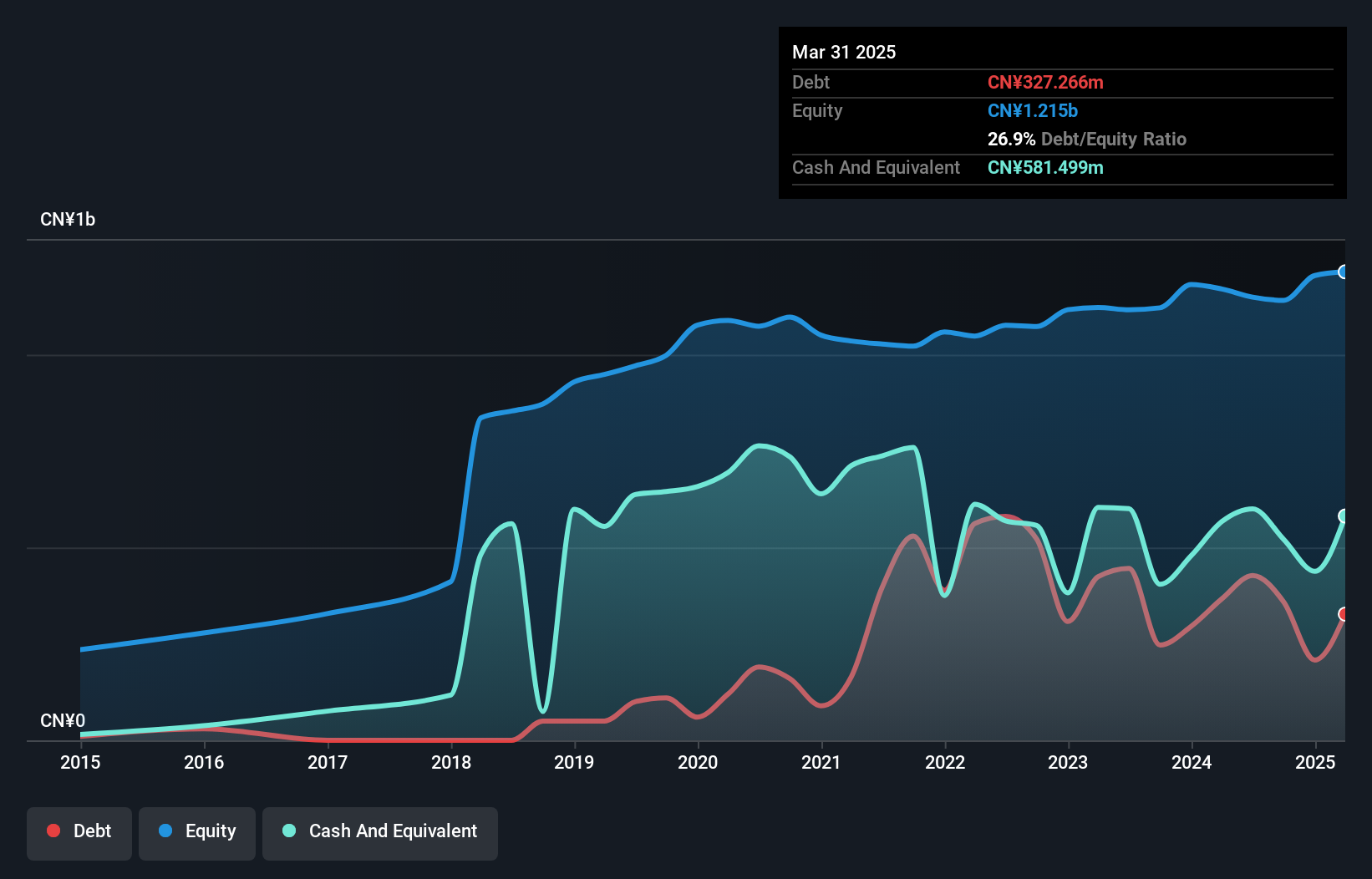

Shanghai Aiyingshi Ltd, a small player in the specialty retail sector, has seen its earnings grow by 20.1% over the past year, outpacing the industry average of -5.5%. The company's debt to equity ratio has risen from 11% to 31.4% in five years, indicating increased leverage but is balanced by having more cash than total debt. With a price-to-earnings ratio of 30.9x below the market's 34.8x and free cash flow positive status, it seems financially stable despite recent share price volatility and a CN¥47M one-off gain affecting last year's results up to September 2024.

- Unlock comprehensive insights into our analysis of Shanghai AiyingshiLtd stock in this health report.

Evaluate Shanghai AiyingshiLtd's historical performance by accessing our past performance report.

Taiwan Paiho (TWSE:9938)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taiwan Paiho Limited is a company that manufactures and sells a variety of products including touch fasteners, digital woven fabrics, and shoelaces both in Taiwan and internationally, with a market cap of NT$20.32 billion.

Operations: The company's revenue is primarily driven by its Main Sub-Materials and Accessories Segment, which generated NT$14.67 billion, while the Construction Sector contributed NT$85.98 million.

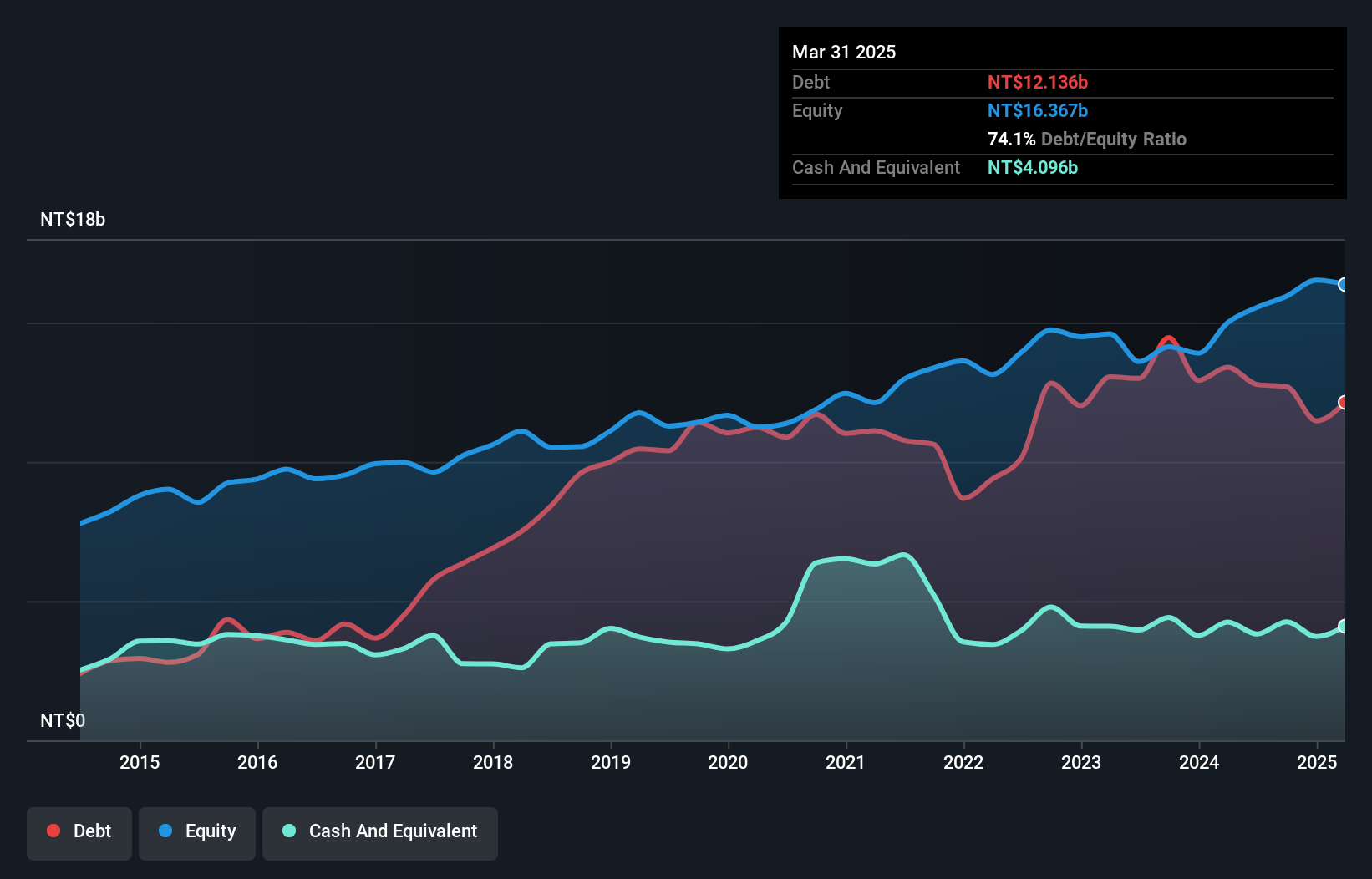

Taiwan Paiho, a dynamic player in its sector, has shown impressive growth with net sales for the eleven months ending November 2024 reaching TWD 14.19 billion, up from TWD 11.42 billion the previous year. The company's earnings for the third quarter of 2024 were notable at TWD 456.16 million compared to TWD 254.91 million a year ago, reflecting robust performance with basic earnings per share climbing to TWD 1.53 from TWD 0.86 last year. Furthermore, Taiwan Paiho's debt to equity ratio has improved over five years from an earlier high of nearly double digits to a more manageable figure today at around mid-70s percent range, indicating better financial health and strategic management in reducing leverage while maintaining growth momentum in its operations and profitability metrics.

- Delve into the full analysis health report here for a deeper understanding of Taiwan Paiho.

Assess Taiwan Paiho's past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 4638 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Paiho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9938

Taiwan Paiho

Manufactures and sells touch fasteners, webbing, elastic, easy tape, jacquard digital woven fabric, jacquard engineered mesh, and other functional auxiliary materials and textile fabrics in Taiwan, China, Vietnam, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives