As global markets navigate a landscape marked by volatile earnings, competitive pressures in the AI sector, and shifting monetary policies, investors are increasingly seeking stability amid uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential cushion against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

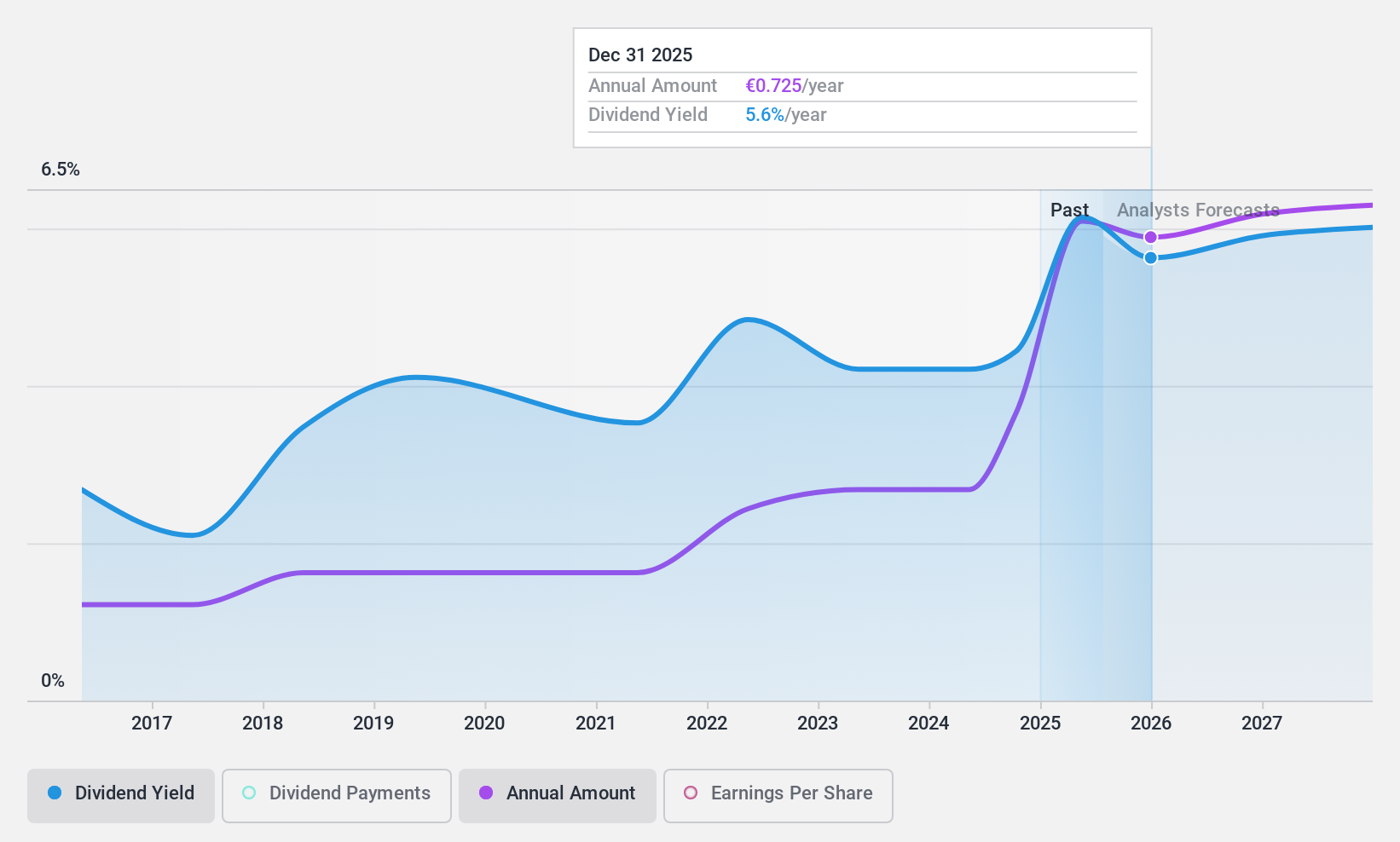

Credito Emiliano (BIT:CE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Credito Emiliano S.p.A., along with its subsidiaries, operates in Italy focusing on commercial banking and wealth management, with a market cap of €4 billion.

Operations: Credito Emiliano S.p.A.'s revenue segments include commercial banking and wealth management activities in Italy.

Dividend Yield: 3.8%

Credito Emiliano is trading at 25% below its estimated fair value, making it potentially attractive for value-focused dividend investors. However, its dividend history is marked by volatility with past annual drops over 20%, and the current yield of 3.79% falls short of Italy's top tier. Despite this, dividends are well-covered by earnings now (26.1%) and in three years (47.1%). Earnings are projected to decline by 9.7% annually over the next three years, impacting future payouts' sustainability.

- Navigate through the intricacies of Credito Emiliano with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Credito Emiliano's current price could be quite moderate.

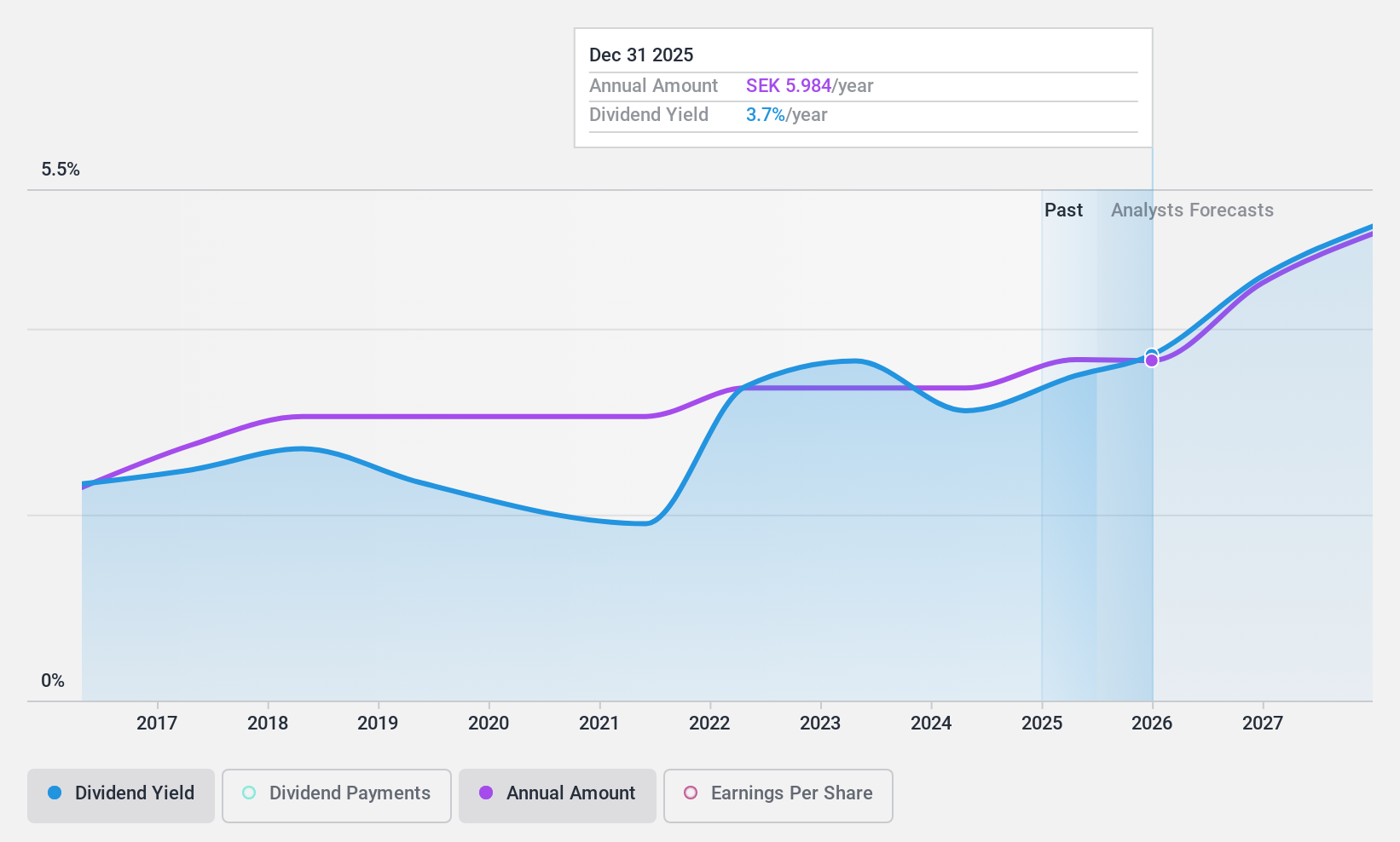

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB offers engineering, design, and advisory services across the infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe with a market cap of SEK20.43 billion.

Operations: Afry AB's revenue is primarily derived from its segments: Infrastructure (SEK10.42 billion), Industrial & Digital Solutions (SEK6.85 billion), Process Industries (SEK5.33 billion), Energy (SEK3.77 billion), and Management Consulting (SEK1.69 billion).

Dividend Yield: 3%

AFRY's dividend yield of 3.05% is lower than the Swedish market's top quartile, and its dividends have been volatile over the past decade. However, payouts are well-covered by earnings (52.1%) and cash flows (41.4%). Despite a high debt level, AFRY's recent strategic projects in renewable energy sectors may enhance long-term growth prospects. The appointment of Linda Pålsson as CEO could bring fresh leadership to capitalize on these opportunities while maintaining financial discipline.

- Dive into the specifics of Afry here with our thorough dividend report.

- Our valuation report unveils the possibility Afry's shares may be trading at a discount.

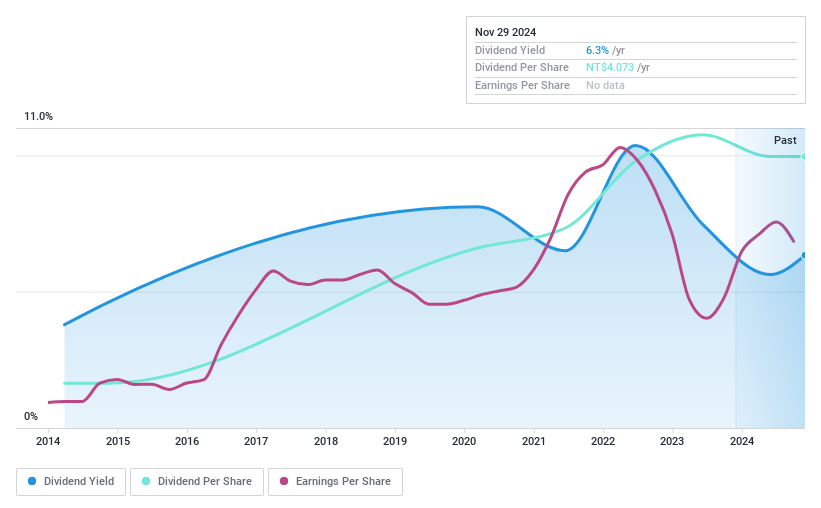

Supreme Electronics (TWSE:8112)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Supreme Electronics Co., Ltd. operates as an import and export dealer of electronic products and components across Taiwan, Hong Kong, China, the United States, and internationally, with a market cap of NT$34.20 billion.

Operations: Supreme Electronics Co., Ltd. generates its revenue primarily from the Computer Peripherals and Electronic Components segment, amounting to NT$235.52 billion.

Dividend Yield: 6.6%

Supreme Electronics offers a compelling dividend yield of 6.57%, ranking in the top 25% of Taiwan's market, but its sustainability is questionable due to lack of free cash flow coverage. Despite stable and reliable dividends over the past decade, current payments exceed earnings and cash flows. The company trades at 7.8% below estimated fair value, with recent earnings growth of 70.7%. However, debt coverage by operating cash flow remains inadequate.

- Unlock comprehensive insights into our analysis of Supreme Electronics stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Supreme Electronics shares in the market.

Taking Advantage

- Click this link to deep-dive into the 1954 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CE

Credito Emiliano

Engages in commercial banking and wealth management activities in Italy.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives